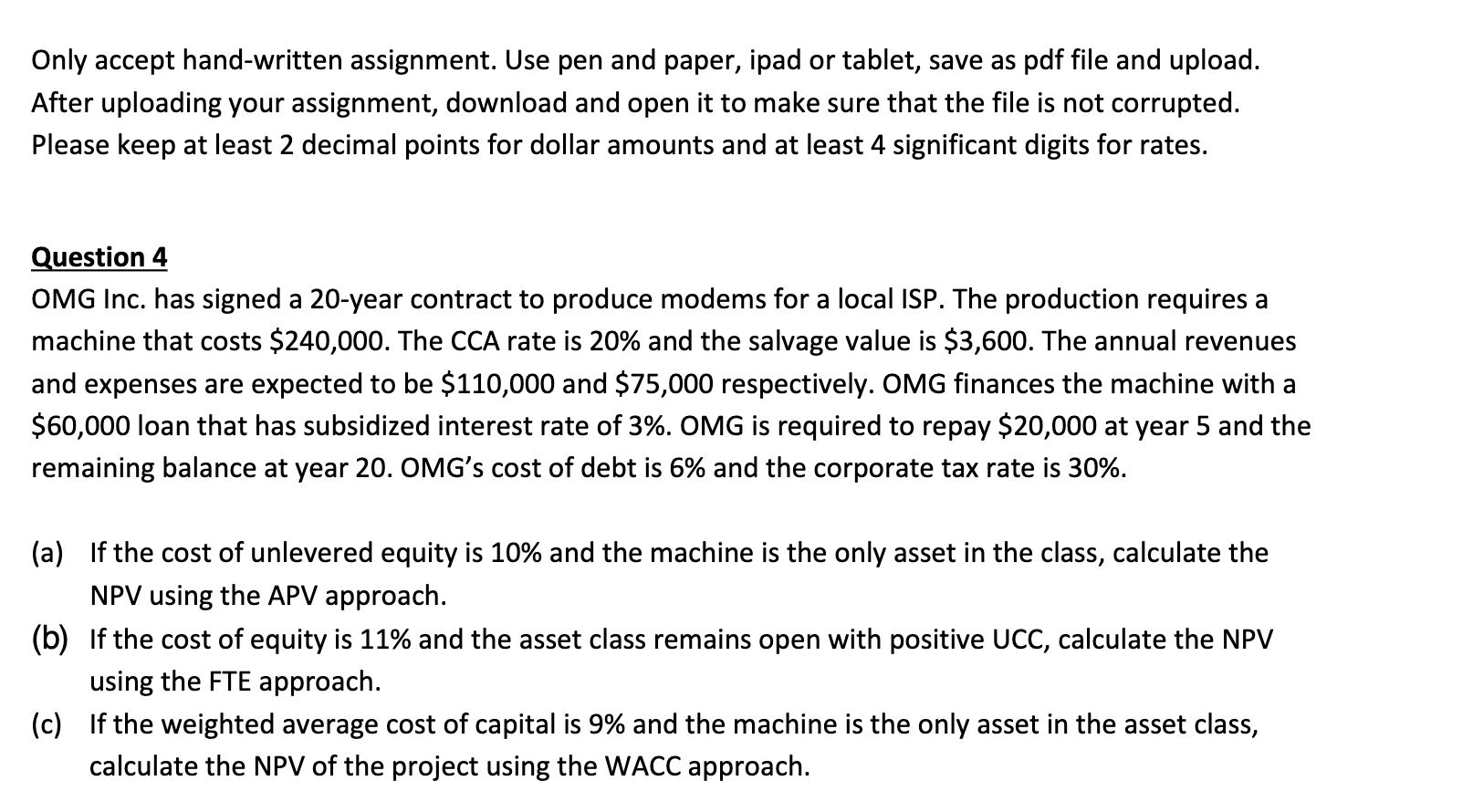

Question: Only accept hand - written assignment. Use pen and paper, ipad or tablet, save as pdf file and upload. After uploading your assignment, download and

Only accept handwritten assignment. Use pen and paper, ipad or tablet, save as pdf file and upload.

After uploading your assignment, download and open it to make sure that the file is not corrupted.

Please keep at least decimal points for dollar amounts and at least significant digits for rates.

Question

OMG Inc. has signed a year contract to produce modems for a local ISP. The production requires a

machine that costs $ The CCA rate is and the salvage value is $ The annual revenues

and expenses are expected to be $ and $ respectively. OMG finances the machine with a

$ loan that has subsidized interest rate of OMG is required to repay $ at year and the

remaining balance at year OMG's cost of debt is and the corporate tax rate is

a If the cost of unlevered equity is and the machine is the only asset in the class, calculate the

NPV using the APV approach.

b If the cost of equity is and the asset class remains open with positive UCC, calculate the NPV

using the FTE approach.

c If the weighted average cost of capital is and the machine is the only asset in the asset class,

calculate the NPV of the project using the WACC approach.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock