Question: one long question :(. explanations would be helpful, thanks Consider the following two mutually exclusive projects: Year O Cash Flow (A) 358,000 37,000 57,000 57,000

one long question :(. explanations would be helpful, thanks

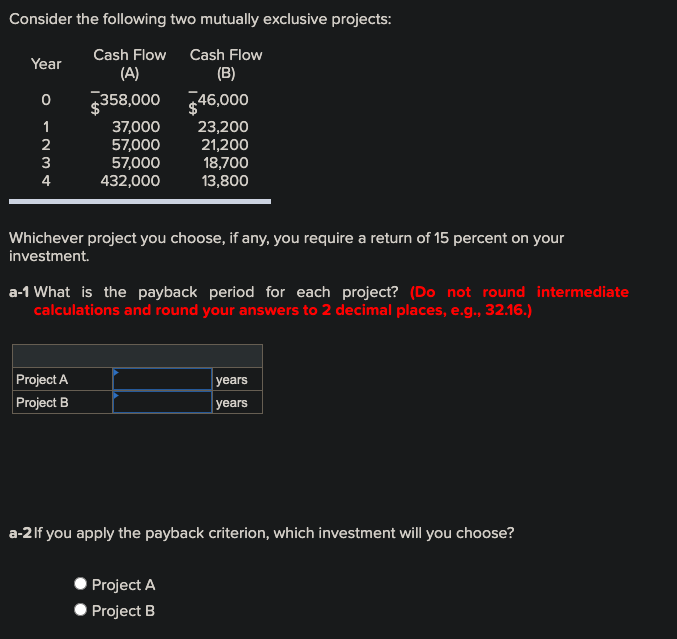

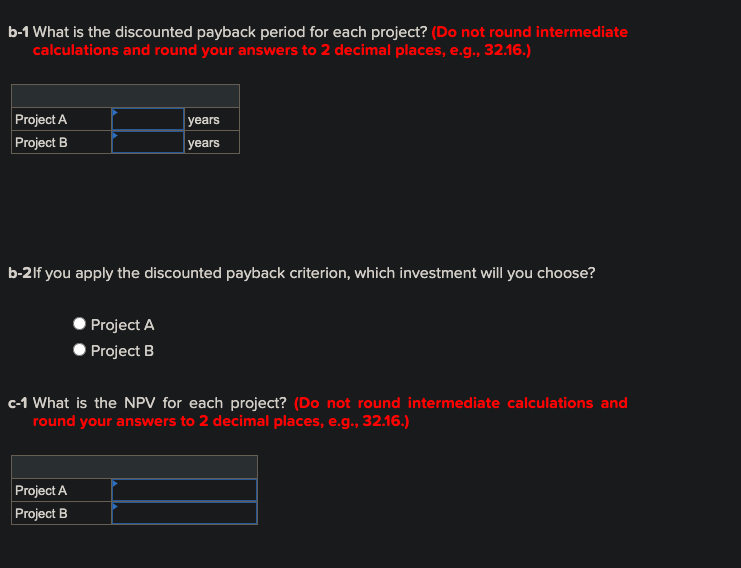

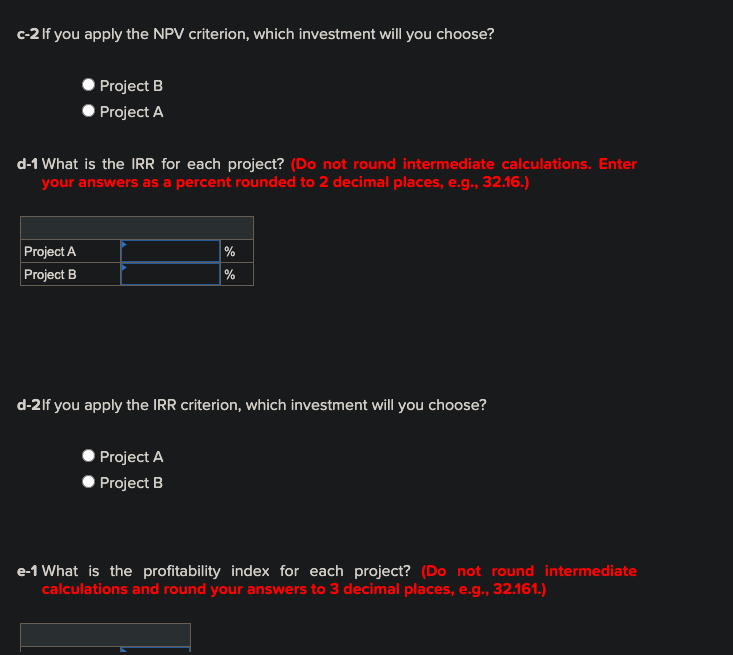

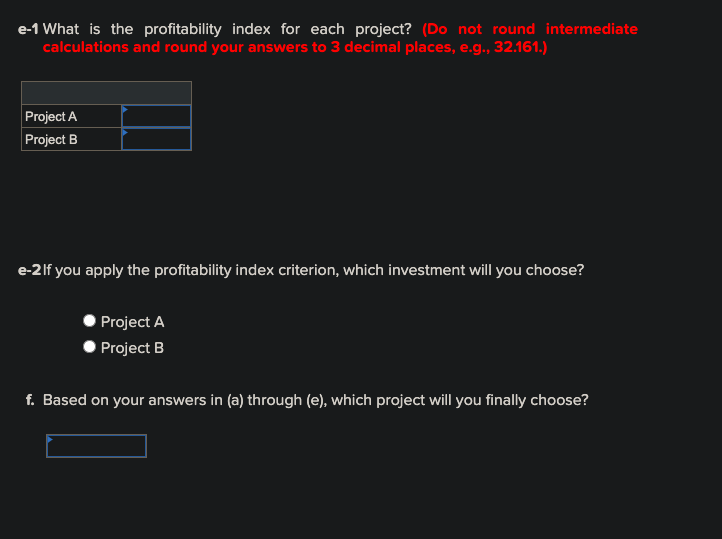

Consider the following two mutually exclusive projects: Year O Cash Flow (A) 358,000 37,000 57,000 57,000 432,000 Cash Flow (B) +46,000 23,200 21,200 18,700 13,800 FNM 2 3 4 Whichever project you choose, if any, you require a return of 15 percent on your investment. a-1 What is the payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project A Project B years years a-2If you apply the payback criterion, which investment will you choose? Project A Project B b-1 What is the discounted payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) years Project A Project B years b-2If you apply the discounted payback criterion, which investment will you choose? Project A Project B c-1 What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project A Project B c-2 If you apply the NPV criterion, which investment will you choose? Project B Project A d-1 What is the IRR for each project? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Project A Project B % % d-2If you apply the IRR criterion, which investment will you choose? Project A Project B e-1 What is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) e-1 What is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Project A Project B e-2If you apply the profitability index criterion, which investment will you choose? Project A Project B f. Based on your answers in (a) through (e), which project will you finally choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts