Question: On October 31, 2018, the bank statement for the checking account of Blockwood Video shows a balance of $12,900, while the company's records show a

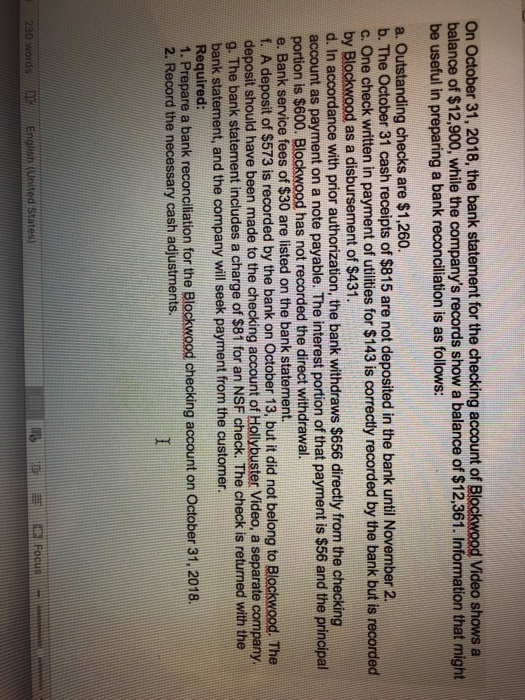

On October 31, 2018, the bank statement for the checking account of Blockwood Video shows a balance of $12,900, while the company's records show a balance of $12,361. Information that might be useful in preparing a bank reconciliation is as follows: 4 a. Outstanding checks are $1,260. b. The October 31 cash receipts of $815 are not deposited in the bank until November 2. c. One check written in payment of utilities for $143 is correctly recorded by the bank but is recorded by Blockwood as a disbursement of $431. d. In accordance with prior authorization, the bank withdraws $656 directly from the checking 2 account as payment on a note payable. The interest portion of that payment is $56 and the principal portion is $600. Blockwood has not recorded the direct withdrawal. e. Bank service fees of $30 are listed on the bank statement. f. A deposit of $573 is recorded by the bank on October 13, but it did not belong to Blockwood. The deposit should have been made to the checking account of Hollybuster Video, a separate company 9. The bank statement includes a charge of $81 for an NSF check. The check is returned with the bank statement, and the company will seek payment from the customer Required: 1. Prepare a bank reconciliation for the Blockwood checking account on October 31, 2018 2. Record the necessary cash adjustments. English United States)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts