Question: On May 1 , Year 7 , Air Canada needs to secure 6 0 0 , 0 0 0 barrels of jet fuel for future

On May Year Air Canada needs to secure barrels of jet fuel for future use and wants to lock in today's fuel price due to concerns about potential price increases. Consequently, they wish to hedge against paying more for of their requirement by May Year Shell, a producer of jet fuels, also wants to lock in today's price to avoid the risk of future price drops. Let's say the price of jet fuel on May Year is $ barrel. Air Canada and Shell enter into a forward contract to buysell barrels of jet fuel at $ per barrel on May Year

Journal entry on May Year

No journal entry is required for this contract at the company; however, a short memo, termed a "memorandum entry" is noted in the books.

As of December Year Air Canada's fiscal yearend, jet fuel is traded at $ per barrel. Air Canada uses effective annual interest rate for such financial instruments.

Journal entry on December Year

Problem

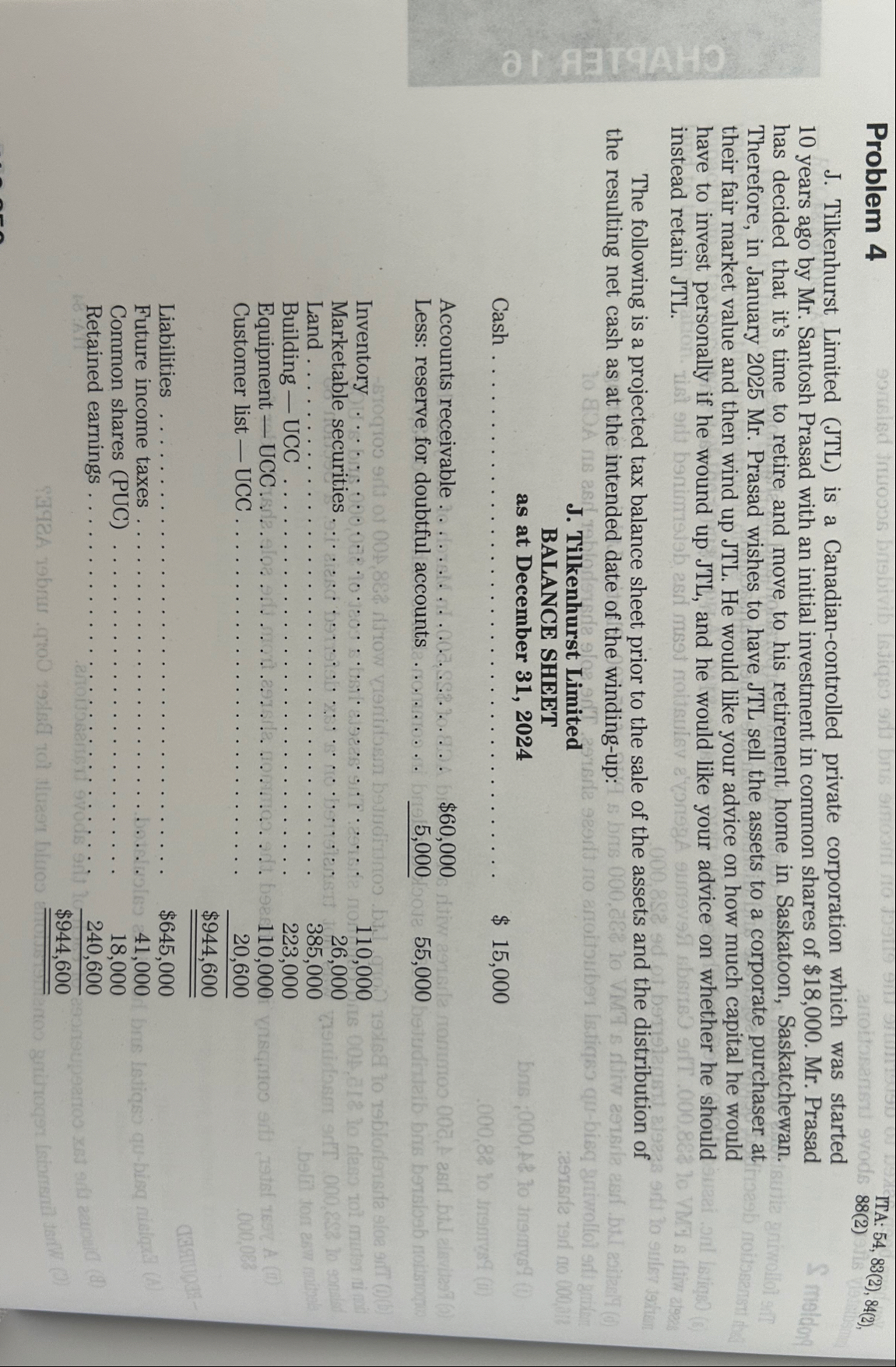

J Tilkenhurst Limited JTL is a Canadiancontrolled private corporation which was started years ago by Mr Santosh Prasad with an initial investment in common shares of $ Mr Prasad has decided that it's time to retire and move to his retirement home in Saskatoon, Saskatchewan. Therefore, in January Mr Prasad wishes to have JTL sell the assets to a corporate purchaser at their fair market value and then wind up JTL He would like your advice on how much capital he would have to invest personally if he wound up JTL and he would like your advice on whether he should instead retain JTL

The following is a projected tax balance sheet prior to the sale of the assets and the distribution of the resulting net cash as at the intended date of the windingup:

J Tilkenhurst Limited

BALANCE SHEET as at December

tableCash $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock