Question: only answer question 32. 31 is considered help for problem 32 thats why it is included. 31. CAPM and Valuation. You are a consultant to

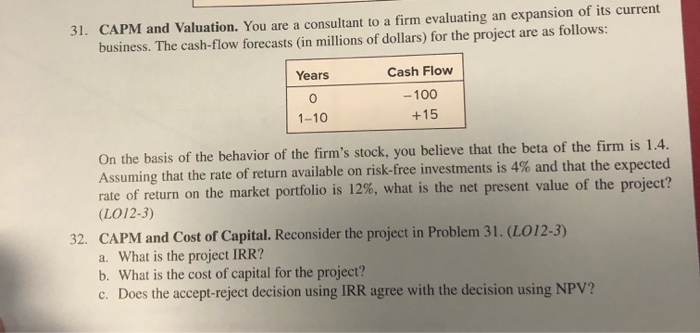

31. CAPM and Valuation. You are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the project are as follows: Years Cash Flow -- 100 1-10 +15 On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.4. Assuming that the rate of return available on risk-free investments is 4% and that the expected rate of return on the market portfolio is 12%, what is the net present value of the project? (LO12-3) 32. CAPM and Cost of Capital. Reconsider the project in Problem 31. (L012-3) a. What is the project IRR? b. What is the cost of capital for the project? c. Does the accept-reject decision using IRR agree with the decision using NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts