Question: One of your friends needs your help in computing the cost of capital for a company. She has the following information about the company. What

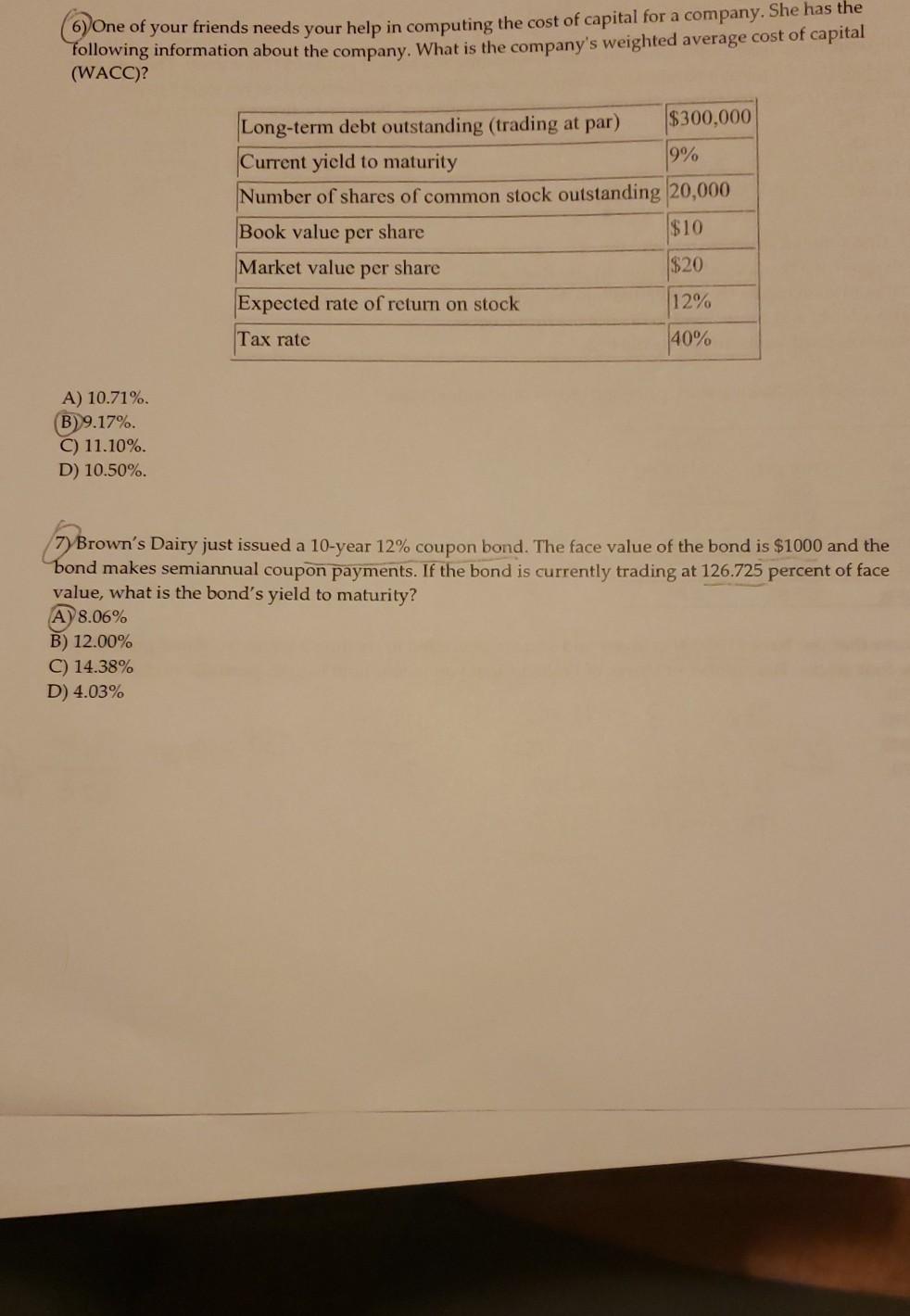

One of your friends needs your help in computing the cost of capital for a company. She has the following information about the company. What is the company's weighted average cost of capital (WACC)? Long-term debt outstanding (trading at par) $300,000 Current yield to maturity 9% Number of shares of common stock outstanding 20,000 Book value per share $10 Market value per share $20 Expected rate of return on stock 12% Tax rate 40% A) 10.71% B) 9.17%. C) 11.10%. D) 10.50%. 7) Brown's Dairy just issued a 10-year 12% coupon bond. The face value of the bond is $1000 and the bond makes semiannual coupon payments. If the bond is currently trading at 126.725 percent of face value, what is the bond's yield to maturity? A) 8.06% B) 12.00% C) 14.38% D) 4.03%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts