Question: Question 1 If a firm's projects differ in risk, then one way of handling this problem is to evaluate each project with the appropriate risk-adjusted

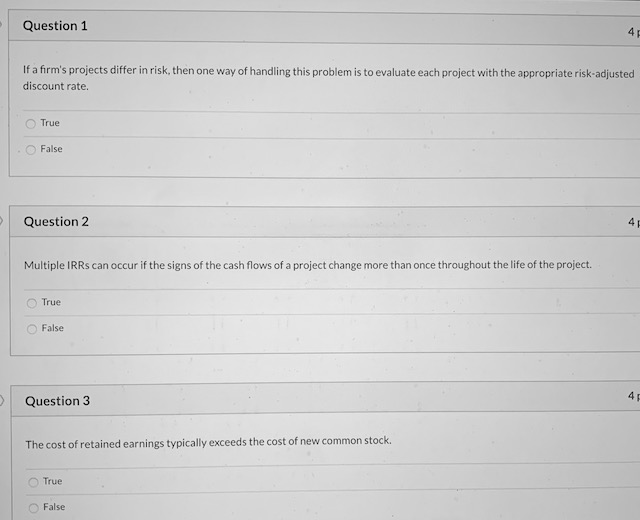

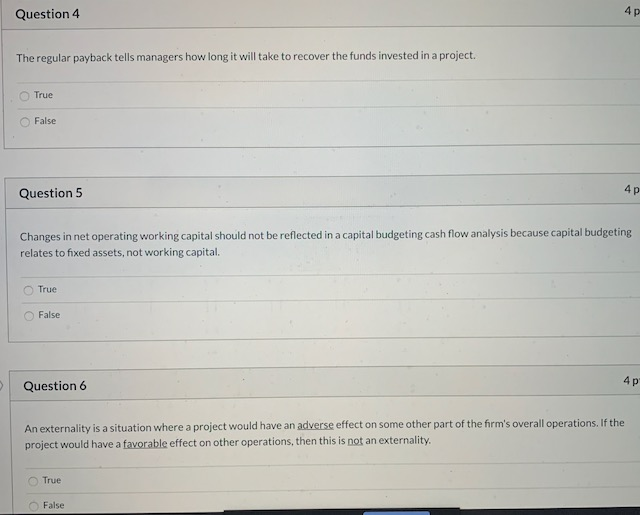

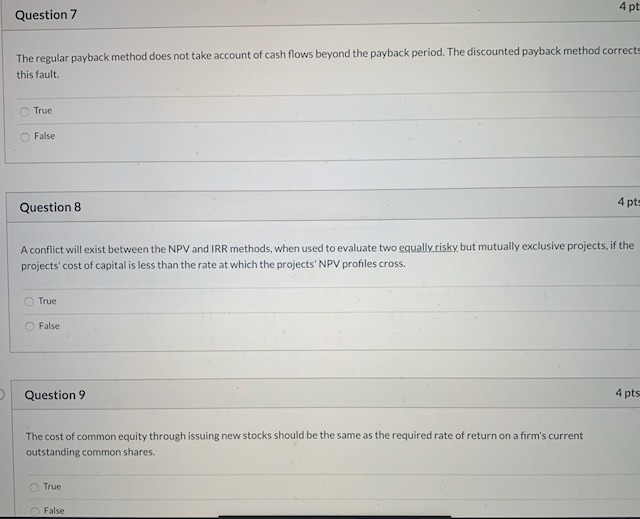

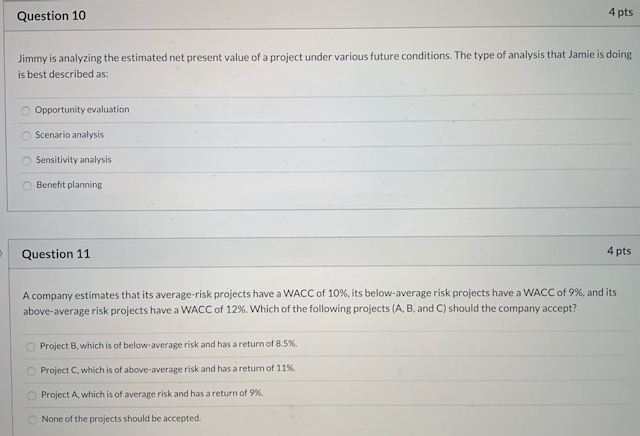

Question 1 If a firm's projects differ in risk, then one way of handling this problem is to evaluate each project with the appropriate risk-adjusted discount rate. True False Question 2 41 Multiple IRRs can occur if the signs of the cash flows of a project change more than once throughout the life of the project. True False Question 3 The cost of retained earnings typically exceeds the cost of new common stock. True Question 4 The regular payback tells managers how long it will take to recover the funds invested in a project. True False Question 5 Changes in net operating working capital should not be reflected in a capital budgeting cash flow analysis because capital budgeting relates to fixed assets, not working capital. True False Question 6 4p An externality is a situation where a project would have an adverse effect on some other part of the firm's overall operations. If the project would have a favorable effect on other operations, then this is not an externality. True False Question 7 4p The regular payback method does not take account of cash flows beyond the payback period. The discounted payback method correct this fault. True False Question 8 4 pt: A conflict will exist between the NPV and IRR methods, when used to evaluate two equally risky but mutually exclusive projects, if the projects' cost of capital is less than the rate at which the projects' NPV profiles cross. True False Question 9 4 pts The cost of common equity through issuing new stocks should be the same as the required rate of return on a firm's current outstanding common shares. True False Question 10 4 pts Jimmy is analyzing the estimated net present value of a project under various future conditions. The type of analysis that Jamie is doing is best described as: Opportunity evaluation Scenario analysis Sensitivity analysis Benefit planning Question 11 4 pts A company estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 9%, and its above-average risk projects have a WACC of 12%. Which of the following projects (A, B, and C) should the company accept? Project B, which is of below average risk and has a return of 8.5%. Project C, which is of above average risk and has a return of 11% Project A which is of average risk and has a return of 9%. None of the projects should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts