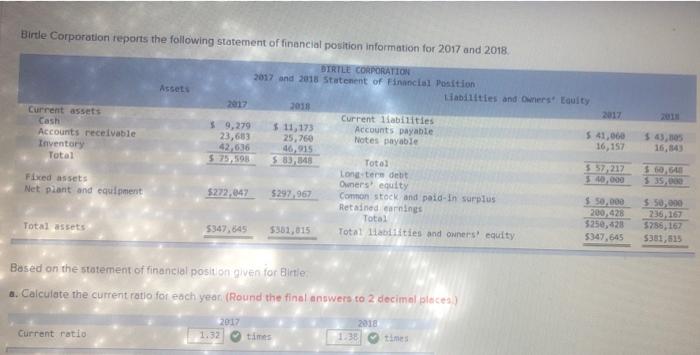

Question: one wrong please help Birtle Corporation reports the following statement of financial position information for 2017 and 2018 Assets Current assets Cash Accounts receivable Inventory

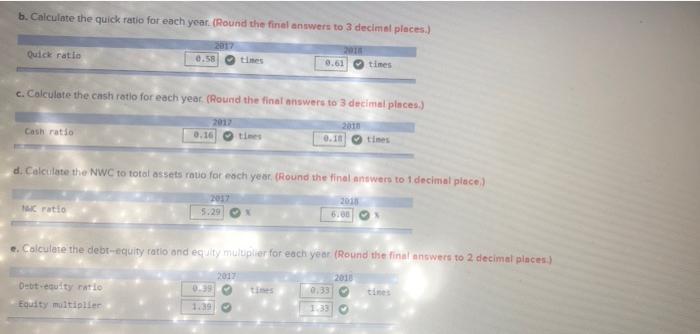

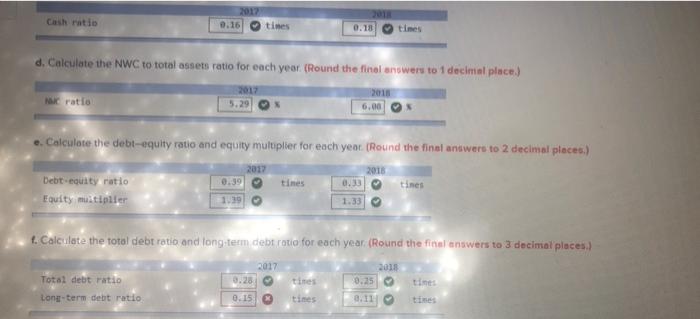

Birtle Corporation reports the following statement of financial position information for 2017 and 2018 Assets Current assets Cash Accounts receivable Inventory Total BIRTLE CORPORATION 2017 and 2018 Statement of Financial Position Liabilities and Owners' Louity 2017 2015 2017 Current liabilities 59,279 $ 11,173 Accounts payable 5 41,000 23,683 25,760 Notes payable 16,157 42,636 46,915 $ 75,98 5:33 Total 5:57,217 Long-tere detit 30,000 Owners equity 5272,047 5297,967 Common stock and paid in surplus $50,000 Retained earnings 200,428 Total 5250,428 5347,645 5301,015 Total Habilities and owners' equity 5347,645 $ 43,005 16,543 $ , Fixed assets Net plant and equipment Total assets $50,000 236, 167 5786, 167 5381,515 Based on the statement of financial position given for Birtle a. Calculate the current ratio for each year (Round the final answers to 2 decimal places) Current ratio 2017 1.32 2018 138 times times b. Calculate the quick ratio for each year. (Round the final answers to 3 decimal places.) Quick ratio 2017 0.58 2011 0.61 times c. Calculate the cash ratio for each year (Round the final answers to 3 decimal places) Cash ratio 2013 0.16 ties 2013 0.18 ties d. Calculate the NWC to total assets roue for each year. (Round the final antwers to 1 decimal place) 2018 ratio 2017 5.29 e. Calculate the debr-equity ratio and equity multiplier for each year (Round the final answers to 2 decimal places) 2017 2013 Det eau tyrio 0.35 Equity multiplier 1.39 1.33 Cash ratio 2017 0.16 times 0.18 d. Calculate the NWC to total assets ratio for each year. (Round the final answers to 1 decimal place.) Na ratio 2017 5.29 2018 6.00 e. Calculate the debt-equity ratio and equity multiplier for each year (Round the final answers to 2 decimal places.) 2017 2015 0.30 times Debt equity ratio Equity multiplier times 1.39 1.33 f. Calculate the total debt ratio and long-term debt ratio for each year. (Round the final answers to 3 decimal places.) 2017 3.28 2018 Total debt ratio times 0.25 time Lons-term debt ratio 0.15 @ 3.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts