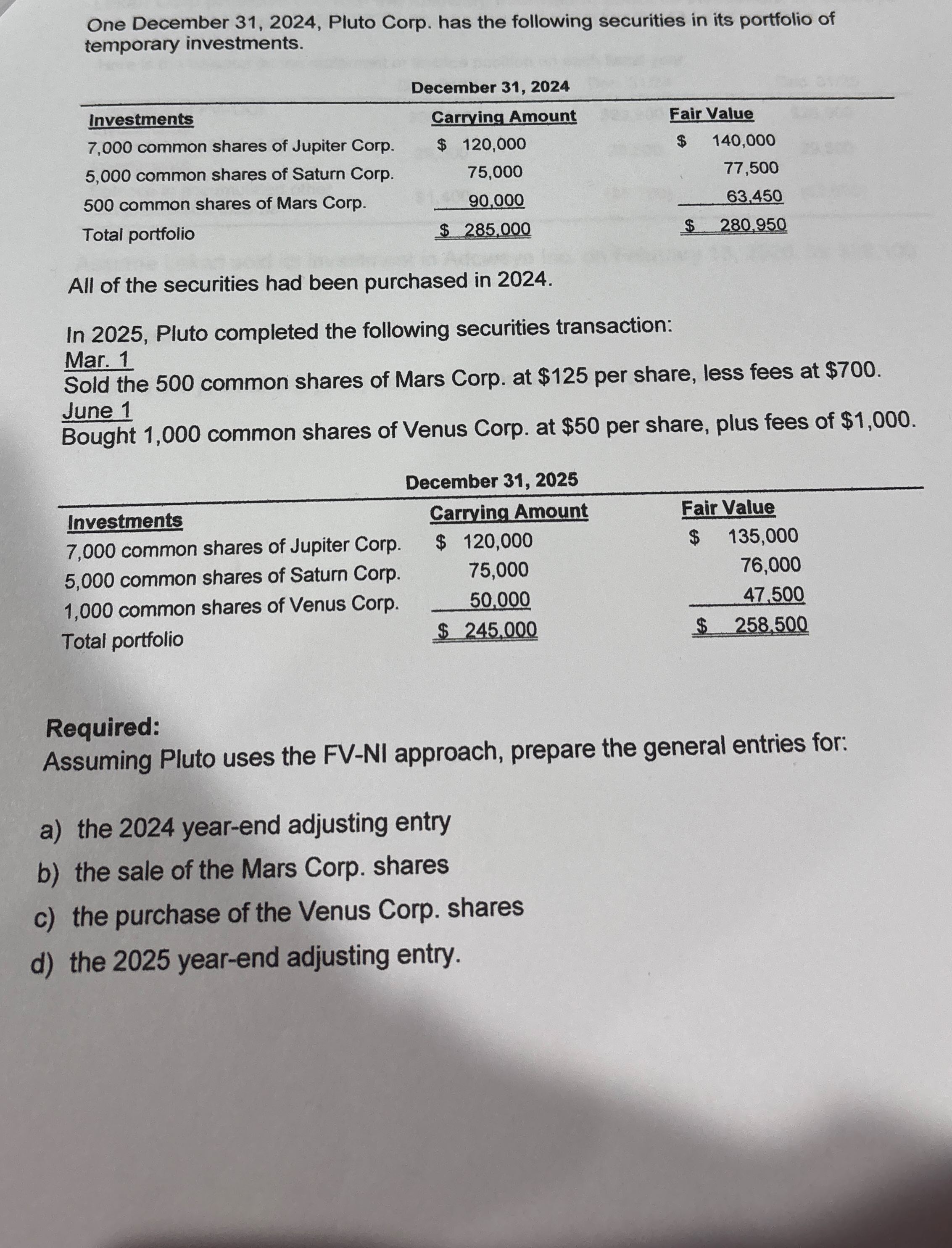

Question: One December 3 1 , 2 0 2 4 , Pluto Corp. has the following securities in its portfolio of temporary investments. December 3 1

One December Pluto Corp. has the following securities in its portfolio of temporary investments.

December

tableDecember InvestmentsCarrying Amount,Fair Value common shares of Jupiter Corp.,$ $ common shares of Saturn Corp., common shares of Mars Corp.,Total portfolio,$ $

All of the securities had been purchased in

In Pluto completed the following securities transaction:

Mar.

Sold the common shares of Mars Corp. at $ per share, less fees at $ June

Bought common shares of Venus Corp. at $ per share, plus fees of $

Required:

Assuming Pluto uses the FVNI approach, prepare the general entries for:

a the yearend adjusting entry

b the sale of the Mars Corp. shares

c the purchase of the Venus Corp. shares

d the yearend adjusting entry.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock