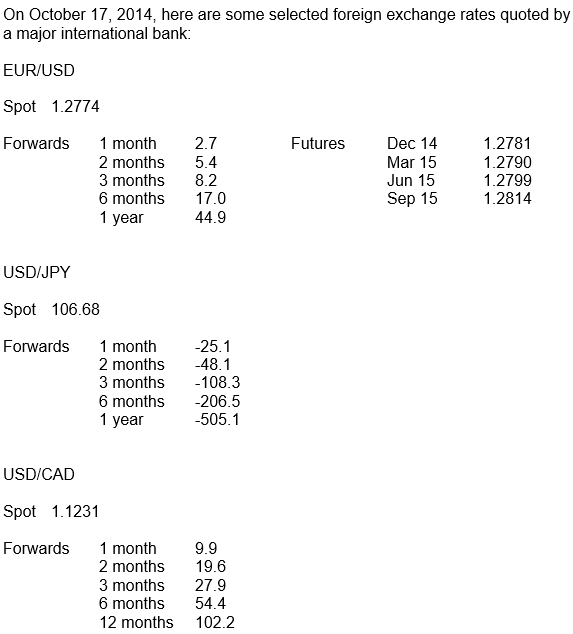

Question: On October 17, 2014, here are some selected foreign exchange rates quoted by a major international bank (in figure below). Answer the following questions based

On October 17, 2014, here are some selected foreign exchange rates quoted by a major international bank (in figure below).

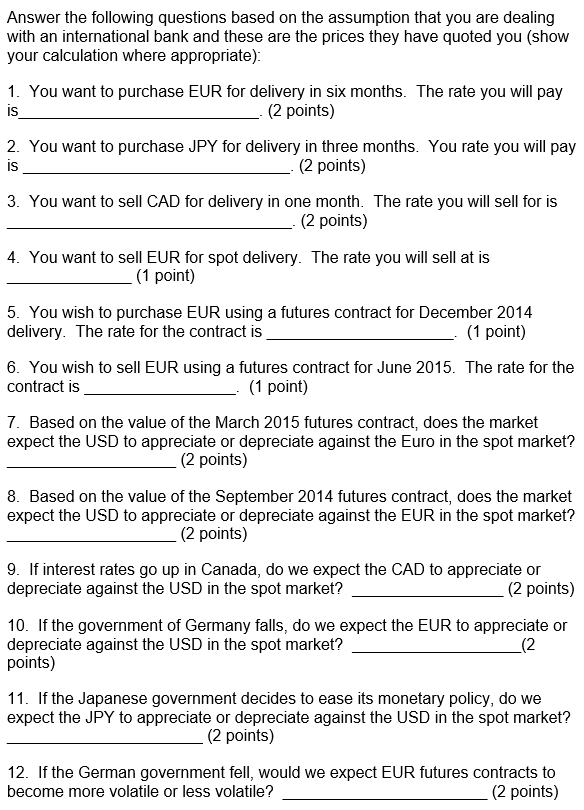

Answer the following questions based on the assumption that you are dealing with an international bank and these are the prices they have quoted you (show your calculation where appropriate):

1. You want to purchase EUR for delivery in six months. The rate you will pay is___________________________. (2 points)

2. You want to purchase JPY for delivery in three months. You rate you will pay is ______________________________. (2 points)

3. You want to sell CAD for delivery in one month. The rate you will sell for is ________________________________. (2 points)

4. You want to sell EUR for spot delivery. The rate you will sell at is ______________ (1 point)

5. You wish to purchase EUR using a futures contract for December 2014 delivery. The rate for the contract is _____________________. (1 point)

6. You wish to sell EUR using a futures contract for June 2015. The rate for the contract is _________________. (1 point)

7. Based on the value of the March 2015 futures contract, does the market expect the USD to appreciate or depreciate against the Euro in the spot market? ___________________ (2 points)

8. Based on the value of the September 2014 futures contract, does the market expect the USD to appreciate or depreciate against the EUR in the spot market? ___________________ (2 points)

9. If interest rates go up in Canada, do we expect the CAD to appreciate or depreciate against the USD in the spot market? _________________ (2 points)

10. If the government of Germany falls, do we expect the EUR to appreciate or depreciate against the USD in the spot market? ___________________(2 points)

11. If the Japanese government decides to ease its monetary policy, do we expect the JPY to appreciate or depreciate against the USD in the spot market? ______________________ (2 points)

12. If the German government fell, would we expect EUR futures contracts to become more volatile or less volatile? _______________________ (2 points)

On October 17, 2014, here are some selected foreign exchange rates quoted by a major international bank: EUR/USD Spot 1.2774 Forwards 1 month 2.7 Dec 14 Mar 15 Jun 15 Sep 15 1.2781 1.2790 1.2799 1.2814 Futures 2 months 3 months 6 months 1 year 5.4 8.2 17.0 44.9 USD/JPY Spot 106.68 Forwards 1 month -25.1 2 months 48.1 3 months -108.3 6 months -206.5 1 year 505.1 USD/CAD Spot 1.1231 Forwards 1 month 9.9 2 months 19.6 3 months 27.9 6 months 54.4 12 months 102.2 Answer the following questions based on the assumption that you are dealing with an international bank and these are the prices they have quoted you (show your calculation where appropriate) 1. You want to purchase EUR for delivery in six months. The rate you will pay IS (2 points) 2. You want to purchase JPY for delivery in three months. You rate you will pay IS (2 points) 3. You want to sell CAD for delivery in one month. The rate you will sell for is (2 points) 4. You want to sell EUR for spot delivery. The rate you will sell at is (1 point) 5. You wish to purchase EUR using a futures contract for December 2014 delivery. The rate for the contract is (1 point) 6. You wish to sell EUR using a futures contract for June 2015. The rate for the contract is (1 point) 7. Based on the value of the March 2015 futures contract, does the market expect the USD to appreciate or depreciate against the Euro in the spot market? (2 points) 8. Based on the value of the September 2014 futures contract, does the market expect the USD to appreciate or depreciate against the EUR in the spot market? (2 points) 9. If interest rates go up in Canada, do we expect the CAD to appreciate or depreciate against the USD in the spot market? (2 points) 10. If the government of Germany falls, do we expect the EUR to appreciate or depreciate against the USD in the spot market? points) (2 11. If the Japanese government decides to ease its monetary policy, do we expect the JPY to appreciate or depreciate against the USD in the spot market? 2 pointS) 12. If the German government fell, would we expect EUR futures contracts to become more volatile or less volatile? (2 points) On October 17, 2014, here are some selected foreign exchange rates quoted by a major international bank: EUR/USD Spot 1.2774 Forwards 1 month 2.7 Dec 14 Mar 15 Jun 15 Sep 15 1.2781 1.2790 1.2799 1.2814 Futures 2 months 3 months 6 months 1 year 5.4 8.2 17.0 44.9 USD/JPY Spot 106.68 Forwards 1 month -25.1 2 months 48.1 3 months -108.3 6 months -206.5 1 year 505.1 USD/CAD Spot 1.1231 Forwards 1 month 9.9 2 months 19.6 3 months 27.9 6 months 54.4 12 months 102.2 Answer the following questions based on the assumption that you are dealing with an international bank and these are the prices they have quoted you (show your calculation where appropriate) 1. You want to purchase EUR for delivery in six months. The rate you will pay IS (2 points) 2. You want to purchase JPY for delivery in three months. You rate you will pay IS (2 points) 3. You want to sell CAD for delivery in one month. The rate you will sell for is (2 points) 4. You want to sell EUR for spot delivery. The rate you will sell at is (1 point) 5. You wish to purchase EUR using a futures contract for December 2014 delivery. The rate for the contract is (1 point) 6. You wish to sell EUR using a futures contract for June 2015. The rate for the contract is (1 point) 7. Based on the value of the March 2015 futures contract, does the market expect the USD to appreciate or depreciate against the Euro in the spot market? (2 points) 8. Based on the value of the September 2014 futures contract, does the market expect the USD to appreciate or depreciate against the EUR in the spot market? (2 points) 9. If interest rates go up in Canada, do we expect the CAD to appreciate or depreciate against the USD in the spot market? (2 points) 10. If the government of Germany falls, do we expect the EUR to appreciate or depreciate against the USD in the spot market? points) (2 11. If the Japanese government decides to ease its monetary policy, do we expect the JPY to appreciate or depreciate against the USD in the spot market? 2 pointS) 12. If the German government fell, would we expect EUR futures contracts to become more volatile or less volatile? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts