Question: ONLY answer question 4! Please show work In this problem, we calculate the yield to maturity of different types of bonds, which equate the present

ONLY answer question 4! Please show work

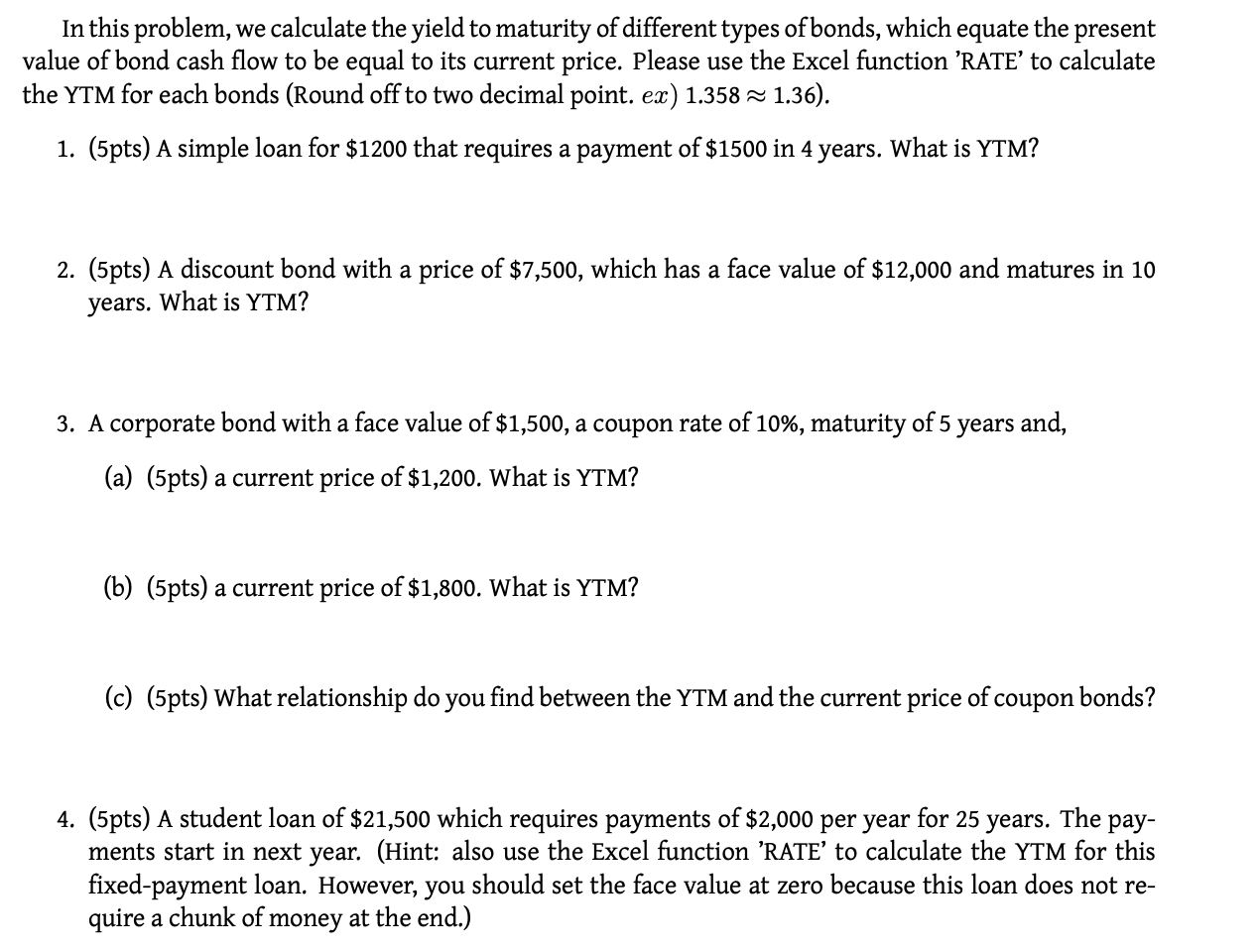

In this problem, we calculate the yield to maturity of different types of bonds, which equate the present value of bond cash flow to be equal to its current price. Please use the Excel function 'RATE to calculate the YTM for each bonds (Round off to two decimal point. ex) 1.358 1.36). 1. (5pts) A simple loan for $1200 that requires a payment of $1500 in 4 years. What is YTM? 2. (5pts) A discount bond with a price of $7,500, which has a face value of $12,000 and matures in 10 years. What is YTM? 3. A corporate bond with a face value of $1,500, a coupon rate of 10%, maturity of 5 years and, (a) (5pts) a current price of $1,200. What is YTM? (b) (5pts) a current price of $1,800. What is YTM? (c) (5pts) What relationship do you find between the YTM and the current price of coupon bonds? 4. (5pts) A student loan of $21,500 which requires payments of $2,000 per year for 25 years. The pay- ments start in next year. (Hint: also use the Excel function 'RATE' to calculate the YTM for this fixed-payment loan. However, you should set the face value at zero because this loan does not re- quire a chunk of money at the end.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts