Question: Only A&B Comprehensive Problem 17-77 (LO 17-1, LO 17-2, LO 17-3, LO 17-4, LO 17-5) You have been assigned to compute the income tax provision

Only A&B

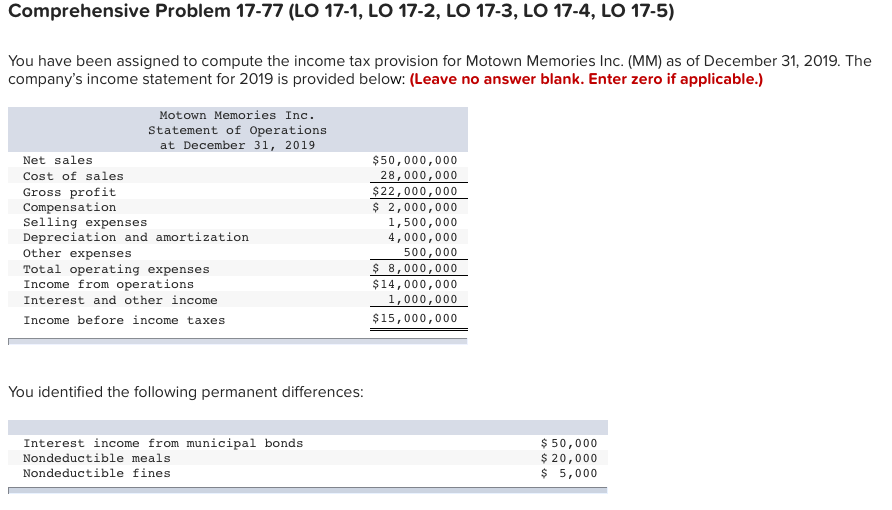

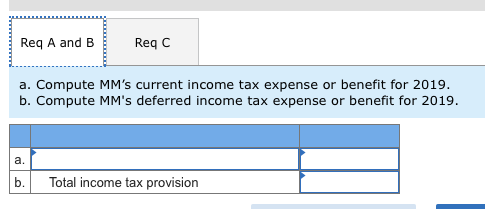

Comprehensive Problem 17-77 (LO 17-1, LO 17-2, LO 17-3, LO 17-4, LO 17-5) You have been assigned to compute the income tax provision for Motown Memories Inc. (MM) as of December 31, 2019. The company's income statement for 2019 is provided below: (Leave no answer blank. Enter zero if applicable.) Motown Memories Inc. Statement of Operations at December 31, 2019 Net sales Cost of sales Gross profit Compensation Selling expenses Depreciation and amortization Other expenses Total operating expenses Income from operations Interest and other income Income before income taxes $50,000,000 28,000,000 $22,000,000 $ 2,000,000 1,500,000 4,000,000 500,000 $ 8,000,000 $14,000,000 1,000,000 $15,000,000 You identified the following permanent differences: Interest income from municipal bonds Nondeductible meals Nondeductible fines $50,000 $ 20,000 $ 5,000 Req A and B ReqC a. Compute MM's current income tax expense or benefit for 2019. b. Compute MM's deferred income tax expense or benefit for 2019. b. Total income tax provision Comprehensive Problem 17-77 (LO 17-1, LO 17-2, LO 17-3, LO 17-4, LO 17-5) You have been assigned to compute the income tax provision for Motown Memories Inc. (MM) as of December 31, 2019. The company's income statement for 2019 is provided below: (Leave no answer blank. Enter zero if applicable.) Motown Memories Inc. Statement of Operations at December 31, 2019 Net sales Cost of sales Gross profit Compensation Selling expenses Depreciation and amortization Other expenses Total operating expenses Income from operations Interest and other income Income before income taxes $50,000,000 28,000,000 $22,000,000 $ 2,000,000 1,500,000 4,000,000 500,000 $ 8,000,000 $14,000,000 1,000,000 $15,000,000 You identified the following permanent differences: Interest income from municipal bonds Nondeductible meals Nondeductible fines $50,000 $ 20,000 $ 5,000 Req A and B ReqC a. Compute MM's current income tax expense or benefit for 2019. b. Compute MM's deferred income tax expense or benefit for 2019. b. Total income tax provision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts