Question: . Question - Explain whether the product and geographic diversification coexist for OYO. (International Strategic Management) Ivey Publishing 9B19M123 OYO: GLOBAL EXPANSION Arpita Agnihotri and

.

Question - Explain whether the product and geographic diversification coexist for OYO. (International Strategic Management)

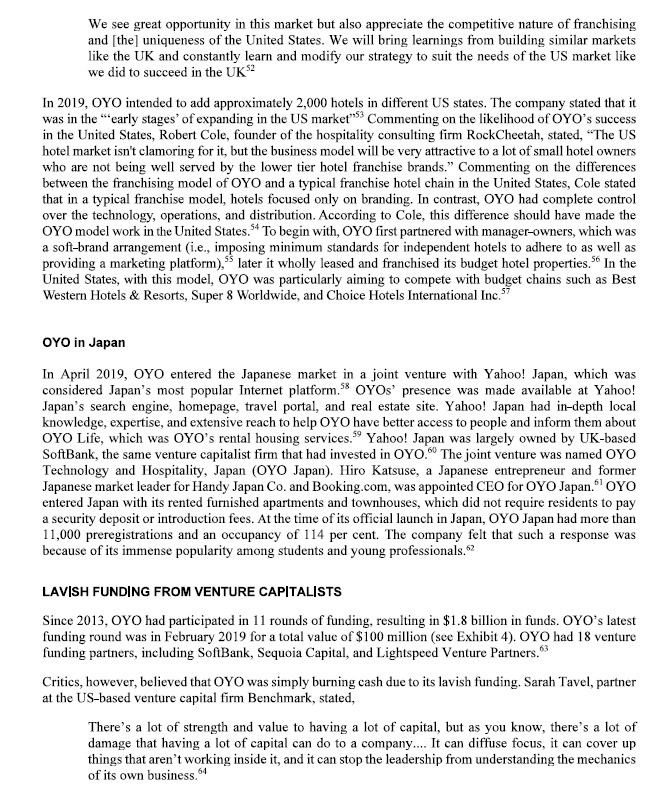

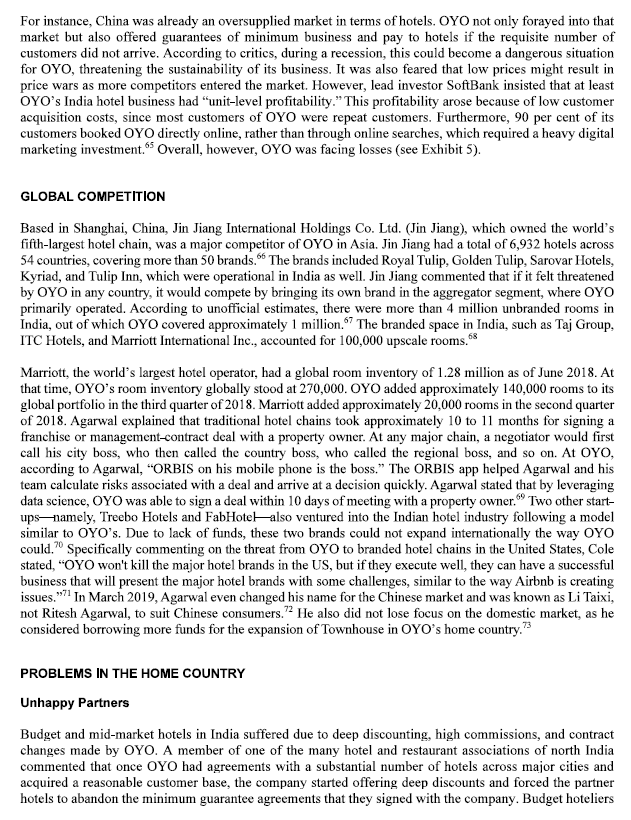

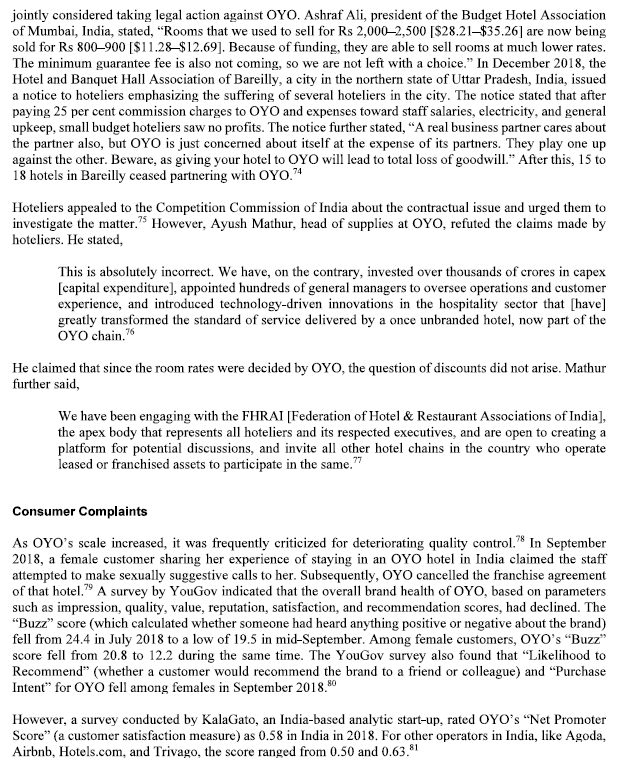

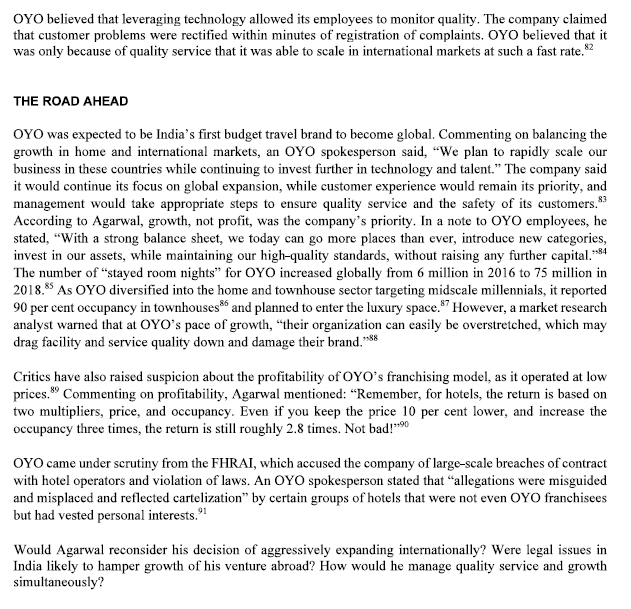

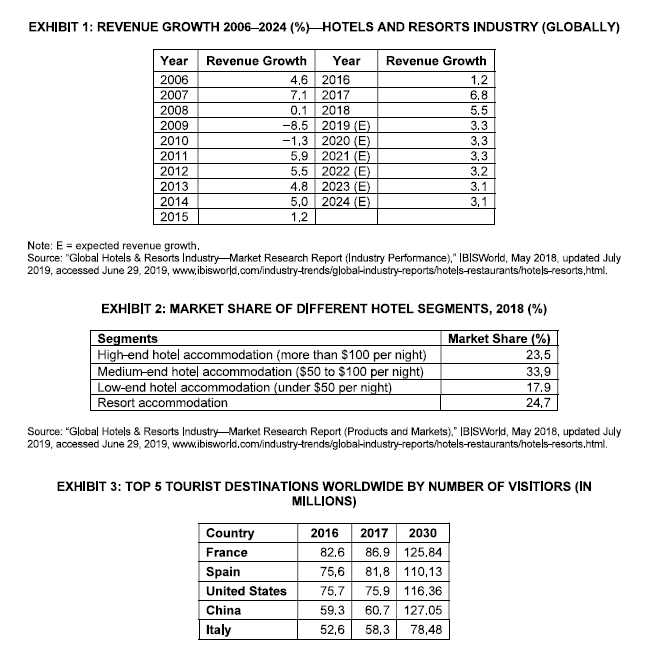

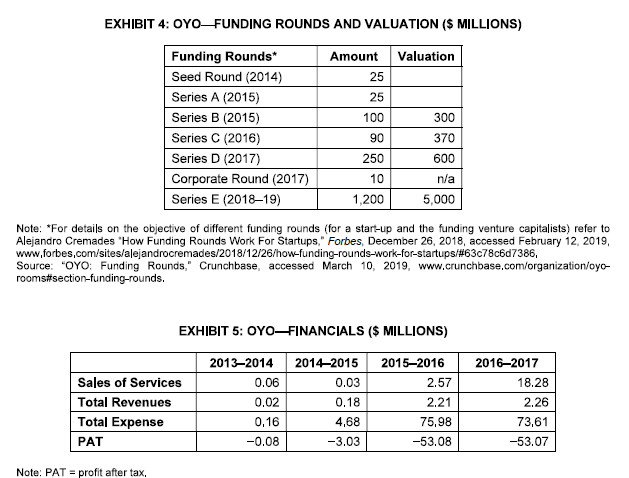

Ivey Publishing 9B19M123 OYO: GLOBAL EXPANSION Arpita Agnihotri and Saurabh Bhattacharya wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Our goal is to publish materials of the highest quality; submit any errata to publishcases@ivey.ca. Copyright 2019, Ivey Business School Foundation Version: 2019-10-04 India-based Oravel Stays Private Limited (OYO) was South Asia's biggest among China's top five largest, and the world's fastest-growing chain of leased and franchised hotels, homes, and living spaces. According to Fast Company magazine, OYO was the 10th most innovative company from India in 2018. In September 2018, the company was valued at US$5 billion. In April 2019, within six years of its inception, OYO was present in 11 countries, including India, China, the United Arab Emirates (UAE), and the United Kingdom. Ritesh Agarwal, founder and chief executive officer (CEO) of OYO, wanted to make the company the world's largest global hotel chain. He stated, We want to convert broken, unbranded assets around the globe into better-quality living spaces. Globally, budget hotel space was largely unorganized. OYO investors, including venture capitalists like UK-based SoftBank Vision Fund (SoftBank) and US-based Greenoaks Capital, believed that OYO could become a large player in several geographies. Satish Meena, senior forecast analyst of Forrester India, stated, "There is an absolute merit in OYO's back-to-back entry into foreign countries. The size of opportunity seems to have driven investors to value OYO that much."-5 Nevertheless, as the company prepared itself for global expansion, problems occurred in its home country, India. According to YouGov, a UK-based online market research firm, the customer satisfaction index for OYO fell from 21 to 15 between July and September 2018, especially among female customers, owing to safety issues. In addition, in December 2018, some budget and mid-market hoteliers from India decided to file a lawsuit against OYO over breach of contract between OYO and these hoteliers.' Jai Vardhan, an expert on Indian start-ups, considered OYO's global ambitions lofty and believed that a $5 billion valuation of the company was based on the optimism of its investors regarding OYO's international expansion potential and not on OYO's actual performance in its home country. Tim Culpan, an award-winning technology journalist, also believed that OYO should focus on quality rather than international expansion. He stated, If quality plays second fiddle to expansion, OYO risks becoming a brand name that's of little value to anyone." Agarwal wondered if the company could succeed in international markets or if he needed to reconsider his strategy of focusing on international markets instead of the domestic market. Could legal issues in OYO's home country create impediments to his growth plan in foreign countries? If so, how should Agarwal deal with these issues? BACKGROUND 913 OYO was founded by Agarwal in 2012, when he was just 19 years old. Prior to starting his venture, Agarwal juggled different roles, such as a hotel housekeeper and a call centre employee. Agarwal started the OYO journey by first taking a lease on 11 rooms from a hotel located in Gurugram, in the north of India. He followed an aggregation model." Whenever hotel owners signed an agreement with OYO, OYO upgraded the hotel's belongings, including linen, toiletries, and bathroom fittings, to OYO's quality specifications. The hotel staff was trained by the company, and supplies across hotels were standardized. After a hotel was upgraded, OYO listed the hotel on its website, with room prices starting from $25 per night. OYO charged a 25 per cent commission to the hotel.'? For Indian budget travellers, who were used to dirty washrooms, broken taps, and soiled bed linen, the standard amenities that OYO provided were like wish fulfillment. This entire service was under the brand name OYO Rooms, with OYO standing for "on your own." Later in 2016, in a move to reduce excessive spending and negative cash flow, OYO stopped giving a minimum occupancy guarantee (i.e., an assurance where OYO would pay the hotel if a minimum number of bookings was not received by the hotel) to hoteliers and switched to a revenue-sharing model.' Then, in 2017, the company shifted from being an aggregator to a franchising model for faster expansion in different geographical markets. By January 2018, 90 per cent of OYO's revenue came from hotels operating under the franchising model, wherein OYO leased the hotels from their owners. Agarwal aimed to reach 100 per cent by 2019. Under the franchising agreement, OYO spent between $0.14 million and $0.21 million on leasing, renovating, hiring, and deposits for hotel management. The franchising model was also popularly known as a "manachised model," as it had features of both management contracts and franchising.is In 2017, OYO expanded the portfolio of its services and launched OYO Home and OYO Townhouse. OYO Home was similar to the Airbnb Inc. (Airbnb) short-term rental marketplace. Under the OYO Home brand, OYO provided long-term self-service independent homes managed by OYO. OYO Townhouse, on the other hand, operated as a 25 per cent hotel, 25 per cent home, 25 per cent cafe, and 25 per cent store." By the end of 2018, OYO had more than 125,000 rooms in India and was present in more than 350 cities across nine countries.21 Despite being in the hotel industry, technology was at the heart of OYO's business model.22 OYO employed approximately 700 software engineers out of its total workforce of 8,500. The engineering team released an average of 20 software developments every day, which included new and updated versions of existing mobile applications (apps). For instance, one of OYO's most effective apps, ORBIS, instantly calculated a hotel's projected occupancy rate and potential revenues if the hotel joined OYO's network. ORBIS did this by analyzing hundreds of thousands of items of data in that particular local lodging market.23 INTERNATIONAL MARKET EXPANSION Globally, the hotels and resorts industry experienced strong growth between 2015 and 2018, mainly due to the rise in global travel and tourism (see Exhibit 1). Among the different hotel segments in 2018, medium- end hotel accommodations had the maximum market share (see Exhibit 2). Globally, the majority of travellers staying in hotel accommodations were domestic travellers, contributing approximately 55.6 per cent to the industry.24 By 2018, 42.2 per cent of global tourism occurred in Europe, followed by North America (see Exhibit 3). However, between 2018 and 2024, the annual growth in hotel revenue was expected to remain stagnant at 3 per cent (see Exhibit 1). OYO in the People's Republic of China OYO started its international expansion in 2016, with Malaysia being its first market. In 2017, it expanded to Nepal and then, in November 2017, to China. Despite being fragmented, China's hotel industry was worth $150 billion in 2018. China had a strong influx of both domestic and international tourists. With the economic boom, more than 500 million Chinese locals wanted good accommodation at reasonable prices.25 Agarwal stated that "OYO's platform of "predictability, standardization, quality, and affordability will help attract both guests and investors. It aimed to add 30,000 rooms per month in China to its portfolio.26 As in India, OYO followed the manachised model in China. OYO also launched six OYO Skill Institutes in China; by November 2018, it had trained 924 staff across 76 cities in China." China was also expected to become the leading tourist destination globally by 2030 (see Exhibit 3). In 2018, OYO formed an alliance and signed a five-year memorandum of understanding with Shanghai- based Huazhu Group Ltd. (Huazhu), which was in the business of developing and operating manachised and franchised hotels in China. OYO believed that Huazhu's experience and expertise in managing large properties could accelerate the growth plans of OYO in China.28 OYO also signed an agreement with China Lodging Group, a hotel operator in China. According to this agreement, China Lodging Group invested $10 million in OYO in return for 1 per cent equity in the company.29 OYO and China Lodging Group were also expected to jointly develop knowledge and technology-sharing projects related to the field of hospitality. These projects included an exchange program for employees, apart from sharing intellectual property. OYO stated, The partnership is also expected to leverage benefits for economies of scale, not limited to sourcing and procurement and joint loyalty programs."30 OYO scaled up from only a handful of properties in November 2017 to 87,000 rooms across 171 cities in China within 10 months of its entry into the country. Within one year of OYO's expansion into China, it became one of China's top five hotel chains. Agarwal stated, Our secret to success in China is the way we've built our business in the country. We didn't approach the market like an Indian start-up setting shop in China, but like a Chinese player building and localizing the OYO business model to make it work in the Chinese market."92 Local managers in China had significant decision-making autonomy to manage the complexities of Chinese markets. Agarwal stated, We operate like a Chinese company, not a global company operating in China." He added, "If you go to one of our hotel owners in China and ask them [sic] where OYO is from, they'll say it's Chinese." OYO intended to spend approximately $600 million in the Chinese hotel industry. In fact, by November 2018, OYO was growing faster in China than in its home market (i.e., India).36 In February 2019, China's ride-hailing company Didi Chuxing Technology Co. (Didi Chuxing) also made a $100 million investment in OYO, which brought OYO's $1 billion financing round to a close. OYO and Didi Chuxing's partnership was not new. In 2017, when OYO entered China, it partnered with Didi Chuxing to announce its entry into China's market. In fact, its tag line was, "Ride comfortably with Didi, Stay comfortably with OYO.137 35 OYO in Middle Eastern Countries In October 2018, OYO entered Dubai with an inventory of 1,100 rooms. Commenting on the choice of market, Manu Midha, regional head of Middle East, OYO Hotels & Homes, stated the UAE, one of the world's leading MICE [meetings, incentives, conferencing, and events] capital[s] of the world then becomes a highly strategic location for us [OYOJ.1938 By 2020, the company was expected to reach 12,000 rooms across 150 hotels. In January 2019, OYO also launched OYO Home brand of service in Dubai with 40 homes. The company aimed to increase this to 200 homes by August 2019. Elaborating on OYO Home in the UAE, Kavikrut, the chief growth officer of OYO, stated, What we are attempting with OYO Home guarantees [a] unique experience for our guests and higher yields for homeowners. There is significant market opportunity, especially as people have invested in second homes in top holiday destinations across the UAE. GCC [Gulf Cooperation Council and international travelers today are open to choosing the comforts of a fully managed holiday home for short stays." OYO in UAE adopted the same manachised model across two-, three-, and four-star hotels. Commenting on the success of this model, Midha stated, Since our recent launch, we have been inundated with requests from several hotel owners in the UAE to migrate onto OYO's (manachise] business model. We are on track at the moment and our vision is to support the large number of business travelers that are expected to arrive by the time UAE opens [the] door to its billion-dollar EXPO 2020, with 190 country pavilions.^2 In February 2019, OYO launched operations in Saudi Arabia after signing deals with 50 hotels offering more than 3,000 rooms across seven cities.43 Agarwal said that OYO would completely support Saudi Arabia's blossoming hospitality ecosystem while creating infrastructure for asset owners so that a high quality of service standards would be ensured. He stated, We are honoured and delighted to support the Saudi government's Vision 2030 for the Kingdom of Saudi Arabia and are committed to continuing investing in the multi-billion dollar opportunity in the hospitality industry in the country." OYO intended to create over 5,000 jobs for Saudi citizens by 2020. The company also intended to launch two OYO Skill Institutes, one in Riyadh and another in Jeddah, the two major cities of Saudi Arabia, to provide hotel management training to Saudi graduates." OYO in the United Kingdom and the United States OYO ventured into the United Kingdom in September 2018. According to Agarwal, the United Kingdom represented a multi-billion dollar opportunity for OYO. He stated, The UK has been the topmost international travel destination for several years and last year hosted over 19 million tourists from around the world." He further added that with OYO, independent hoteliers of the United Kingdom would be empowered with technology and operational expertise that would help them enhance the customer experience and thus increase sustainable incomes." The United Kingdom was OYO's first expansion outside Asia. The company planned to invest $53 million to launch its services across 10 British cities. OYO wanted to select hotels from Britain's 35,000 to 40,000 independent operators and help them compete by offering design services, property management, and marketing support. To begin, OYO was present in Manchester, Birmingham, Glasgow, and Edinburgh, in addition to four properties in London that offered about 80 rooms. 47 Under its Townhouse brand, OYO partnered with small-scale hotels through its manachised model. OYO intended to increase its presence in the United Kingdom to more than 5,000 rooms by 2020." In the United Kingdom, the company also intended to expand its OYO Townhouse hotel brand to between 400 and 500 accommodations by mid-2019.49 In February 2019, OYO entered the budget hotel market in the United States. It opened an office in Dallas and tested properties in both Austin and Dallas." In December 2018, Marcus Higgins was appointed head of OYO's US operations. Furthermore, several business development managers and sales executives were also hired in cities including Dallas, Austin, San Antonio, Miami, Orlando, Denver, and Charlotte. Commenting on OYO's US expansion, a company spokesperson stated, We see great opportunity in this market but also appreciate the competitive nature of franchising and [the] uniqueness of the United States. We will bring learnings from building similar markets like the UK and constantly learn and modify our strategy to suit the needs of the US market like we did to succeed in the UK $2 In 2019, OYO intended to add approximately 2,000 hotels in different US states. The company stated that it was in the early stages of expanding in the US market**** Commenting on the likelihood of OYO's success in the United States, Robert Cole, founder of the hospitality consulting firm RockCheetah, stated, "The US hotel market isn't clamoring for it, but the business model will be very attractive to a lot of small hotel owners who are not being well served by the lower tier hotel franchise brands." Commenting on the differences between the franchising model of OYO and a typical franchise hotel chain in the United States, Cole stated that in a typical franchise model, hotels focused only on branding. In contrast, OYO had complete control over the technology, operations, and distribution. According to Cole, this difference should have made the OYO model work in the United States. S* To begin with, OYO first partnered with manager-owners, which was a soft-brand arrangement (i.e., imposing minimum standards for independent hotels to adhere to as well as providing a marketing platform), later it wholly leased and franchised its budget hotel properties. In the United States, with this model, OYO was particularly aiming to compete with budget chains such as Best Western Hotels & Resorts, Super 8 Worldwide, and Choice Hotels International Inc. OYO in Japan In April 2019, OYO entered the Japanese market in a joint venture with Yahoo! Japan, which was considered Japan's most popular Internet platform. OYOs presence was made available at Yahoo! Japan's search engine, homepage, travel portal, and real estate site. Yahoo! Japan had in-depth local knowledge, expertise, and extensive reach to help OYO have better access to people and inform them about OYO Life, which was OYO's rental housing services.59 Yahoo! Japan was largely owned by UK-based SoftBank, the same venture capitalist firm that had invested in OYO. The joint venture was named OYO Technology and Hospitality, Japan (OYO Japan). Hiro Katsuse, a Japanese entrepreneur and former Japanese market leader for Handy Japan Co. and Booking.com, was appointed CEO for OYO Japan. OYO entered Japan with its rented furnished apartments and townhouses, which did not require residents to pay a security deposit or introduction fees. At the time of its official launch in Japan, OYO Japan had more than 11,000 preregistrations and an occupancy of 114 per cent. The company felt that such a response was because of its immense popularity among students and young professionals.62 LAVISH FUNDING FROM VENTURE CAPITALISTS Since 2013, OYO had participated in 11 rounds of funding, resulting in $1.8 billion in funds. OYO's latest funding round was in February 2019 for a total value of $100 million (see Exhibit 4). OYO had 18 venture funding partners, including SoftBank, Sequoia Capital, and Lightspeed Venture Partners. 3 Critics, however, believed that OYO was simply burning cash due to its lavish funding. Sarah Tavel, partner at the US-based venture capital firm Benchmark, stated, There's a lot of strength and value to having a lot of capital, but as you know, there's a lot of damage that having a lot of capital can do to a company.... It can diffuse focus, it can cover up things that aren't working inside it, and it can stop the leadership from understanding the mechanics of its own business. For instance, China was already an oversupplied market in terms of hotels. OYO not only forayed into that market but also offered guarantees of minimum business and pay to hotels if the requisite number of customers did not arrive. According to critics, during a recession, this could become a dangerous situation for OYO, threatening the sustainability of its business. It was also feared that low prices might result in price wars as more competitors entered the market. However, lead investor SoftBank insisted that at least OYO's India hotel business had unit-level profitability." This profitability arose because of low customer acquisition costs, since most customers of OYO were repeat customers. Furthermore, 90 per cent of its customers booked OYO directly online, rather than through online searches, which required a heavy digital marketing investment. Overall, however, OYO was facing losses (see Exhibit 5). GLOBAL COMPETITION Based in Shanghai, China, Jin Jiang International Holdings Co. Ltd. (Jin Jiang), which owned the world's fifth-largest hotel chain, was a major competitor of OYO in Asia. Jin Jiang had a total of 6,932 hotels across 54 countries, covering more than 50 brands. The brands included Royal Tulip, Golden Tulip, Sarovar Hotels, Kyriad, and Tulip Inn, which were operational in India as well. Jin Jiang commented that if it felt threatened by OYO in any country, it would compete by bringing its own brand in the aggregator segment, where OYO primarily operated. According to unofficial estimates, there were more than 4 million unbranded rooms in India, out of which OYO covered approximately 1 million. The branded space in India, such as Taj Group, ITC Hotels, and Marriott International Inc., accounted for 100,000 upscale rooms. Marriott, the world's largest hotel operator, had a global room inventory of 1.28 million as of June 2018. At that time, OYO's room inventory globally stood at 270,000. OYO added approximately 140,000 rooms to its global portfolio in the third quarter of 2018. Marriott added approximately 20,000 rooms in the second quarter of 2018. Agarwal explained that traditional hotel chains took approximately 10 to 11 months for signing a franchise or management-contract deal with a property owner. At any major chain, a negotiator would first call his city boss, who then called the country boss, who called the regional boss, and so on. At OYO, according to Agarwal, "ORBIS on his mobile phone is the boss." The ORBIS app helped Agarwal and his team calculate risks associated with a deal and arrive at a decision quickly. Agarwal stated that by leveraging data science, OYO was able to sign a deal within 10 days of meeting with a property owner. Two other start- ups-namely, Treebo Hotels and FabHotehalso ventured into the Indian hotel industry following a model similar to OYO's. Due to lack of funds, these two brands could not expand internationally the way OYO could. Specifically commenting on the threat from OYO to branded hotel chains in the United States, Cole stated, "OYO won't kill the major hotel brands in the US, but if they execute well, they can have a successful business that will present the major hotel brands with some challenges, similar to the way Airbnb is creating issues."7l In March 2019, Agarwal even changed his name for the Chinese market and was known as Li Taixi, not Ritesh Agarwal, to suit Chinese consumers. He also did not lose focus on the domestic market, as he considered borrowing more funds for the expansion of Townhouse in OYO's home country. PROBLEMS IN THE HOME COUNTRY Unhappy Partners Budget and mid-market hotels in India suffered due to deep discounting, high commissions, and contract changes made by OYO. A member of one of the many hotel and restaurant associations of north India commented that once OYO had agreements with a substantial number of hotels across major cities and acquired a reasonable customer base, the company started offering deep discounts and forced the partner hotels to abandon the minimum guarantee agreements that they signed with the company. Budget hoteliers jointly considered taking legal action against OYO. Ashraf Ali, president of the Budget Hotel Association of Mumbai, India, stated, Rooms that we used to sell for Rs 2,0002,500 [$28.21-$35.26] are now being sold for Rs 800-900 [$11.28_$12.69]. Because of funding, they are able to sell rooms at much lower rates. The minimum guarantee fee is also not coming, so we are not left with a choice." In December 2018, the Hotel and Banquet Hall Association of Bareilly, a city in the northern state of Uttar Pradesh, India, issued a notice to hoteliers emphasizing the suffering of several hoteliers in the city. The notice stated that after paying 25 per cent commission charges to OYO and expenses toward staff salaries, electricity, and general upkeep, small budget hoteliers saw no profits. The notice further stated, A real business partner cares about the partner also, but OYO is just concerned about itself at the expense of its partners. They play one up against the other. Beware, as giving your hotel to OYO will lead to total loss of goodwill." After this, 15 to 18 hotels in Bareilly ceased partnering with OYO.74 Hoteliers appealed to the Competition Commission of India about the contractual issue and urged them to investigate the matter. However, Ayush Mathur, head of supplies at OYO, refuted the claims made by hoteliers. He stated, This is absolutely incorrect. We have, on the contrary, invested over thousands of crores in capex [capital expenditure], appointed hundreds of general managers to oversee operations and customer experience, and introduced technology-driven innovations in the hospitality sector that [have] greatly transformed the standard of service delivered by a once unbranded hotel, now part of the OYO chain. He claimed that since the room rates were decided by OYO, the question of discounts did not arise. Mathur further said, We have been engaging with the FHRAI [Federation of Hotel & Restaurant Associations of India), the apex body that represents all hoteliers and its respected executives, and are open to creating a platform for potential discussions, and invite all other hotel chains in the country who operate leased or franchised assets to participate in the same." Consumer Complaints As OYO's scale increased, it was frequently criticized for deteriorating quality control." In September 2018, a female customer sharing her experience of staying in an OYO hotel in India claimed the staff attempted to make sexually suggestive calls to her. Subsequently, OYO cancelled the franchise agreement of that hotel." A survey by YouGov indicated that the overall brand health of OYO, based on parameters such as impression, quality, value, reputation, satisfaction, and recommendation scores, had declined. The "Buzz" score (which calculated whether someone had heard anything positive or negative about the brand) fell from 24.4 in July 2018 to a low of 19.5 in mid-September. Among female customers, OYO's Buzz" score fell from 20.8 to 12.2 during the same time. The YouGov survey also found that "Likelihood to Recommend (whether a customer would recommend the brand to a friend or colleague) and Purchase Intent" for OYO fell among females in September 2018.50 However, a survey conducted by KalaGato, an India-based analytic start-up, rated OYO's "Net Promoter Score" (a customer satisfaction measure) as 0.58 in India in 2018. For other operators in India, like Agoda, Airbnb, Hotels.com, and Trivago, the score ranged from 0.50 and 0.63.81 OYO believed that leveraging technology allowed its employees to monitor quality. The company claimed that customer problems were rectified within minutes of registration of complaints. OYO believed that it was only because of quality service that it was able to scale in international markets at such a fast rate. 2 82 THE ROAD AHEAD 83 OYO was expected to be India's first budget travel brand to become global. Commenting on balancing the growth in home and international markets, an OYO spokesperson said, "We plan to rapidly scale our business in these countries while continuing to invest further in technology and talent. The company said it would continue its focus on global expansion, while customer experience would remain its priority, and management would take appropriate steps to ensure quality service and the safety of its customers. According to Agarwal, growth, not profit, was the company's priority. In a note to OYO employees, he stated, With a strong balance sheet, we today can go more places than ever, introduce new categories, invest in our assets, while maintaining our high-quality standards, without raising any further capital. 1984 The number of stayed room nights for OYO increased globally from 6 million in 2016 to 75 million in 2018. As OYO diversified into the home and townhouse sector targeting midscale millennials, it reported 90 per cent occupancy in townhouses and planned to enter the luxury space. However, a market research analyst warned that at OYO's pace of growth, "their organization can easily be overstretched, which may drag facility and service quality down and damage their brand.1988 Critics have also raised suspicion about the profitability of OYO's franchising model, as it operated at low prices. Commenting on profitability, Agarwal mentioned: Remember, for hotels, the return is based on two multipliers, price, and occupancy. Even if you keep the price 10 per cent lower, and increase the occupancy three times, the return is still roughly 2.8 times. Not bad!"590 OYO came under scrutiny from the FHRAI, which accused the company of large-scale breaches of contract with hotel operators and violation of laws. An OYO spokesperson stated that allegations were misguided and misplaced and reflected cartelization by certain groups of hotels that were not even OYO franchisees but had vested personal interests. Would Agarwal reconsider his decision of aggressively expanding internationally? Were legal issues in India likely to hamper growth of his venture abroad? How would he manage quality service and growth simultaneously? EXHIBIT 1: REVENUE GROWTH 20062024 (%) HOTELS AND RESORTS INDUSTRY (GLOBALLY) Year Revenue Growth Year 2006 4.6 2016 2007 7.1 2017 2008 0.1 2018 2009 -8.5 2019(E) 2010 -1.3 2020 (E) 2011 5.9 2021 (E) 2012 5,5 2022 (E) 2013 4.8 2023 (E) 2014 5,0 2024 (E) 2015 1.2 Revenue Growth 1.2 6.8 5.5 3.3 3,3 3.3 3.2 3.1 3,1 Note: E = expected revenue growth. Source: "Global Hotels & Resorts Industry Market Research Report (Industry Performance)" IBISWorld, May 2018, updated July 2019, accessed June 29, 2019, www.ibisworld.com/industry-trends/global-industry-reports/hotels-restaurants/hotels-resorts,html. EXHIBIT 2: MARKET SHARE OF DIFFERENT HOTEL SEGMENTS, 2018 (%) Segments Market Share (%) High-end hotel accommodation (more than $100 per night) 23,5 Medium-end hotel accommodation ($50 to $100 per night) 33,9 Low-end hotel accommodation (under $50 per night) 17.9 Resort accommodation 24,7 Source: "Global Hotels & Resorts Industry Market Research Report (Products and Markets)," IBISWorld, May 2018, updated July 2019, accessed June 29, 2019, www.ibisworld.com/industrytrends/global-industry-reports/hotels-restaurants/hotels-resorts.html. EXHIBIT 3: TOP 5 TOURIST DESTINATIONS WORLDWIDE BY NUMBER OF VISITIORS (IN MILLIONS) Country France Spain United States China Italy 2016 82.6 75,6 75.7 59,3 52,6 2017 2030 86.9 125.84 81,8 110,13 75,9 116,36 60.7 127.05 58,3 78,48 EXHIBIT 4: OYO_FUNDING ROUNDS AND VALUATION ($ MILLIONS) 25 Funding Rounds* Amount Valuation Seed Round (2014) Series A (2015) 25 Series B (2015) 100 300 Series C (2016) 90 370 Series D (2017) 250 600 Corporate Round (2017) 10 n/a Series E (2018-19) 1,200 5,000 Note: *For details on the objective of different funding rounds (for a start-up and the funding venture capitalists) refer to Alejandro Cremades "How Funding Rounds Work For Startups," Forbes, December 26, 2018, accessed February 12, 2019, www.forbes.com/sites/alejandrocremades/2018/12/26/how-funding-rounds-work-for-startups/#63c78c6d7386, Source: "OYO: Funding Rounds," Crunchbase, accessed March 10, 2019, www.crunchbase.com/organization/oyo- rooms#section-funding-rounds. EXHIBIT 5: OYOFINANCIALS ($ MILLIONS) Sales of Services Total Revenues Total Expense PAT 2013-2014 0.06 0.02 0,16 -0.08 20142015 0.03 0.18 4,68 -3.03 20152016 2.57 2.21 75,98 -53.08 2016-2017 18.28 2.26 73,61 -53.07 Note: PAT = profit after tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts