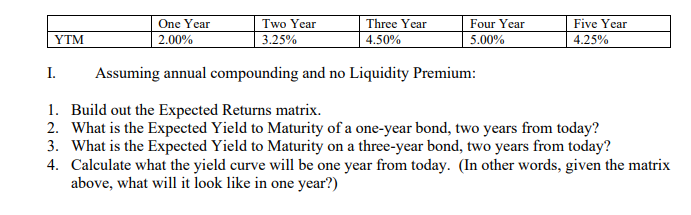

Question: One Year 2.00% Two Year 3.25% Three Year 4.50% Four Year 5.00% Five Year 4.25% YTM I. Assuming annual compounding and no Liquidity Premium: 1.

One Year 2.00% Two Year 3.25% Three Year 4.50% Four Year 5.00% Five Year 4.25% YTM I. Assuming annual compounding and no Liquidity Premium: 1. Build out the Expected Returns matrix. 2. What is the Expected Yield to Maturity of a one-year bond, two years from today? 3. What is the Expected Yield to Maturity on a three-year bond, two years from today? 4. Calculate what the yield curve will be one year from today. (In other words, given the matrix above, what will it look like in one year?) One Year 2.00% Two Year 3.25% Three Year 4.50% Four Year 5.00% Five Year 4.25% YTM I. Assuming annual compounding and no Liquidity Premium: 1. Build out the Expected Returns matrix. 2. What is the Expected Yield to Maturity of a one-year bond, two years from today? 3. What is the Expected Yield to Maturity on a three-year bond, two years from today? 4. Calculate what the yield curve will be one year from today. (In other words, given the matrix above, what will it look like in one year?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts