Question: only b please Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the

only b please

only b please

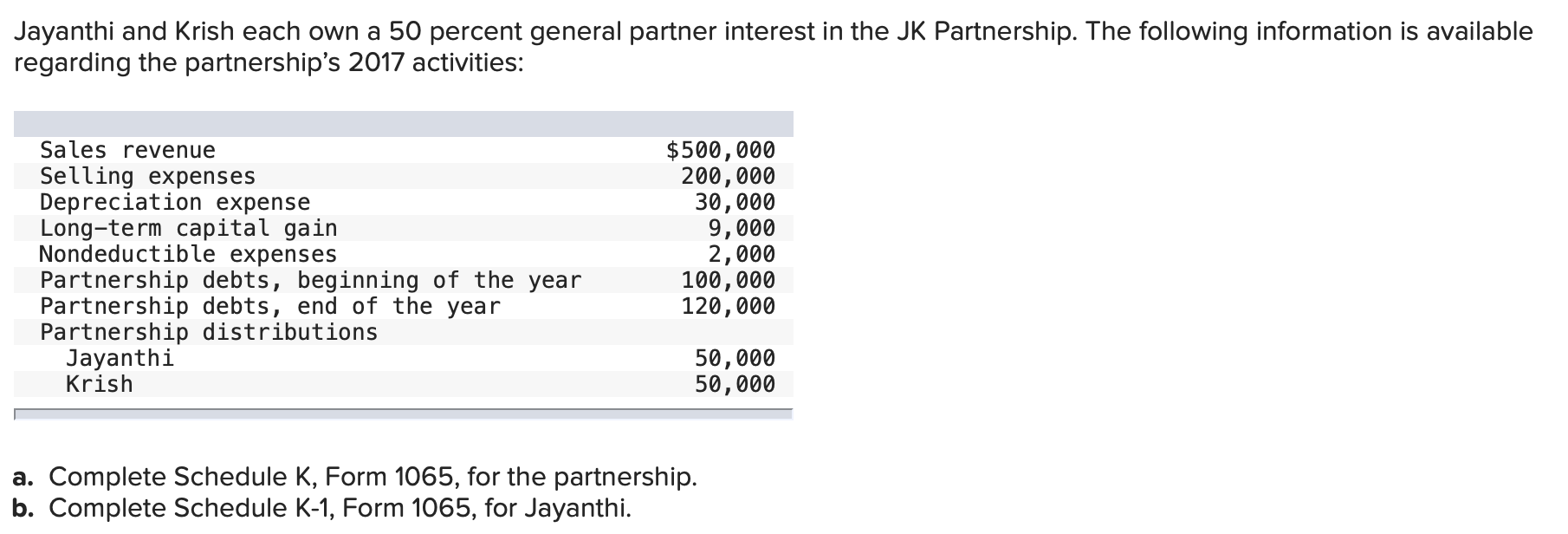

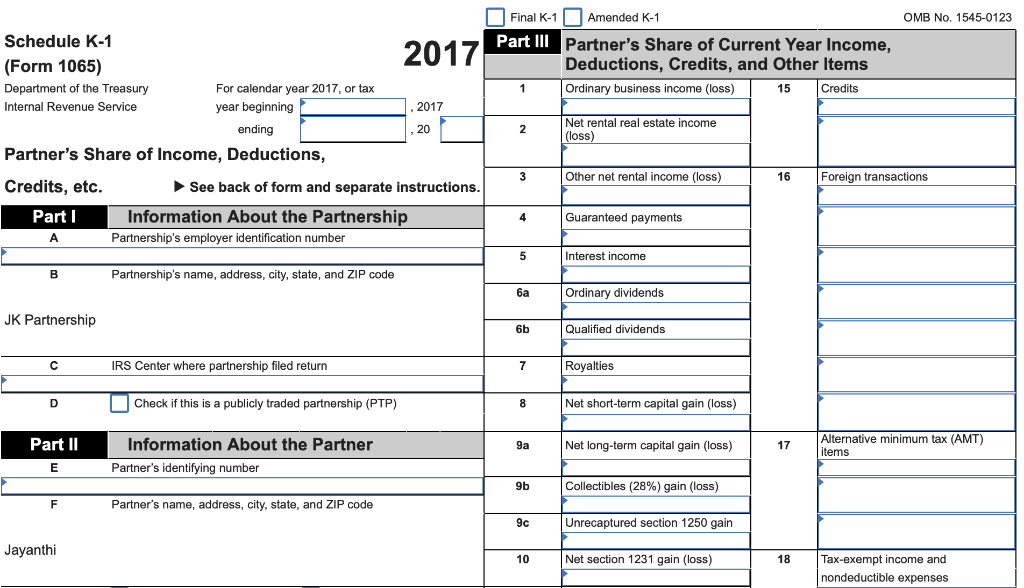

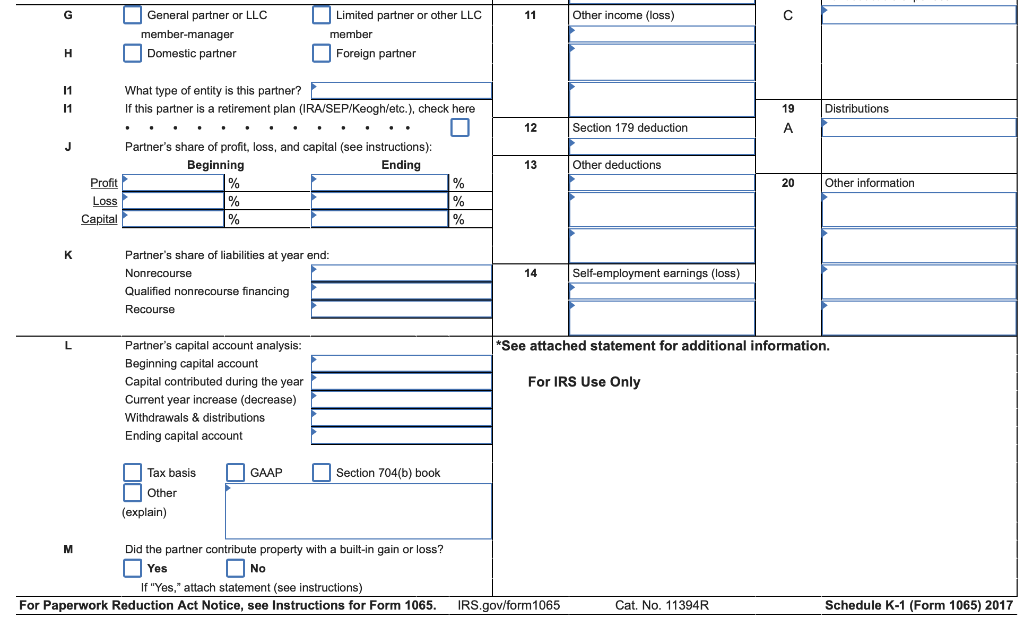

Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnerships 2017 activities: Sales revenue Selling expenses Depreciation expense Long-term capital gain Nondeductible expenses Partnership debts, beginning of the year Partnership debts, end of the year Partnership distributions Jayanthi Krish $500,000 200,000 30,000 9,000 2,000 100,000 120,000 50,000 50,000 a. Complete Schedule K, Form 1065, for the partnership. b. Complete Schedule K-1, Form 1065, for Jayanthi. OMB No. 1545-0123 Final K-1 Amended K-1 Part II Partner's Share of Current Year Income. Deductions, Credits, and Other Items Ordinary business income (loss) 1 15 Credits Schedule K-1 90z (Form 1065) Department of the Treasury For calendar year 2017, or tax Internal Revenue Service year beginning . 2017 ending C .20 Partner's Share of Income, Deductions, Credits, etc. See back of form and separate instructions. Part Information About the Partnership A Partnership's employer identification number Net rental real estate income (loss) Other net rental income (loss) 16 Foreign transactions Guaranteed payments Interest income B Partnership's name, address, city, state, and ZIP code 6a Ordinary dividends JK Partnership 6b Qualified dividends IRS Center where partnership filed return Royalties D Check if this is a publicly traded partnership (PTP) Net short-term capital gain (loss) Part II Net long-term capital gain (loss) 17 Information About the Partner Partner's identifying number Alternative minimum tax (AMT) items E Collectibles (28%) gain (loss) F Partner's name, address, city, state, and ZIP code Unrecaptured section 1250 gain Jayanthi 10 Net section 1231 gain (loss) 18 Tax-exempt income and nondeductible expenses 11 Other income (loss) General partner or LLC member-manager Domestic partner Limited partner or other LLC member Foreign partner What type of entity is this partner? If this partner is a retirement plan (IRA/SEP/Keoghletc.), check here 19 Distributions 12 Section 179 deduction A 13 Other deductions Partner's share of profit, loss, and capital (see instructions): Beginning Ending Profit % Loss % Capital 20 Other information % % % % 14 Self-employment earnings (loss) Partner's share of liabilities at year end: Nonrecourse Qualified nonrecourse financing Recourse *See attached statement for additional information. For IRS Use Only Partner's capital account analysis: Beginning capital account Capital contributed during the year Current year increase (decrease) Withdrawals & distributions Ending capital account O GAAP Section 704(b) book Tax basis Other (explain) Did the partner contribute property with a built-in gain or loss? Yes No If "Yes," attach statement (see instructions) For Paperwork Reduction Act Notice, see Instructions for Form 1065. IRS.gov/form 1065 Cat. No. 11394R Schedule K-1 (Form 1065) 2017 Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnerships 2017 activities: Sales revenue Selling expenses Depreciation expense Long-term capital gain Nondeductible expenses Partnership debts, beginning of the year Partnership debts, end of the year Partnership distributions Jayanthi Krish $500,000 200,000 30,000 9,000 2,000 100,000 120,000 50,000 50,000 a. Complete Schedule K, Form 1065, for the partnership. b. Complete Schedule K-1, Form 1065, for Jayanthi. OMB No. 1545-0123 Final K-1 Amended K-1 Part II Partner's Share of Current Year Income. Deductions, Credits, and Other Items Ordinary business income (loss) 1 15 Credits Schedule K-1 90z (Form 1065) Department of the Treasury For calendar year 2017, or tax Internal Revenue Service year beginning . 2017 ending C .20 Partner's Share of Income, Deductions, Credits, etc. See back of form and separate instructions. Part Information About the Partnership A Partnership's employer identification number Net rental real estate income (loss) Other net rental income (loss) 16 Foreign transactions Guaranteed payments Interest income B Partnership's name, address, city, state, and ZIP code 6a Ordinary dividends JK Partnership 6b Qualified dividends IRS Center where partnership filed return Royalties D Check if this is a publicly traded partnership (PTP) Net short-term capital gain (loss) Part II Net long-term capital gain (loss) 17 Information About the Partner Partner's identifying number Alternative minimum tax (AMT) items E Collectibles (28%) gain (loss) F Partner's name, address, city, state, and ZIP code Unrecaptured section 1250 gain Jayanthi 10 Net section 1231 gain (loss) 18 Tax-exempt income and nondeductible expenses 11 Other income (loss) General partner or LLC member-manager Domestic partner Limited partner or other LLC member Foreign partner What type of entity is this partner? If this partner is a retirement plan (IRA/SEP/Keoghletc.), check here 19 Distributions 12 Section 179 deduction A 13 Other deductions Partner's share of profit, loss, and capital (see instructions): Beginning Ending Profit % Loss % Capital 20 Other information % % % % 14 Self-employment earnings (loss) Partner's share of liabilities at year end: Nonrecourse Qualified nonrecourse financing Recourse *See attached statement for additional information. For IRS Use Only Partner's capital account analysis: Beginning capital account Capital contributed during the year Current year increase (decrease) Withdrawals & distributions Ending capital account O GAAP Section 704(b) book Tax basis Other (explain) Did the partner contribute property with a built-in gain or loss? Yes No If "Yes," attach statement (see instructions) For Paperwork Reduction Act Notice, see Instructions for Form 1065. IRS.gov/form 1065 Cat. No. 11394R Schedule K-1 (Form 1065) 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts