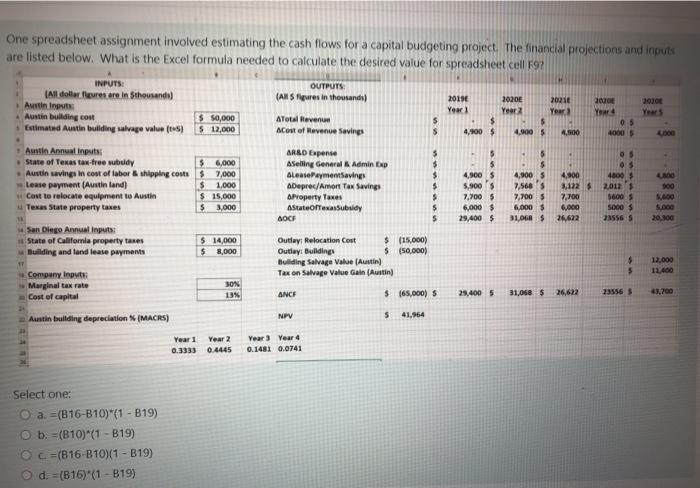

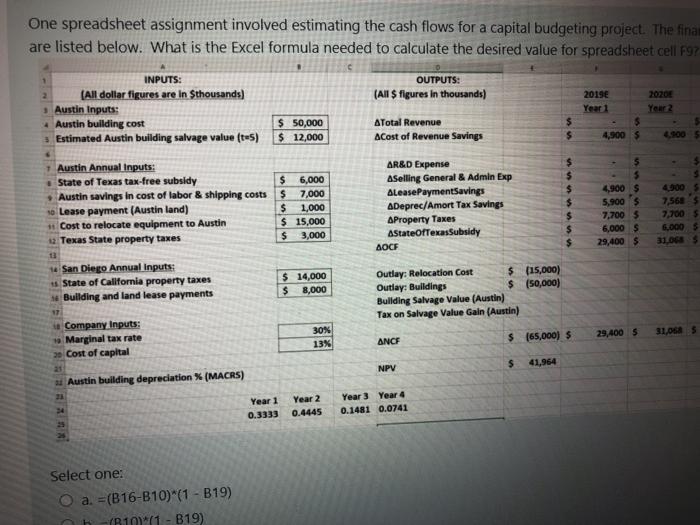

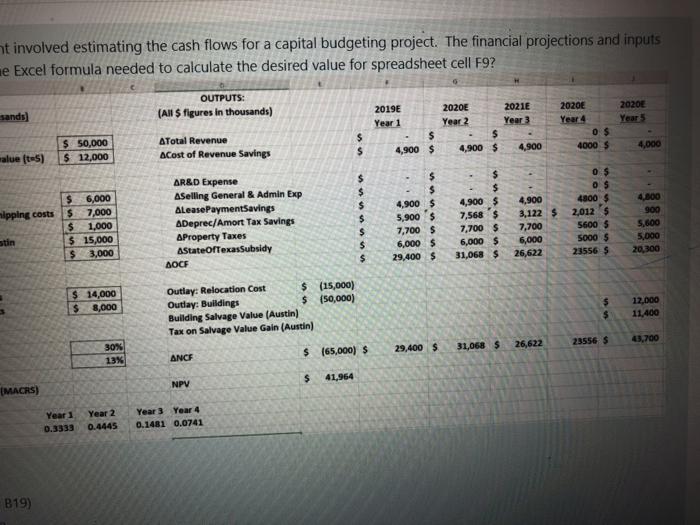

Question: One spreadsheet assignment involved estimating the cash flows for a capital budgeting project. The financial projections and inputs are listed below. What is the Excel

One spreadsheet assignment involved estimating the cash flows for a capital budgeting project. The financial projections and inputs are listed below. What is the Excel formula needed to calculate the desired value for spreadsheet cell F9? OUTPUTS: (ARS figures in thousands INPUTS: All doller fleres are in thousands) Austin Input Austin building con Estimated Austin buliding alage value (5) $ 50,000 $ 12,000 2019 Year1 $ 4,200 $ 20210 Years ATotal Revenue Acost of Revenue Savings 2020 Yeer $ 40005 2020 Year 4 05 4000 5 4,100 1000 Austin Annual inputs State of Texas tax-free wbudy 5 6,000 Austin savings in cost of labor & shipping costs $7,000 Lease payment Austin tand) $ 1.000 Cost to relocate equipment to Austin $ 15,000 Texas State property taxes $ 3,000 ARSD Expense Selling General Admin Exp AleasePayment Saving A Deprec/Amort Tax Savings Property Taxes AstateofuxasSubsidy AOC $ $ $ 4,900 $ 5,900 7,7005 6,000 $ 29,400 $ 4,900 5 7,560 7,7005 6,000 $ 31.06R$ 4,900 3.122 7,700 6.000 26.622 05 4000 $ 2012 5600 5000 $ 235565 40 DOO 5.000 SOOG 20.300 $ San Diego Annual inputs State of California property taxes Building and fand lease payments $ 14,000 $ 8,000 Outlay Relocation Cost $ (15,000) Outley Buildings S (50.000) Building Salvage Value (Austin) Taxon Salvage Value Gain (Austin) 12.000 5 5 Company Input Marginal tax rate Cost of capital SON 131 ANCE $ 165,000) 29.400 5 31,068 $ 26,622 23556 5 43,700 NPV $ Austin building depreciation (MACRS) 41.964 Year 1 0.3333 Year 2 0.4445 Year 3 Year 0.1481 0.0741 Select one: a. =(B16-B10)*(1 - B19) b. =(B10)*(1 - B19) Oc=(816-B10)(1 - B19) d. =(B16) (1 - B19) One spreadsheet assignment involved estimating the cash flows for a capital budgeting project. The finan are listed below. What is the Excel formula needed to calculate the desired value for spreadsheet cell F97 INPUTS: OUTPUTS: (All dollar figures are in Sthousands) (All $ figures in thousands) Austin Inputs: Austin building cost $ 50,000 ATotal Revenue Estimated Austin building salvage value (-5) $ 12,000 Acost of Revenue Savings 2019 2020 Year 1 Your 2 5 4,900 $ 4.900 $ $ Austin Annual Inputs: State of Texas tax-free subsidy Austin savings in cost of labor & shipping costs Lease payment (Austin land) Cost to relocate equipment to Austin Texas State property taxes $ 6,000 $ 7,000 $ 1,000 $ 15,000 $ 3,000 AR&D Expense ASelling General & Admin Exp Alease Payment Savings ADeprec/Amort Tax Savings AProperty Taxes AStateOfTexasSubsidy OCIE $ $ $ $ 4,900 5,9005 7,7005 6,000 S 29.400 4900 7,568 7,700 5 6.000 $ 31.068 San Diego Annual Inputs: State of California property taxes Building and land lease payments $ 14,000 $ 8,000 Outlay: Relocation Cost $(15,000) Outlay: Buildings $ (50,000) Buliding Salvage Value (Austin) Tax on Salvage Value Gain (Austin) 30% 13% 31.05 29,400 5 $ (65,000) S ANCE Company Inputs: Marginal tax rate Cost of capital Austin building depreciation % (MACRS) NPV $ 41,964 Year 1 0.3333 Year 2 0.4445 Year 3 Year 4 0.1481 0.0741 Select one: O a. =(B16-B10)"(1 - B19) h (B10111 - B19) nt involved estimating the cash flows for a capital budgeting project. The financial projections and inputs ne Excel formula needed to calculate the desired value for spreadsheet cell F9? OUTPUTS: (All S figures in thousands) sands) 2021E Year 3 2020 Year 5 2019E Year 1 $ 4,900 $ 2020E Year 2 $ 4,900 $ 2020 Year 4 0$ 4000 $ $ 50,000 $ 12,000 ATotal Revenue Acost of Revenue Savings $ $ 4.900 4,000 walue (tes) hipping costs $ 6,000 $ 7,000 $ 1,000 $ 15,000 $ 3,000 AR&D Expense ASelling General & Admin Exp ALeasePayment Savings ADeprec/Amort Tax Savings AProperty Taxes AstateOfTexasSubsidy OCE $ $ $ $ $ $ $ $ $ 4,900 $ 5,900 $ 7,700 $ 6,000 $ 29,400 $ $ $ 4,900 $ 7,568$ 7,700 $ 6,000 $ 31,068 $ 4,900 3,1225 7,700 6,000 26,622 05 OS 4300$ 2,0125 5600 5 5000 $ 23556 $ 4,000 900 5,600 5,000 20,300 atin $ 14,000 $ 8,000 Outlay: Relocation Cost $ (15,000) Outlay: Buildings $ (50,000) Building Salvage Value (Austin) Tax on Salvage Value Gain (Austin) $ $ 12,000 11,400 43,700 23556 5 26,622 31,068 5 30% 13% 29,400 $ $ (65,000) $ ANCE $ 41,964 NPV (MACRS) Year 1 0.3333 Year 2 0.4445 Year 3 Year 4 0.1481 0.0741 B19)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts