Question: Only fill the cells in yellow using formulas and provide explanations for the answers Problem 16-49 The audit staff of Adams, Barnes & Co. (ABC),

Only fill the cells in yellow using formulas and provide explanations for the answers

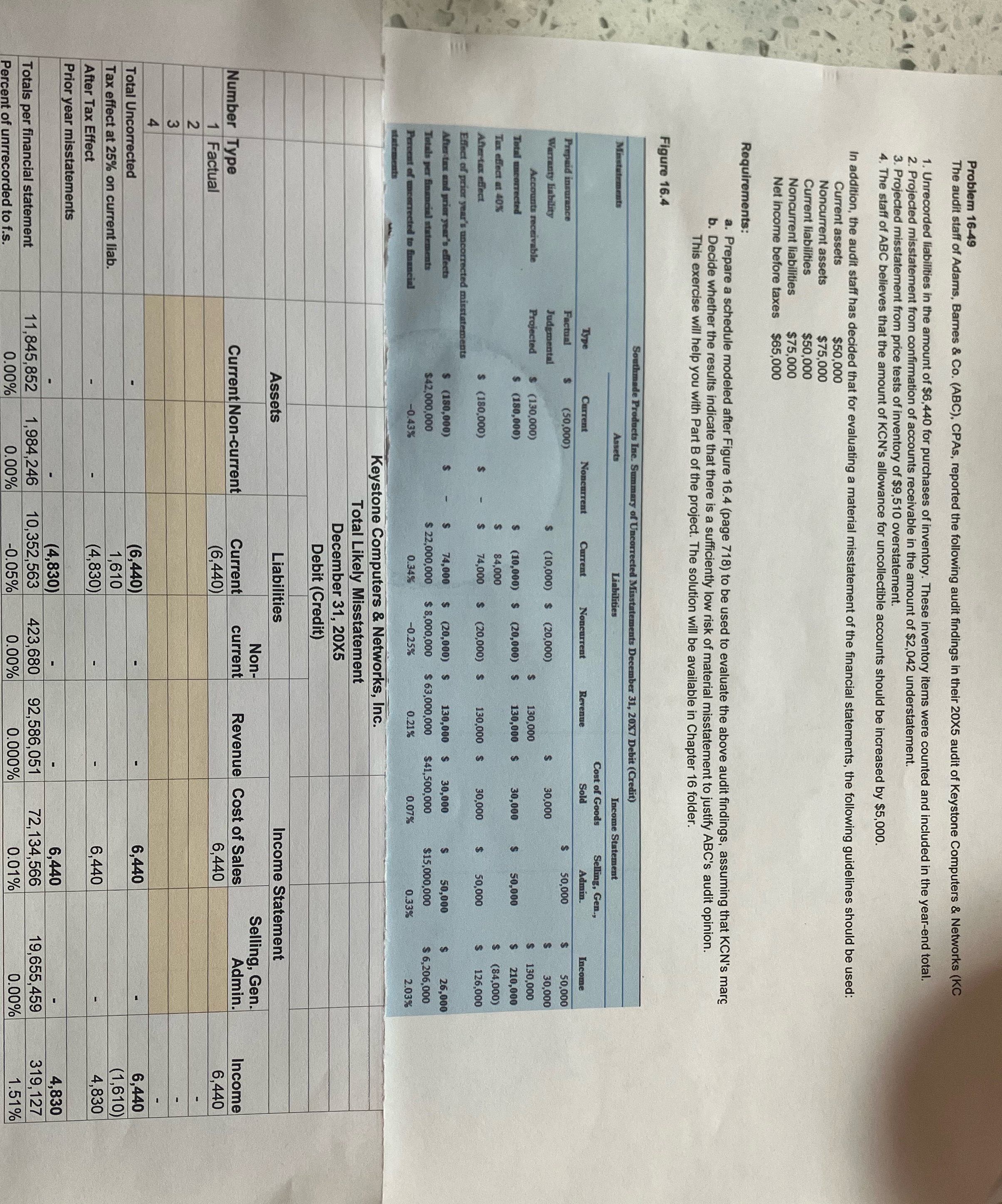

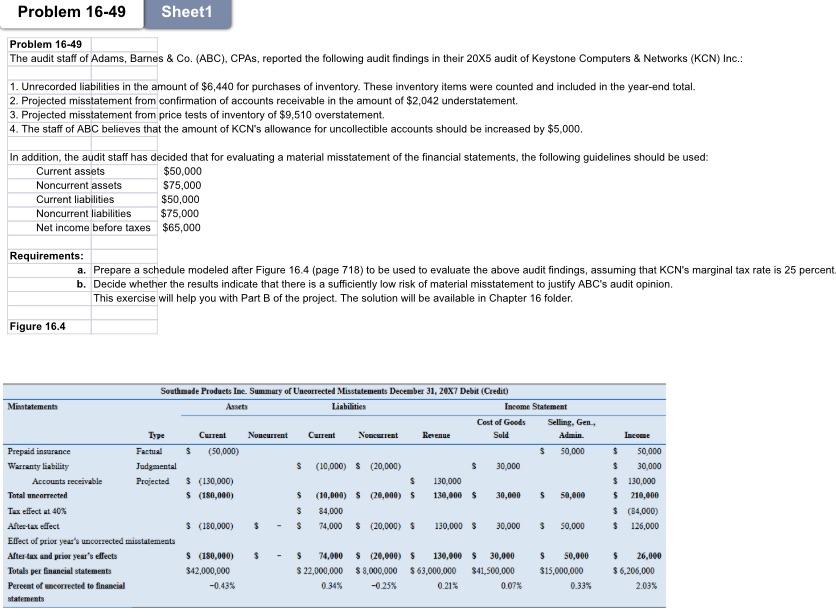

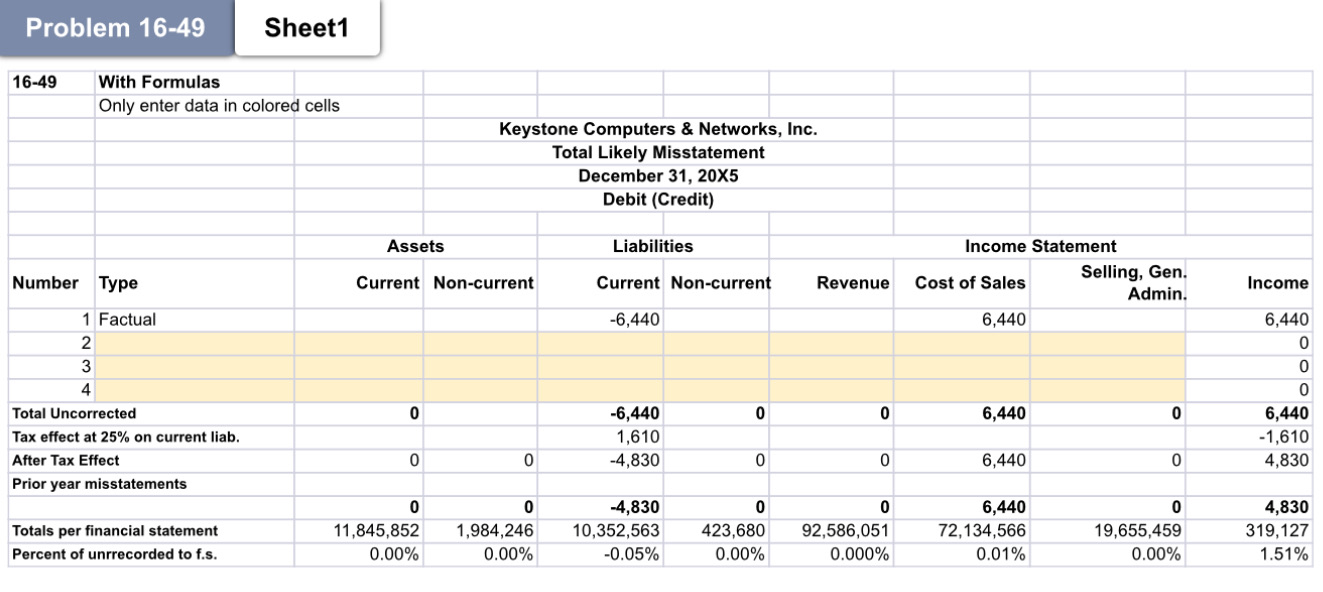

Problem 16-49 The audit staff of Adams, Barnes & Co. (ABC), CPAs, reported the following audit findings in their 20X5 audit of Keystone Computers & Networks (KC 1. Unrecorded liabilities in the amount of $6,440 for purchases of inventory. These inventory items were counted and included in the year-end total. 2. Projected misstatement from confirmation of accounts receivable in the amount of $2,042 understatement. 3. Projected misstatement from price tests of inventory of $9,510 overstatement. 4. The staff of ABC believes that the amount of KCN's allowance for uncollectible accounts should be increased by $5,000. In addition, the audit staff has decided that for evaluating a material misstatement of the financial statements, the following guidelines should be used: Current assets $50,000 Noncurrent assets $75,000 Current liabilities $50.000 Noncurrent liabilities $75.000 Net income before taxes $65,000 Requirements: a. Prepare a schedule modeled after Figure 16.4 (page 718) to be used to evaluate the above audit findings, assuming that KCN's marc b. Decide whether the results indicate that there is a sufficiently low risk of material misstatement to justify ABC's audit opinion. This exercise will help you with Part B of the project. The solution will be available in Chapter 16 folder. Figure 16.4 ents Dec mber 31, 20X7 Debit (Credit) Assets Liabilities ome Statement Cost of Goods Selling, Gen., Type Current Noncurrent Current Noncurrent Revenue Sold Admin Income Prepaid insurance Factual (50,000) 50,000 50,000 Warranty liability Judgmental S (10,000) $ (20,000) S 30.000 30,000 Accounts receivable Projected $ (130,000) 130.000 130.000 Total rected S (180,000) (10,000) $ (20,000) 130.000 S 30.000 50.000 210,000 Tax effect at 40% 84.000 (84,000 Aftertax effect $ (180,000) 74,000 $ (20,000) $ 130.000 $ 30 000 50.000 126.000 Effect of prior year's unco After tax and prior year's effects $ (180,000) S 74,000 $ (20,000) S 130,000 $ 30,000 S 50,000 26,000 Totals per financial stat $42,000,000 $ 22,000,000 $ 8,000,000 $ 63,000,000 $41,500,000 $15.000.000 $ 6,206,000 it of uncorrected to financial -0.43% 0.34% 0.25% 0.21% 0.07% 0.33% 2.03% Keystone Computers & Networks, Inc. Total Likely Misstatement December 31, 20X5 Debit (Credit) Assets Liabilities Income Statement Non- Selling, Gen. Number Type Current Non-current Current current Revenue Cost of Sales Admin. Income 1 Factual (6,440) 6,440 6,440 N M J Total Uncorrected (6,440) 6,440 6,440 Tax effect at 25% on current liab. 1,610 (1,610) After Tax Effect (4,830) 6,440 4.830 Prior year misstatements (4,830) 6,440 4,830 Totals per financial statement 11,845,852 1,984,246 10,352,563 423,680 92,586,051 72, 134,566 19,655,459 319, 127 0.00% 0.00% -0.05% 0.00% 0.000% 0.01% 0.00% 1.51%Problem 16-49 Sheet1 Problem 16-49 The audit staff of Adams, Barnes & Co. (ABC), CPAs, reported the following audit findings in their 20X5 audit of Keystone Computers & Networks (KCN) Inc.: 1. Unrecorded liabilities in the amount of $6,440 for purchases of inventory. These inventory items were counted and included in the year-end total. 2. Projected misstatement from confirmation of accounts receivable in the amount of $2,042 understatement. 3. Projected misstatement from price tests of inventory of $9,510 overstatement. 4. The staff of ABC believes that the amount of KCN's allowance for uncollectible accounts should be increased by $5,000. In addition, the audit staff has decided that for evaluating a material misstatement of the financial statements, the following guidelines should be used: Current assets $50,000 Noncurrent assets $75,000 Current liabilities $50,000 Noncurrent liabilities $75,000 Net income before taxes $65,000 Requirements: a. Prepare a schedule modeled after Figure 16.4 (page 718) to be used to evaluate the above audit findings, assuming that KCN's marginal tax rate is 25 percent b. Decide whether the results indicate that there is a sufficiently low risk of material misstatement to justify ABC's audit opinion. This exercise will help you with Part B of the project. The solution will be available in Chapter 16 folder. Figure 16.4 Southmade Products Inc. Summary of Uncorrected Misstatements December 31, 2017 Debit (Credit) Mentatements Liabilities Income Statement Cost of Goods Selling, Gen Type Current Noncurrent Current Noncurrent Revenue Suld Admin Income Prepaid insurance Factual (50,000) 50.000 50 000 Warranty liability Judgmental (10,000) $ (20,000) 30.000 30,000 Accounts receivable Projected $ (130,000) 130.000 130.000 Total uncorrected $ (180,000) $ (10,00-0) $ (20,000) 5 130,000 30,000 50.000 210,000 Tex effect at 40% 84,000 $34,000) After-tex elect 3 (180,000) 74.000 $ (20,000) $ 130.000 3 30.000 50,000 126,000 Elfect of prior year's uncorrected misstatements After bix and prior year's elfects $ (180,000) 74,000 5 (20,000) $ 130,000 5 30,090 50,0:00 Totals per financial statements $42,000,000 $ 22,000,000 $ 8,000.000 $ 63,000,000 $41 500,090 $15,000,000 $ 6.205.000 Percent of uncorrected to financial -0.43% 0.345 -0.25% 0.21% 0.07% 0.33% 2.051% statementsProblem 16-49 Sheet1 16-49 With Formulas Only enter data in colored cells Keystone Computers & Networks, Inc. Total Likely Misstatement December 31, 20X5 Debit (Credit) Assets Liabilities Income Statement Number Type Current Non-current Current Non-current Revenue Cost of Sales Selling, Gen. Admin. Income 1 Factual -6,440 6,440 6,440 0 W N 0 4 0 Total Uncorrected 0 -6,440 0 0 6,440 0 6,440 Tax effect at 25% on current liab. 1,610 -1,610 After Tax Effect 0 0 -4,830 0 0 6,440 0 4,830 Prior year misstatements 0 0 -4,830 0 0 6,440 0 4,830 Totals per financial statement 11,845,852 1,984,246 10,352,563 423,680 92,586,051 72, 134,566 19,655,459 319,127 Percent of unrrecorded to f.s. 0.00% 0.00% -0.05% 0.00% 0.000% 0.01% 0.00% 1.51%