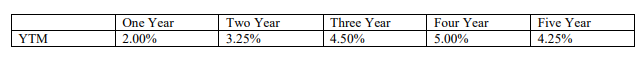

Question: One Year 2.00% Two Year 3.25% Three Year 4.50% Four Year 5.00% Five Year 4.25% YTM III. Application: 9. Assume you are a small business

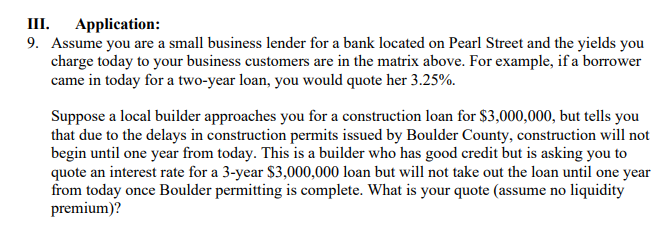

One Year 2.00% Two Year 3.25% Three Year 4.50% Four Year 5.00% Five Year 4.25% YTM III. Application: 9. Assume you are a small business lender for a bank located on Pearl Street and the yields you charge today to your business customers are in the matrix above. For example, if a borrower came in today for a two-year loan, you would quote her 3.25%. Suppose a local builder approaches you for a construction loan for $3,000,000, but tells you that due to the delays in construction permits issued by Boulder County, construction will not begin until one year from today. This is a builder who has good credit but is asking you to quote an interest rate for a 3-year $3,000,000 loan but will not take out the loan until one year from today once Boulder permitting is complete. What is your quote (assume no liquidity premium)? One Year 2.00% Two Year 3.25% Three Year 4.50% Four Year 5.00% Five Year 4.25% YTM III. Application: 9. Assume you are a small business lender for a bank located on Pearl Street and the yields you charge today to your business customers are in the matrix above. For example, if a borrower came in today for a two-year loan, you would quote her 3.25%. Suppose a local builder approaches you for a construction loan for $3,000,000, but tells you that due to the delays in construction permits issued by Boulder County, construction will not begin until one year from today. This is a builder who has good credit but is asking you to quote an interest rate for a 3-year $3,000,000 loan but will not take out the loan until one year from today once Boulder permitting is complete. What is your quote (assume no liquidity premium)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts