Question: On November 1 , 2 0 2 0 , Cheng Company ( a U . S . - based company ) forecasts the purchase of

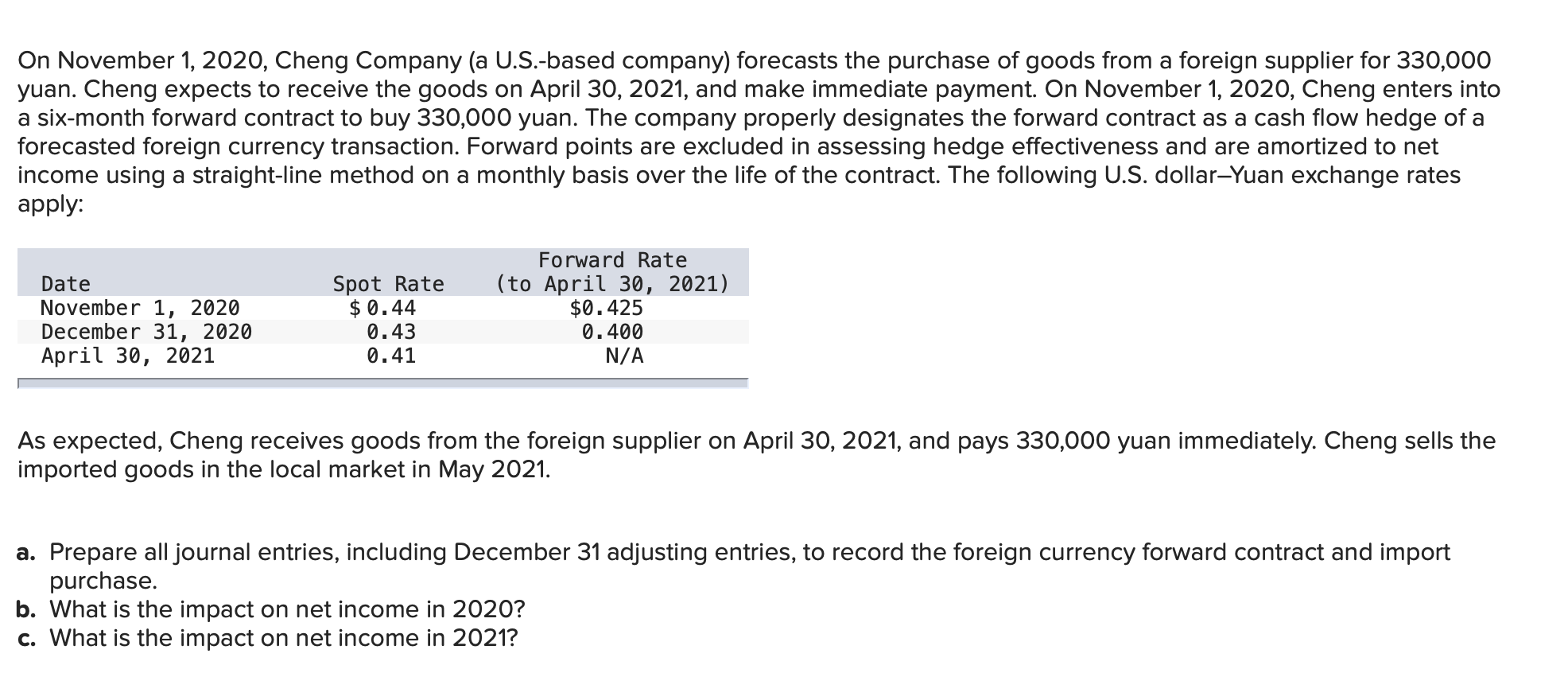

On November Cheng Company a USbased company forecasts the purchase of goods from a foreign supplier for yuan. Cheng expects to receive the goods on April and make immediate payment. On November Cheng enters into a sixmonth forward contract to buy yuan. The company properly designates the forward contract as a cash flow hedge of a forecasted foreign currency transaction. Forward points are excluded in assessing hedge effectiveness and are amortized to net income using a straightline method on a monthly basis over the life of the contract. The following US dollarYuan exchange rates apply:

As expected, Cheng receives goods from the foreign supplier on April and pays yuan immediately. Cheng sells the imported goods in the local market in May

a Prepare all journal entries, including December adjusting entries, to record the foreign currency forward contract and import purchase.

b What is the impact on net income in

c What is the impact on net income in Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Req A

Req B and C

b What is the impact on net income in

c What is the impact on net income in

Negative amounts should be entered with a minus sign. Do not round intermediate calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock