Question: On March 1, 2017, Kyle Quick, Chad Hyde, and Moss Ditchem, 3 divorce lawyers decide to form a partnership under the name Ditchem, Quick

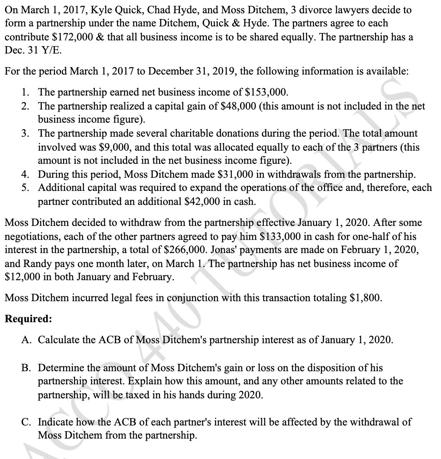

On March 1, 2017, Kyle Quick, Chad Hyde, and Moss Ditchem, 3 divorce lawyers decide to form a partnership under the name Ditchem, Quick & Hyde. The partners agree to each contribute $172,000 & that all business income is to be shared equally. The partnership has a Dec. 31 Y/E. For the period March 1, 2017 to December 31, 2019, the following information is available: 1. The partnership earned net business income of $153,000. 2. The partnership realized a capital gain of $48,000 (this amount is not included in the net business income figure). 3. The partnership made several charitable donations during the period. The total amount involved was $9,000, and this total was allocated equally to each of the 3 partners (this amount is not included in the net business income figure). 4. During this period, Moss Ditchem made $31,000 in withdrawals from the partnership. 5. Additional capital was required to expand the operations of the office and, therefore, each partner contributed an additional $42,000 in cash. Moss Ditchem decided to withdraw from the partnership effective January 1, 2020. After some negotiations, each of the other partners agreed to pay him $133,000 in cash for one-half of his interest in the partnership, a total of $266,000. Jonas' payments are made on February 1, 2020, and Randy pays one month later, on March 1. The partnership has net business income of $12,000 in both January and February. Moss Ditchem incurred legal fees in conjunction with this transaction totaling $1,800. Required: MOT A. Calculate the ACB of Moss Ditchem's partnership interest as of January 1, 2020. B. Determine the amount of Moss Ditchem's gain or loss on the disposition of his partnership interest. Explain how this amount, and any other amounts related to the partnership, will be taxed in his hands during 2020. C. Indicate how the ACB of each partner's interest will be affected by the withdrawal of Moss Ditchem from the partnership.

Step by Step Solution

3.27 Rating (142 Votes )

There are 3 Steps involved in it

A To calculate the adjusted cost base ACB of Moss Ditchems partnership interest as of January 1 2020 ... View full answer

Get step-by-step solutions from verified subject matter experts