Question: On June 1, Year 3, Forever Young Corp. (FYC) ordered merchandise from a supplier in Turkey for Turkish lira (TL) 202,000. The goods were delivered

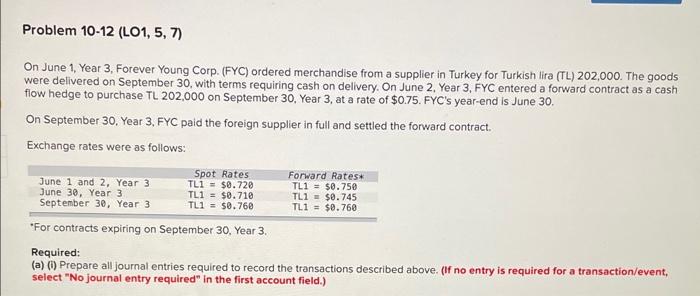

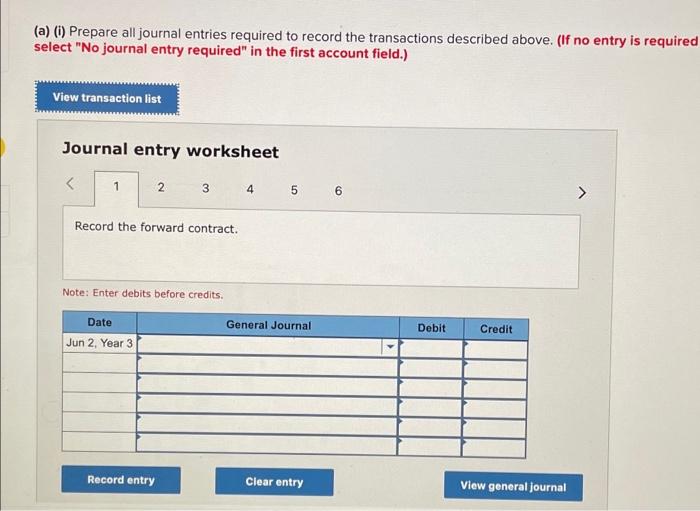

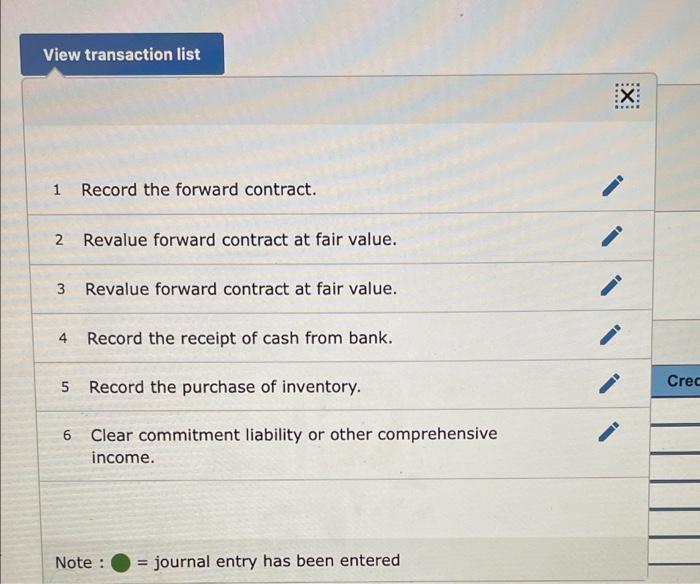

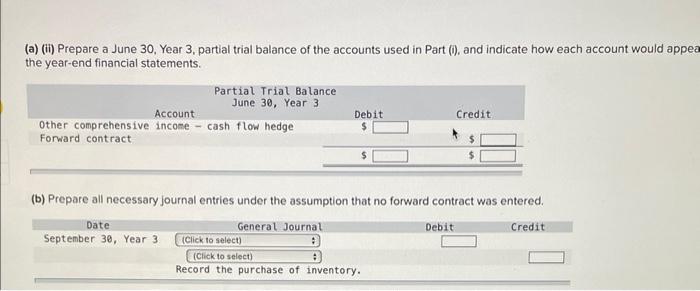

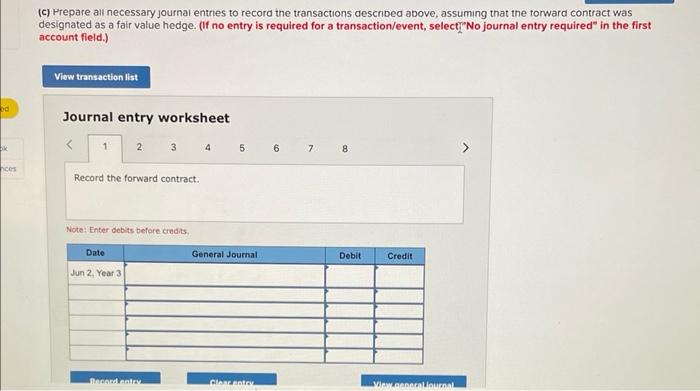

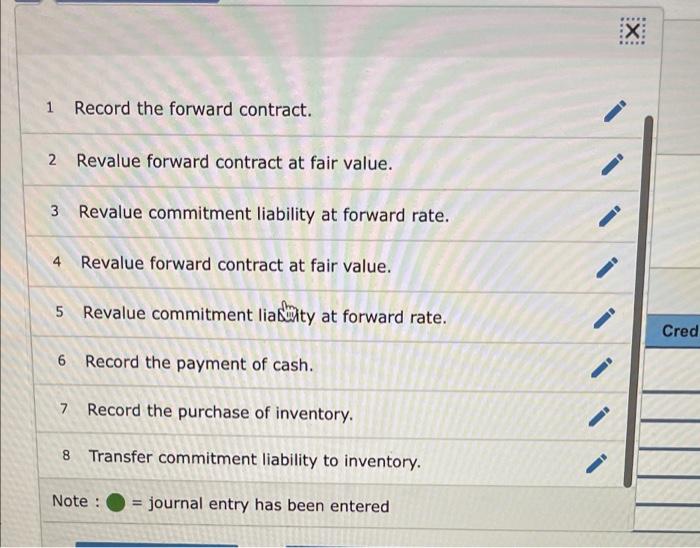

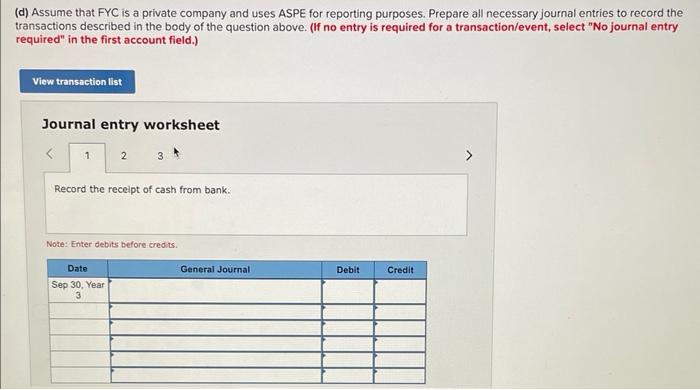

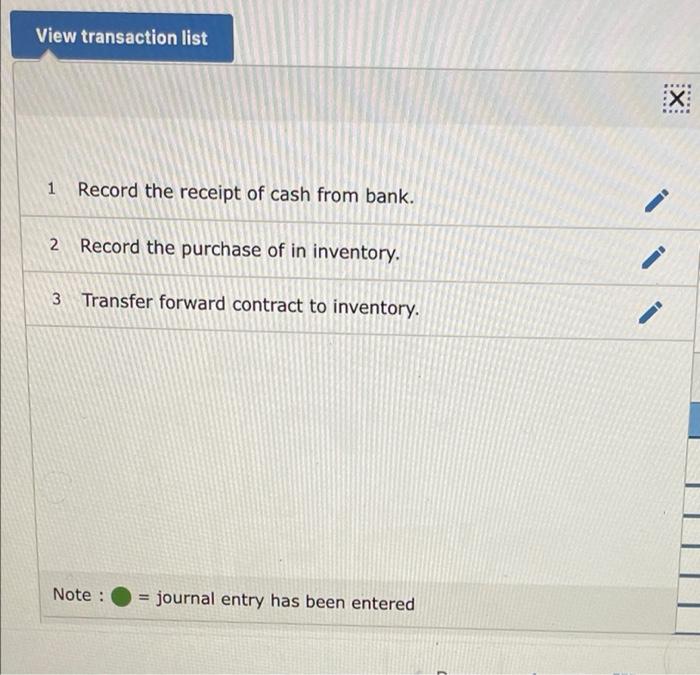

On June 1, Year 3, Forever Young Corp. (FYC) ordered merchandise from a supplier in Turkey for Turkish lira (TL) 202,000. The goods were delivered on September 30 , with terms requiring cash on delivery. On June 2, Year 3. FYC entered a forward contract as a cash flow hedge to purchase TL 202,000 on September 30 , Year 3 , at a rate of $0.75. FYC's year-end is June 30 . On September 30, Year 3, FYC paid the foreign supplier in full and settled the forward contract. Exchange rates were as follows: -For contracts expiring on September 30 , Year 3. Required: (a) (i) Prepare all journal entries required to record the transactions described above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) (a) (i) Prepare all journal entries required to record the transactions described above. (If no entry is requirec select "No journal entry required" in the first account field.) Journal entry worksheet 2 Revalue forward contract at fair value. 3 Revalue forward contract at fair value. 4 Record the receipt of cash from bank. 5 Record the purchase of inventory. (a) (ii) Prepare a June 30, Year 3, partial trial balance of the accounts used in Part (i), and indicate how each account would appe the year-end financial statements. (b) Prepare all necessary journal entries under the assumption that no forward contract was entered. (c) Hrepare all necessary journal entres to record the transactions described above, assuming that the forward contract was designated as a fair value hedge. (If no entry is required for a transaction/event, selecti" No journal entry required" in the first account field.) Journal entry worksheet 1 Record the forward contract. 2 Revalue forward contract at fair value. 3 Revalue commitment liability at forward rate. 4 Revalue forward contract at fair value. 5 Revalue commitment liastity at forward rate. 6 Record the payment of cash. 7 Record the purchase of inventory. 8 Transfer commitment liability to inventory. Note : = journal entry has been entered (d) Assume that FYC is a private company and uses ASPE for reporting purposes. Prepare all necessary journal entries to record the transactions described in the body of the question above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. 1 Record the receipt of cash from bank. 2 Record the purchase of in inventory. On June 1, Year 3, Forever Young Corp. (FYC) ordered merchandise from a supplier in Turkey for Turkish lira (TL) 202,000. The goods were delivered on September 30 , with terms requiring cash on delivery. On June 2, Year 3. FYC entered a forward contract as a cash flow hedge to purchase TL 202,000 on September 30 , Year 3 , at a rate of $0.75. FYC's year-end is June 30 . On September 30, Year 3, FYC paid the foreign supplier in full and settled the forward contract. Exchange rates were as follows: -For contracts expiring on September 30 , Year 3. Required: (a) (i) Prepare all journal entries required to record the transactions described above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) (a) (i) Prepare all journal entries required to record the transactions described above. (If no entry is requirec select "No journal entry required" in the first account field.) Journal entry worksheet 2 Revalue forward contract at fair value. 3 Revalue forward contract at fair value. 4 Record the receipt of cash from bank. 5 Record the purchase of inventory. (a) (ii) Prepare a June 30, Year 3, partial trial balance of the accounts used in Part (i), and indicate how each account would appe the year-end financial statements. (b) Prepare all necessary journal entries under the assumption that no forward contract was entered. (c) Hrepare all necessary journal entres to record the transactions described above, assuming that the forward contract was designated as a fair value hedge. (If no entry is required for a transaction/event, selecti" No journal entry required" in the first account field.) Journal entry worksheet 1 Record the forward contract. 2 Revalue forward contract at fair value. 3 Revalue commitment liability at forward rate. 4 Revalue forward contract at fair value. 5 Revalue commitment liastity at forward rate. 6 Record the payment of cash. 7 Record the purchase of inventory. 8 Transfer commitment liability to inventory. Note : = journal entry has been entered (d) Assume that FYC is a private company and uses ASPE for reporting purposes. Prepare all necessary journal entries to record the transactions described in the body of the question above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. 1 Record the receipt of cash from bank. 2 Record the purchase of in inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts