Question: one: two: thank you !!! Bonus Problem (worth 2 points) Frito Dog Bakeries just reported annual earnings per share of $4.50. Analysts predict the company

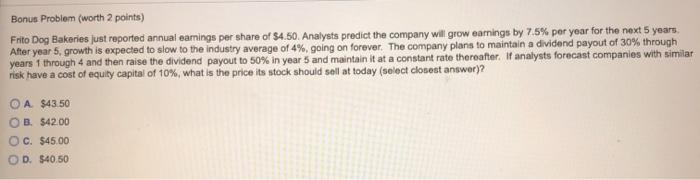

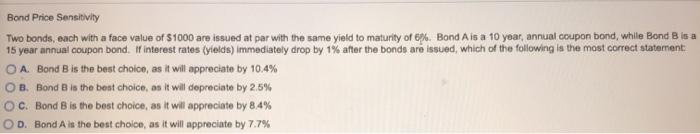

Bonus Problem (worth 2 points) Frito Dog Bakeries just reported annual earnings per share of $4.50. Analysts predict the company will grow earnings by 7.5% per year for the next 5 years, After year 5, growth is expected to slow to the industry average of 4%, going on forever. The company plans to maintain a dividend payout of 30% through years 1 through 4 and then raise the dividend payout to 50% in year 5 and maintain it at a constant rate thereafter. If analysts forecast companies with similar risk have a cost of equity capital of 10%, what is the price its stock should sell at today (select closest answer)? OA $43.50 3. $42.00 OC. $45.00 D. $40.50 Bond Price Sensitivity Two bonds, each with a face value of S1000 are issued at par with the same yield to maturity of 6%. Bond Ais a 10 year, annual coupon bond, while Bond B is a 15 year annual coupon bond. If interest rates (yields) Immediately drop by 1% after the bonds are issued, which of the following is the most correct statement O A. Bond B is the best choice, as it will appreciate by 10.4% O B. Bond is the best choice, as it will depreciate by 2,5% OC. Bond B is the best choice, as it will appreciate by 8.4% OD. Bond A is the best choion, as it will appreciate by 7.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts