Question: Only Looking for Help with Part C and D This is all the information I have. 1. Sweet Sugar Company processes sugar beets into three

Only Looking for Help with Part C and D

This is all the information I have.

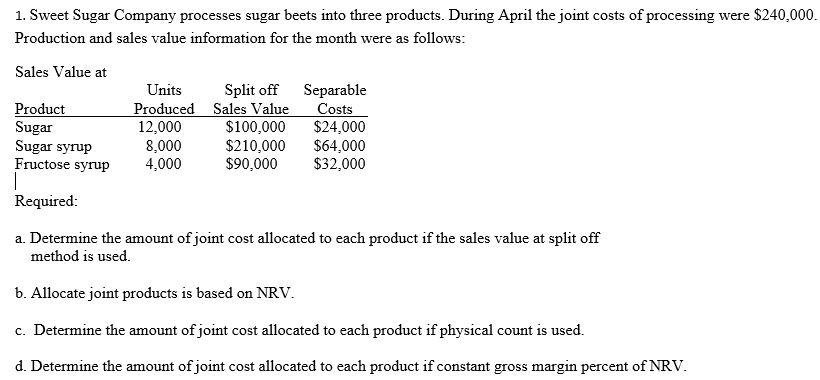

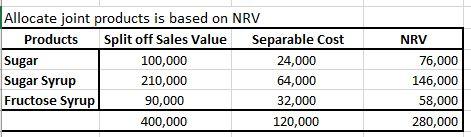

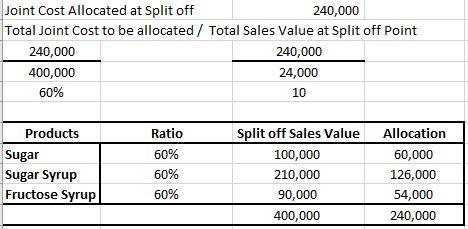

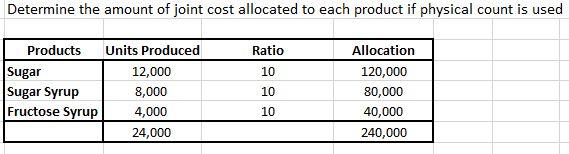

1. Sweet Sugar Company processes sugar beets into three products. During April the joint costs of processing were $240,000 Production and sales value information for the month were as follows: Sales Value at Product Sugar Sugar syrup Fructose syrup 1 Required: Units Split off Separable Produced Sales Value Costs 12,000 $100,000 $24,000 8,000 $210,000 $64,000 4,000 $90,000 $32,000 a. Determine the amount of joint cost allocated to each product if the sales value at split off method is used. b. Allocate joint products is based on NRV. c. Determine the amount of joint cost allocated to each product if physical count is used. d. Determine the amount of joint cost allocated to each product if constant gross margin percent of NRV. Allocate joint products is based on NRV Products Split off Sales Value Separable Cost Sugar 100,000 24,000 Sugar Syrup 210,000 64,000 Fructose Syrup 90,000 32,000 400,000 120,000 NRV 76,000 146,000 58,000 280,000 Joint Cost Allocated at Split off 240,000 Total Joint Cost to be allocated / Total Sales Value at Split off Point 240,000 240,000 400,000 24,000 60% 10 Products Sugar Sugar Syrup Fructose Syrup Ratio 60% 60% 60% Split off Sales Value 100,000 210,000 90,000 400,000 Allocation 60,000 126,000 54,000 240,000 Determine the amount of joint cost allocated to each product if physical count is used Ratio 10 Products Units Produced Sugar 12,000 Sugar Syrup 8,000 Fructose Syrup 4,000 24,000 10 Allocation 120,000 80,000 40,000 240,000 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts