Question: Only answer questions D and please Only answer questiond D and E please ST-2 CAPITAL BUDGETING CRITERIA You must analyze two projects, X and Y.

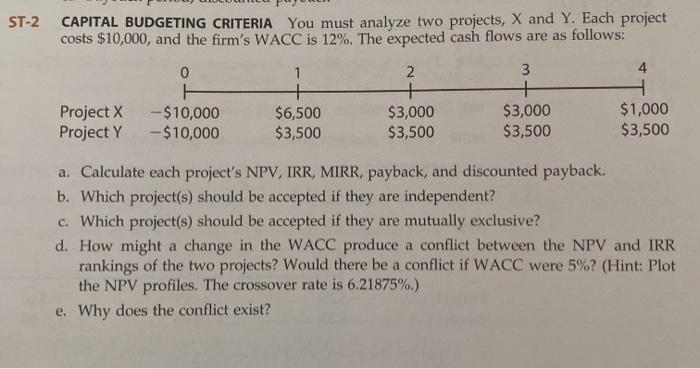

ST-2 CAPITAL BUDGETING CRITERIA You must analyze two projects, X and Y. Each project costs $10,000, and the firm's WACC is 12%. The expected cash flows are as follows: 0 1 2 3 4 H + + H Project X - $10,000 $6,500 $3,000 $3,000 $1,000 Project Y - $10,000 $3,500 $3,500 $3,500 $3,500 a. Calculate each project's NPV, IRR, MIRR, payback, and discounted payback. b. Which project(s) should be accepted if they are independent? c. Which project(s) should be accepted if they are mutually exclusive? d. How might a change in the WACC produce a conflict between the NPV and IRR rankings of the two projects? Would there be a conflict if WACC were 5%? (Hint: Plot the NPV profiles. The crossover rate is 6.21875%.) e. Why does the conflict exist

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts