Question: On November 2 8 , 2 0 2 1 , Shocker receives a $ 2 , 2 5 0 payment from a customer for services

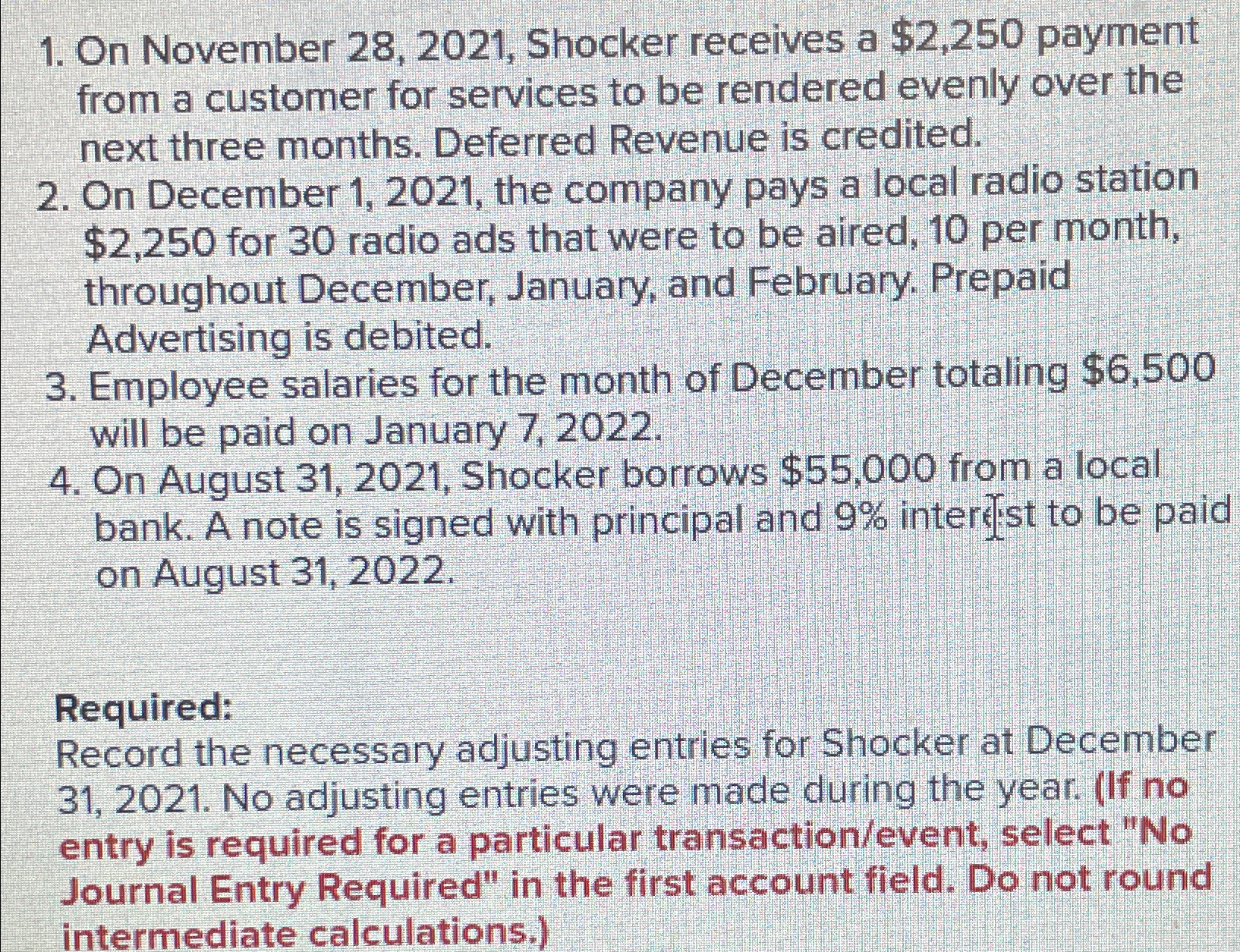

On November Shocker receives a $ payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue is credited.

On December the company pays a local radio station $ for radio ads that were to be aired, per month, throughout December, January, and February. Prepaid Advertising is debited.

Employee salaries for the month of December totaling $ will be paid on January

On August Shocker borrows $ from a local bank. A note is signed with principal and intertist to be paid on August

Required:

Record the necessary adjusting entries for Shocker at December No adjusting entries were made during the year. If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field. Do not round intermediate calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock