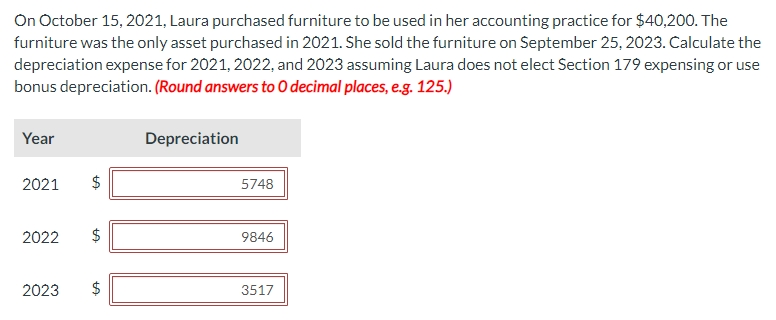

Question: On October 1 5 , 2 0 2 1 , Laura purchased furniture to be used in her accounting practice for ( $

On October Laura purchased furniture to be used in her accounting practice for $ The furniture was the only asset purchased in She sold the furniture on September Calculate the depreciation expense for and assuming Laura does not elect Section expensing or use bonus depreciation. Round answers to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock