Question: one question in 2 pics Sensitivity Analysis: Determine how the net present value of the investment will be affected by various factors. You are about

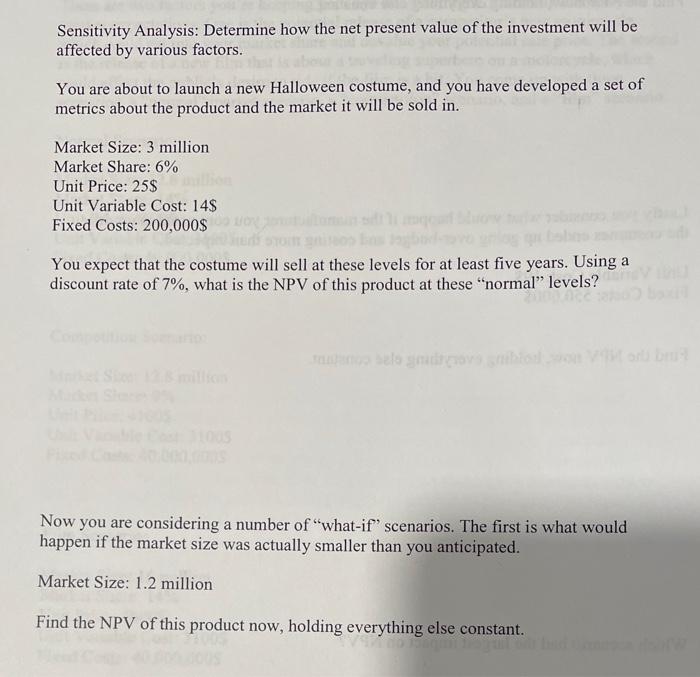

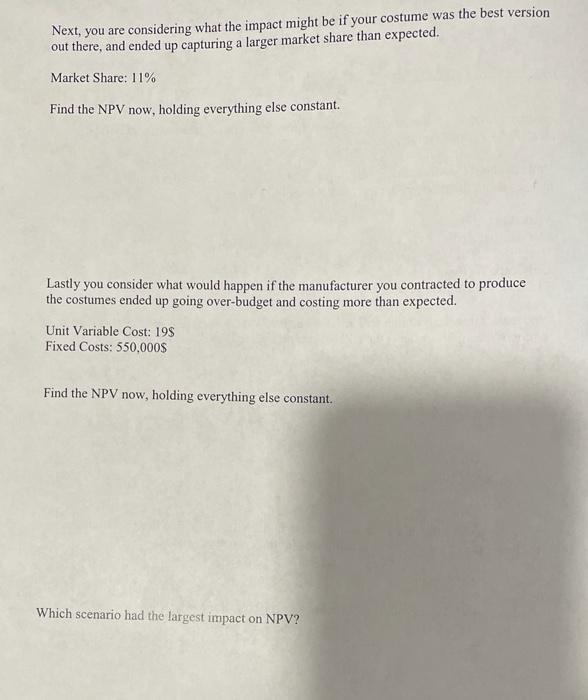

Sensitivity Analysis: Determine how the net present value of the investment will be affected by various factors. You are about to launch a new Halloween costume, and you have developed a set of metrics about the product and the market it will be sold in. Market Size: 3 million Market Share: 6% Unit Price: 25$ Unit Variable Cost: 14$ Fixed Costs: 200,000$ los You expect that the costume will sell at these levels for at least five years. Using a discount rate of 7%, what is the NPV of this product at these normal levels? Now you are considering a number of "what-if' scenarios. The first is what would happen if the market size was actually smaller than you anticipated. Market Size: 1.2 million Find the NPV of this product now, holding everything else constant. Next, you are considering what the impact might be if your costume was the best version out there, and ended up capturing a larger market share than expected. Market Share: 11% Find the NPV now, holding everything else constant. Lastly you consider what would happen if the manufacturer you contracted to produce the costumes ended up going over-budget and costing more than expected. Unit Variable Cost: 195 Fixed Costs: 550,000$ Find the NPV now, holding everything else constant. Which scenario had the largest impact on NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts