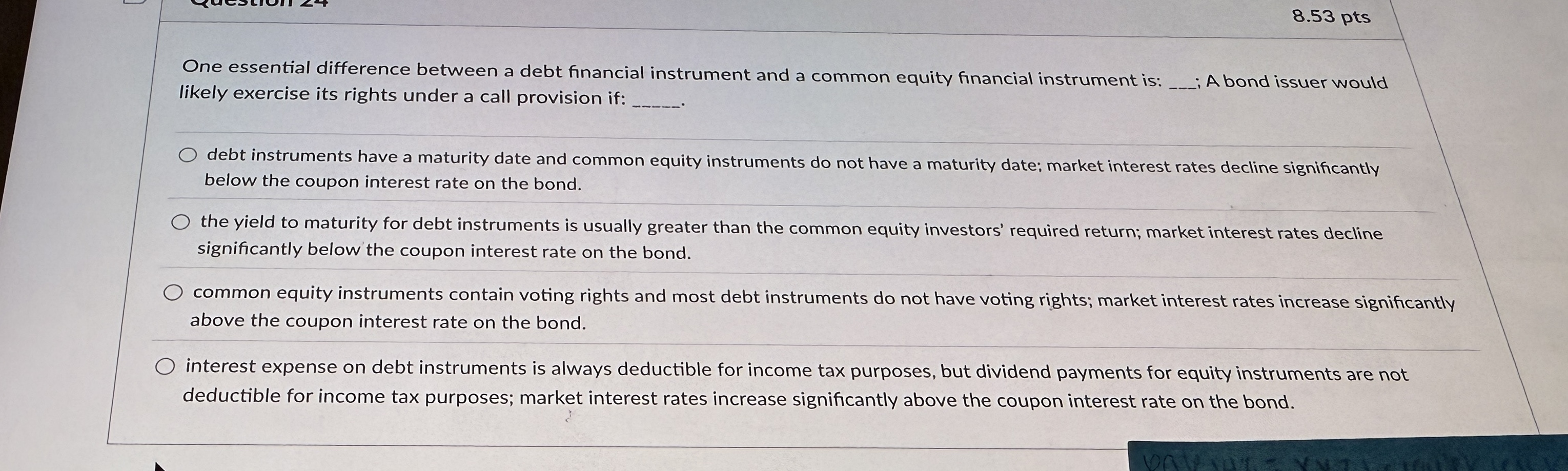

Question: One essential difference between a debt financial instrument and a common equity financial instrument is: ; A bond issuer would likely exercise its rights under

One essential difference between a debt financial instrument and a common equity financial instrument is: ; A bond issuer would likely exercise its rights under a call provision if:debt instruments have a maturity date and common equity instruments do not have a maturity date; market interest rates decline significantly below the coupon interest rate on the bond.the yield to maturity for debt instruments is usually greater than the common equity investors' required return; market interest rates decline significantly below the coupon interest rate on the bond.common equity instruments contain voting rights and most debt instruments do not have voting rights; market interest rates increase significantly above the coupon interest rate on the bond.interest expense on debt instruments is always deductible for income tax purposes, but dividend payments for equity instruments are not deductible for income tax purposes; market interest rates increase significantly above the coupon interest rate on the bond.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock