Question: ONLY ANSWER USING EXCEL OR WORD - NO WORK WRITTEN ON PAPER SHOW ALL WORK STEP BY STEP. THANKS Question 1: Company Minisun is a

ONLY ANSWER USING EXCEL OR WORD - NO WORK WRITTEN ON PAPER SHOW ALL WORK STEP BY STEP.

THANKS

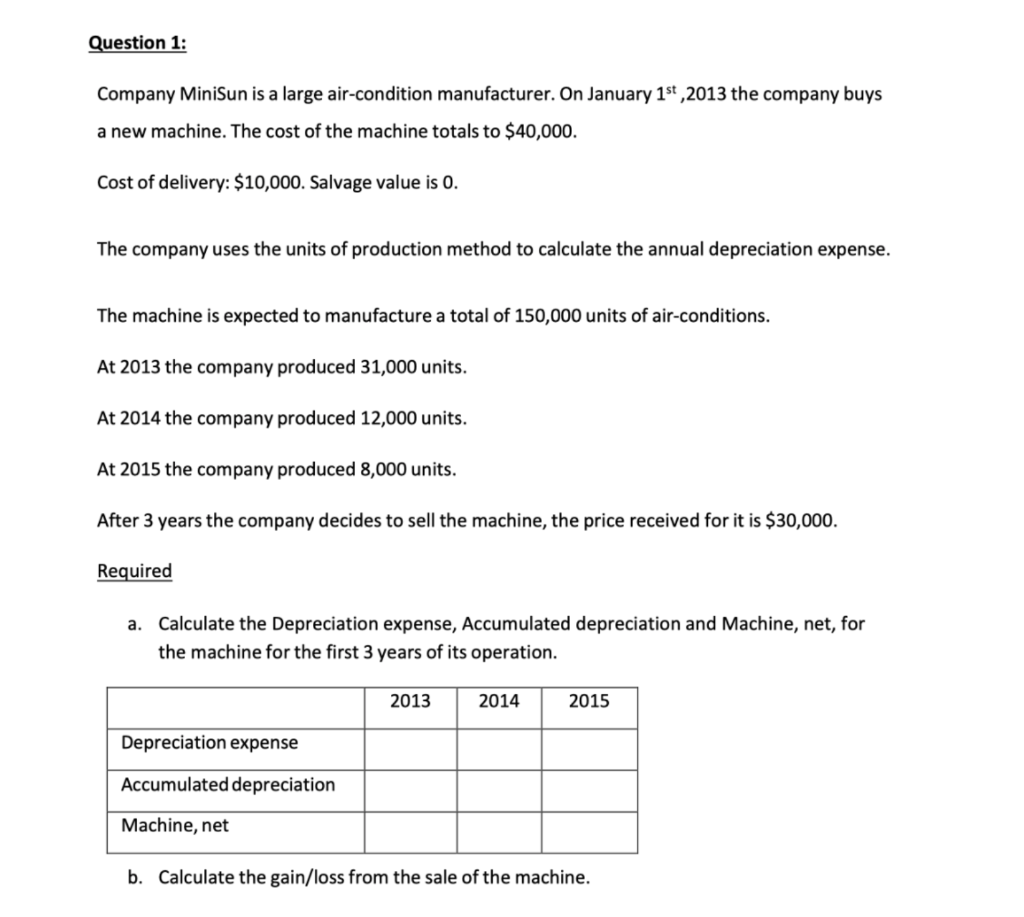

Question 1: Company Minisun is a large air-condition manufacturer. On January 1st, 2013 the company buys a new machine. The cost of the machine totals to $40,000. Cost of delivery: $10,000. Salvage value is 0. The company uses the units of production method to calculate the annual depreciation expense. The machine is expected to manufacture a total of 150,000 units of air-conditions. At 2013 the company produced 31,000 units. At 2014 the company produced 12,000 units. At 2015 the company produced 8,000 units. After 3 years the company decides to sell the machine, the price received for it is $30,000. Required a. Calculate the Depreciation expense, Accumulated depreciation and Machine, net, for the machine for the first 3 years of its operation. 2013 2014 2015 Depreciation expense Accumulated depreciation Machine, net b. Calculate the gain/loss from the sale of the machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts