Question: ONLY BALANCE SHEET AND CASH FLOW STAEMENT INSTRUCTIONS: Using the 2017 trial balance and additional information below, prepare the projected (2018) financial statements for Walnut

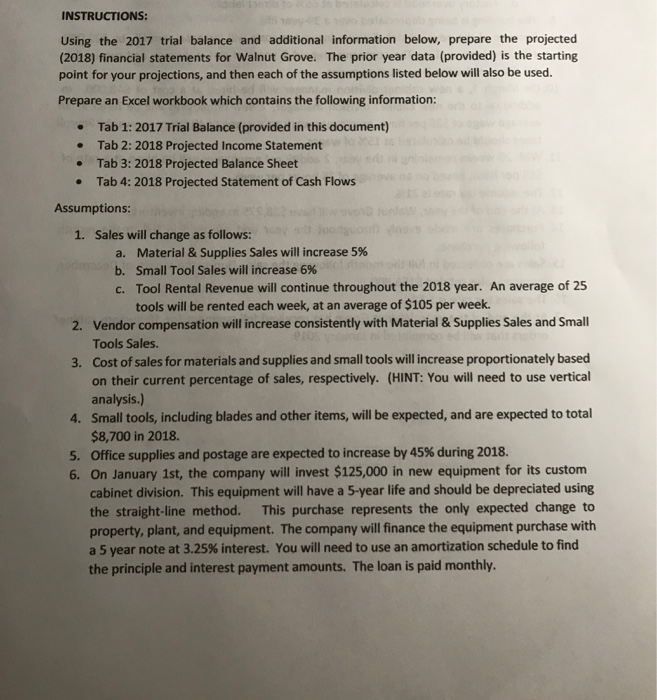

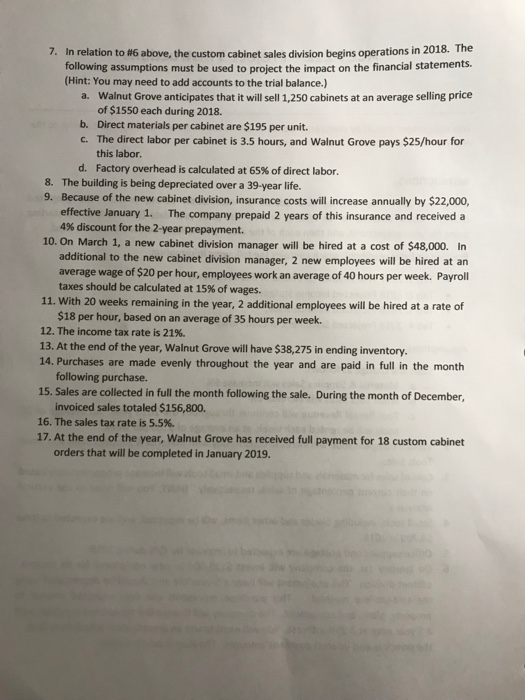

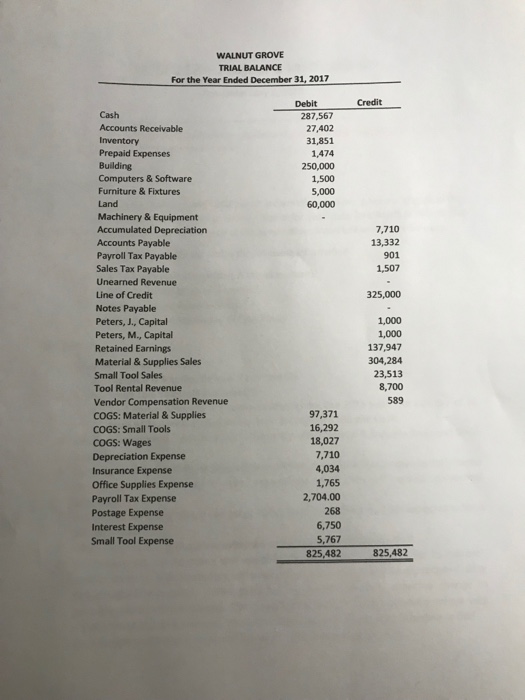

INSTRUCTIONS: Using the 2017 trial balance and additional information below, prepare the projected (2018) financial statements for Walnut Grove. The prior year data (provided) is the starting point for your projections, and then each of the assumptions listed below will also be used. Prepare an Excel workbook which contains the following information: . Tab 1: 2017 Trial Balance (provided in this document) . Tab 2: 2018 Projected Income Statement . Tab 3: 2018 Projected Balance Sheet . Tab 4: 2018 Projected Statement of Cash Flows Assumptions 1. Sales will change as follows: a. Material & Supplies Sales will increase 5% b. Small Tool Sales will increase 6% c. Tool Rental Revenue will continue throughout the 2018 year. An average of 25 tools will be rented each week, at an average of $105 per week. Vendor compensation will increase consistently with Material & Supplies Sales and Small Tools Sales. Cost of sales for materials and supplies and small tools will increase proportionately based on their current percentage of sales, respectively. (HINT: You will need to use vertical analysis.) Small tools, including blades and other items, will be expected, and are expected to total $8,700 in 2018. Office supplies and postage are expected to increase by 45% during 2018. 2. 3. 4. 5, 6. On January 1st, the company will invest $125,000 in new equipment for its custom cabinet division. This equipment will have a 5-year life and should be depreciated using the straight-line method. This purchase represents the only expected change to property, plant, and equipment. The company will finance the equipment purchase with a 5 year note at 3.25% interest. You will need to use an amortization schedule to find the principle and interest payment amounts. The loan is paid monthly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts