Question: only 1-17 a. What is T Corporation's maximum charitable contribution deduction for 2020 ? b. Assuming T Corporation made charitable contributions of $68,000 during 2020

only 1-17

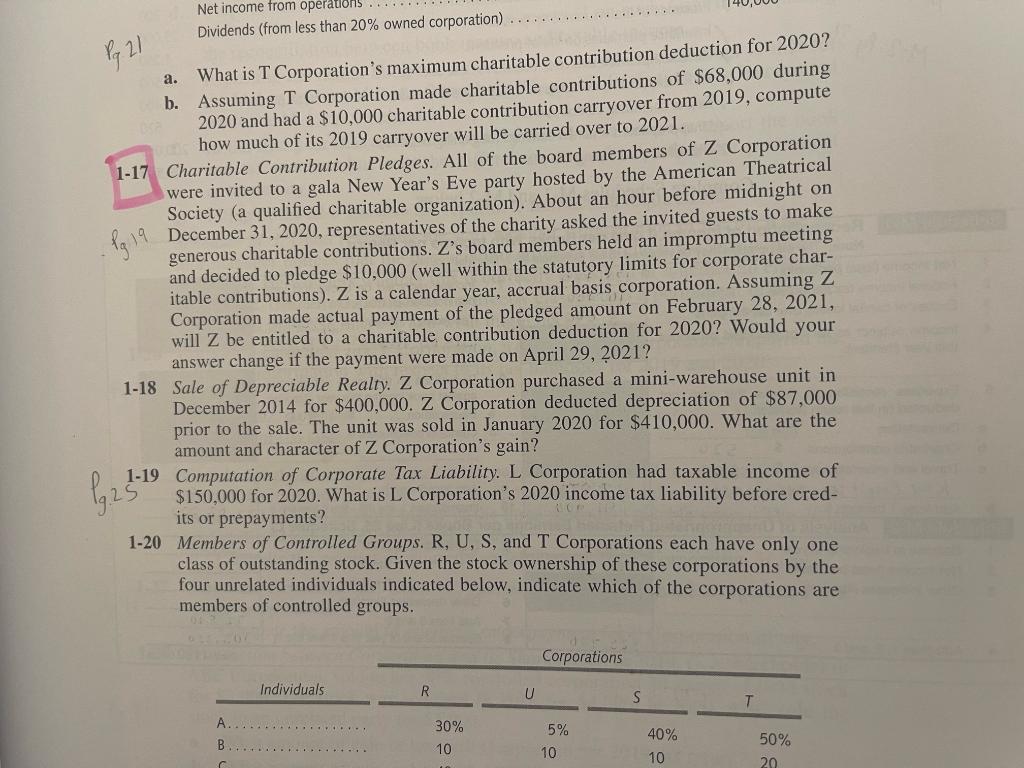

a. What is T Corporation's maximum charitable contribution deduction for 2020 ? b. Assuming T Corporation made charitable contributions of $68,000 during 2020 and had a $10,000 charitable contribution carryover from 2019 , compute how much of its 2019 carryover will be carried over to 2021 . 1-17 Charitable Contribution Pledges. All of the board members of Z Corporation were invited to a gala New Year's Eve party hosted by the American Theatrical Society (a qualified charitable organization). About an hour before midnight on December 31,2020 , representatives of the charity asked the invited guests to make generous charitable contributions. Z's board members held an impromptu meeting and decided to pledge $10,000 (well within the statutory limits for corporate charitable contributions). Z is a calendar year, accrual basis corporation. Assuming Z Corporation made actual payment of the pledged amount on February 28, 2021, will Z be entitled to a charitable contribution deduction for 2020 ? Would your answer change if the payment were made on April 29, 2021? 1-18 Sale of Depreciable Realty. Z Corporation purchased a mini-warehouse unit in December 2014 for $400,000. Z Corporation deducted depreciation of $87,000 prior to the sale. The unit was sold in January 2020 for $410,000. What are the amount and character of Z Corporation's gain? P 1-19 Computation of Corporate Tax Liability. L Corporation had taxable income of $150,000 for 2020 . What is L Corporation's 2020 income tax liability before credits or prepayments? 1-20 Members of Controlled Groups. R, U, S, and T Corporations each have only one class of outstanding stock. Given the stock ownership of these corporations by the four unrelated individuals indicated below, indicate which of the corporations are members of controlled groups

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts