On your first day as a intern at Tri-Star Management Incorporated the CEO asks you to...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

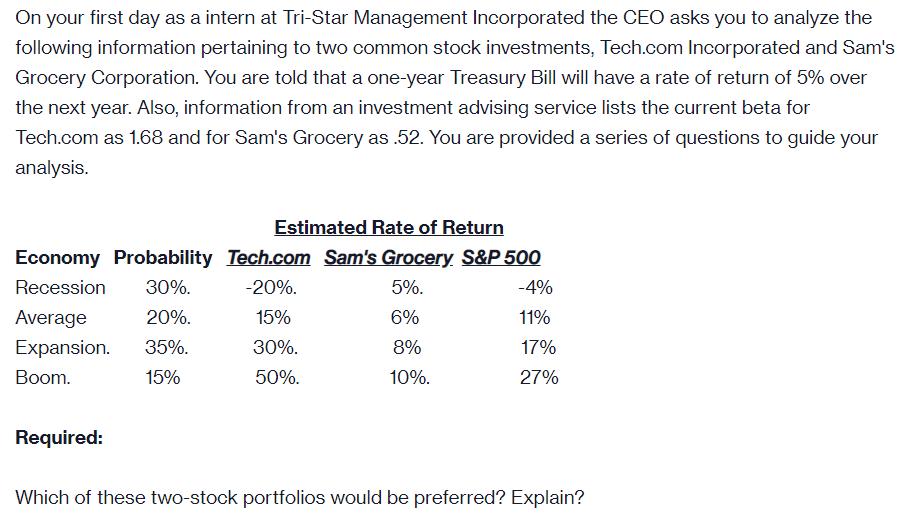

On your first day as a intern at Tri-Star Management Incorporated the CEO asks you to analyze the following information pertaining to two common stock investments, Tech.com Incorporated and Sam's Grocery Corporation. You are told that a one-year Treasury Bill will have a rate of return of 5% over the next year. Also, information from an investment advising service lists the current beta for Tech.com as 1.68 and for Sam's Grocery as .52. You are provided a series of questions to guide your analysis. Estimated Rate of Return Economy Probability Tech.com Sam's Grocery. S&P 500 Recession 30%. -20%. 5%. -4% Average 20%. 15% 6% 11% Expansion. 35%. 30%. 8% 17% Boom. 15% 50%. 10%. 27% Required: Which of these two-stock portfolios would be preferred? Explain? On your first day as a intern at Tri-Star Management Incorporated the CEO asks you to analyze the following information pertaining to two common stock investments, Tech.com Incorporated and Sam's Grocery Corporation. You are told that a one-year Treasury Bill will have a rate of return of 5% over the next year. Also, information from an investment advising service lists the current beta for Tech.com as 1.68 and for Sam's Grocery as .52. You are provided a series of questions to guide your analysis. Estimated Rate of Return Economy Probability Tech.com Sam's Grocery. S&P 500 Recession 30%. -20%. 5%. -4% Average 20%. 15% 6% 11% Expansion. 35%. 30%. 8% 17% Boom. 15% 50%. 10%. 27% Required: Which of these two-stock portfolios would be preferred? Explain?

Expert Answer:

Answer rating: 100% (QA)

To determine which twostock portfolio would be preferred we need to calculate the expected rate of return for each portfolio and then compare them Fir... View the full answer

Related Book For

Introduction to Corporate Finance What Companies Do

ISBN: 978-1111222284

3rd edition

Authors: John Graham, Scott Smart

Posted Date:

Students also viewed these accounting questions

-

1. Calculate the expected rate of return for Tech.com Incorporated, Sams Grocery Corporation, and the S&P 500 Index. 2. Calculate the standard deviations of the estimated rates of return for Tech.com...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

On your first day as a student marketing intern at the O-Tay Research Company, the supervisor hands you a list of yesterdays telephone interviewer records. She tells you to analyze them and to give...

-

A 35 ft3 rigid tank has air at 225 psia and ambient 600 R connected by a valve to a piston cylinder. The piston of area 1 ft2 requires 40 psia below it to float, Fig. P3.99. The valve is opened and...

-

When a company has a policy of making sales for which credit is extended, it is reasonable to expect a portion of those sales to be uncollectible. As a result of this, a company must recognize bad...

-

Are plastic and nylon minerals?

-

Derive the kinematic and dynamic conditions needed in the analysis. Set up the equations to find the constants. Now require that the determinant of the coefficient matrix should be zero to obtain a...

-

Kendall Jackson, CPA, is examining the operating effectiveness of the internal control of Town Mo, a large conglomerate in the music industry. As part of the evaluation, Jackson determined a...

-

The following selected accounts appear in the ledger of Upscale Construction Inc. at the beginning of the current year: Preferred 2% Stock, $75 par (40,000 shares authorized, 20,000 shares issued)...

-

Complete the 2019 federal income tax return for Sarah Hamblin. Be sure to include only required tax forms when completing the tax return. For purposes of this assignment, unless instructed otherwise,...

-

Dear Sir; I am writing in response to your request for additional information in Block #3 of the accident reporting form. I put "Poor Planning" as the cause of my accident. You asked for a fuller...

-

1) We have started the process to extradite the people responsible for the OPM incident. We need to cross all of our Ts and dot all of our Is. So, you need to use the information from your readings...

-

Watch the video of NBC commentator Bob Costas making remarks about gun control during halftime of a Sunday night football game and the discussion on "Reliable Sources." Notice how the journalists who...

-

The Course Project consists of 12 Requirements for you to complete. There are eight worksheets in the workbook you will need to complete. A list of March transactions A Chart of Accounts reference...

-

These questions are from "A first look at communication theory by Em Griffen" These are from chapter 4: Mapping the Territory (Seven Traditions in the Field of Communication Theory) QUESTIONS TO...

-

Sheffield corporation is considered the following alternatives: alternate a Alternate B revenues $ 44,000 $58,000 Variable costs 33,000 33,000 fixed costs 10,000 16,000 What is the incremental profit

-

How much is the increase in the fair value of the biological asset due to physical change? Wander Company is in business of cattle farming. A herd of 200, 3 year old and 150 4-year old cattle are...

-

On 1 July 2021, Croydon Ltd leased ten excavators for five years from Machines4U Ltd. The excavators are expected to have an economic life of 6 years, after which time they will have an expected...

-

List and briefly describe the key services investment banks provide to firms before, during, and after a securities offering.

-

Suppose investors face a tax rate of 40 % on interest received from corporate bonds. Suppose AAA-rated corporate bonds currently offer yields of about 7 %. Approximately what yield would AAA-rated...

-

Use the following information to answer the questions that follow. a. Use the DuPont system to compare the two heavy metal companies shown above (HMM and MS) during 2012. Which of the two has a...

-

Show that for real numbers \(\alpha, \beta\), and \(\delta\) the matrices form a group under matrix multiplication. Show that the matrices \(G\) with \(\alpha=\beta=0\) form an invariant subgroup of...

-

Show that the quotient group of the 4-group \(\mathrm{D}_{2}\) defined in Problem 2.9 is \(\mathrm{C}_{2}\).

-

Prove that the angular momentum operator \(L_{z}\) generates rotations around the \(z\)-axis.

Study smarter with the SolutionInn App