Question: ONLY ANSWER QUESTION 4 Question 3 (4 marks) Suppose you are a FX trader at Citi. A client calls for a JPY quote. You quote

ONLY ANSWER QUESTION 4

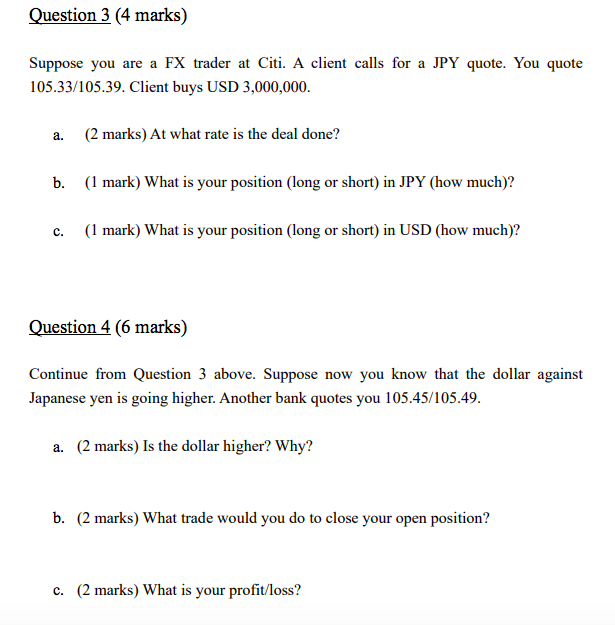

Question 3 (4 marks) Suppose you are a FX trader at Citi. A client calls for a JPY quote. You quote 105.33/105.39. Client buys USD 3,000,000. a. (2 marks) At what rate is the deal done? b. (1 mark) What is your position (long or short) in JPY (how much)? c. (1 mark) What is your position (long or short) in USD (how much)? Question 4 (6 marks) Continue from Question 3 above. Suppose now you know that the dollar against Japanese yen is going higher. Another bank quotes you 105.45/105.49. a. (2 marks) Is the dollar higher? Why? b. (2 marks) What trade would you do to close your open position? C. (2 marks) What is your profit/loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts