Question: only answer if you can do both Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: - Sales

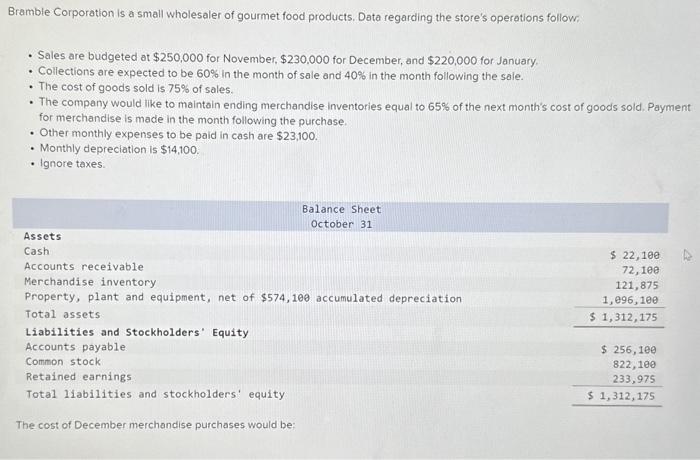

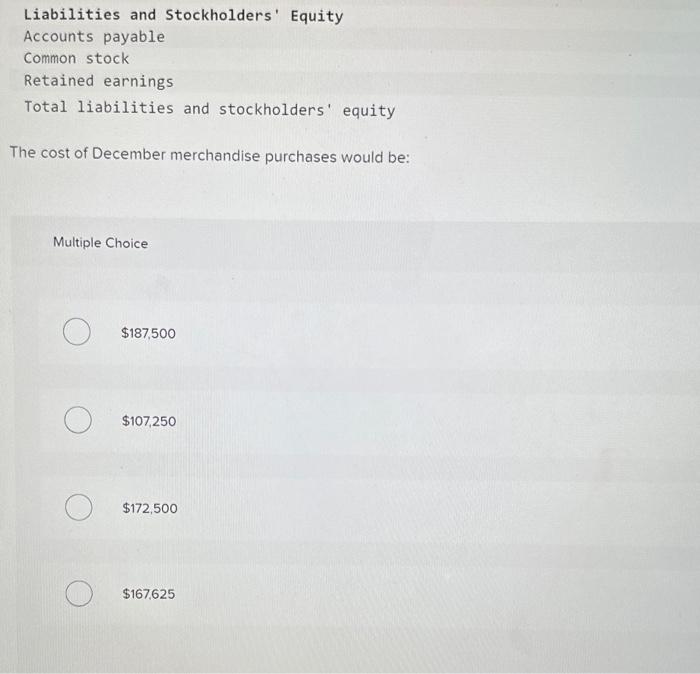

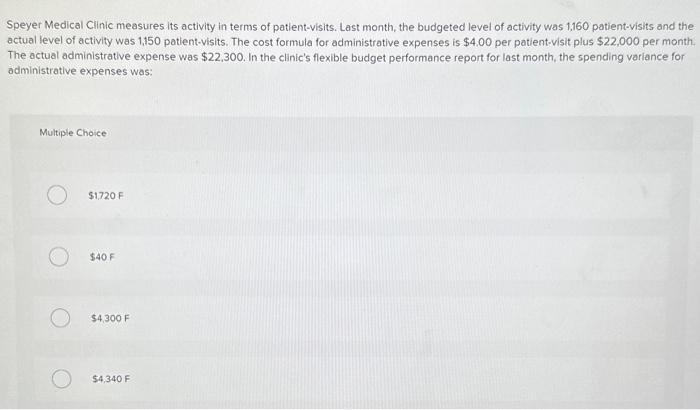

Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: - Sales are budgeted at \\( \\$ 250,000 \\) for November, \\( \\$ 230,000 \\) for December, and \\( \\$ 220,000 \\) for January. - Collections are expected to be \60 in the month of sale and \40 in the month following the sale. - The cost of goods sold is \75 of sales. - The company would like to maintain ending merchandise inventories equal to \65 of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. - Other monthly expenses to be paid in cash are \\( \\$ 23,100 \\). - Monthly depreciation is \\( \\$ 14,100 \\). - Ignore taxes. The cost of December merchandise purchases would be: Multiple Choice \\( \\$ 187,500 \\) \\( \\$ 107,250 \\) \\( \\$ 172,500 \\) \\( \\$ 167.625 \\) Speyer Medical Clinic measures its activity in terms of patient-visits. Last month, the budgeted level of activity was 1,160 patient-visits and the actual level of activity was 1,150 patient-visits. The cost formula for administrative expenses is \\( \\$ 4.00 \\) per patient-visit plus \\( \\$ 22,000 \\) per month. The actual administrative expense was \\( \\$ 22,300 \\). In the clinic's flexible budget performance report for last month, the spending variance for administrative expenses was: Multiple Choice \\( \\$ 1,720 \\mathrm{~F} \\) \\( \\$ 40 \\mathrm{~F} \\) \\( \\$ 4,300 \\mathrm{~F} \\) \\( 54,340 \\mathrm{~F} \\)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts