Question: Question 3 (8 marks) Suppose you are a FX trader at HSBC. A client calls for a GBP quote. You quote 1.3625 / 1.3648. Client

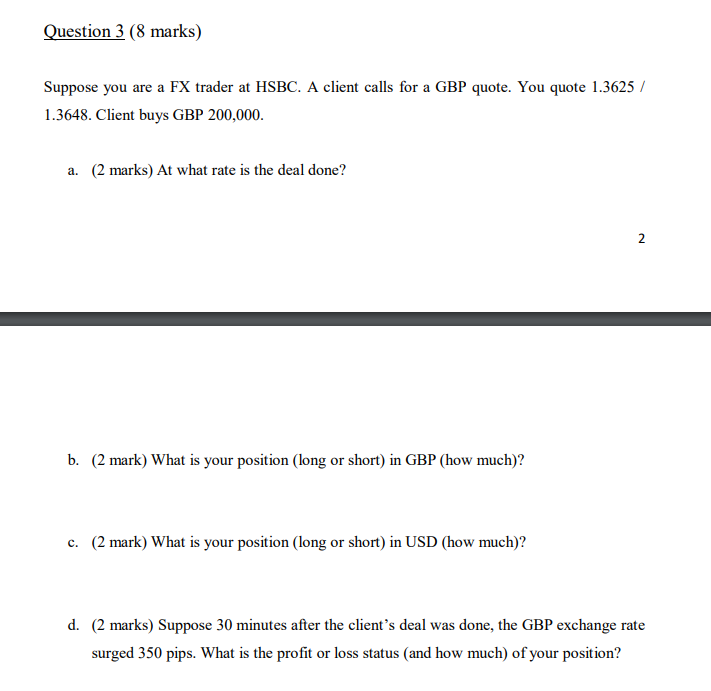

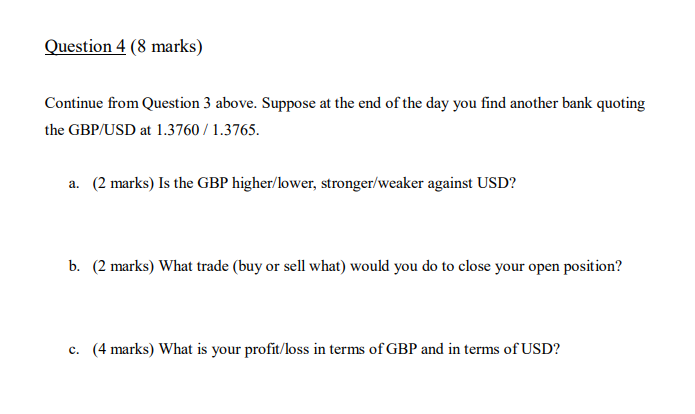

Question 3 (8 marks) Suppose you are a FX trader at HSBC. A client calls for a GBP quote. You quote 1.3625 / 1.3648. Client buys GBP 200,000. a. (2 marks) At what rate is the deal done? N b. (2 mark) What is your position (long or short) in GBP (how much)? c. (2 mark) What is your position (long or short) in USD (how much)? d. (2 marks) Suppose 30 minutes after the client's deal was done, the GBP exchange rate surged 350 pips. What is the profit or loss status and how much) of your position? Question 4 (8 marks) Continue from Question 3 above. Suppose at the end of the day you find another bank quoting the GBP/USD at 1.3760 / 1.3765. a. (2 marks) Is the GBP higher/lower, stronger/weaker against USD? b. (2 marks) What trade (buy or sell what) would you do to close your open position? c. (4 marks) What is your profit/loss in terms of GBP and in terms of USD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts