Question: ONLY NEED QUESTION 2 ANSWERED. PLEASE DO NOT ANSWER Q1 Bond Pricing, Duration, and Convexity 1. Using the following data from Sept. 14, 2020, plot

ONLY NEED QUESTION 2 ANSWERED. PLEASE DO NOT ANSWER Q1

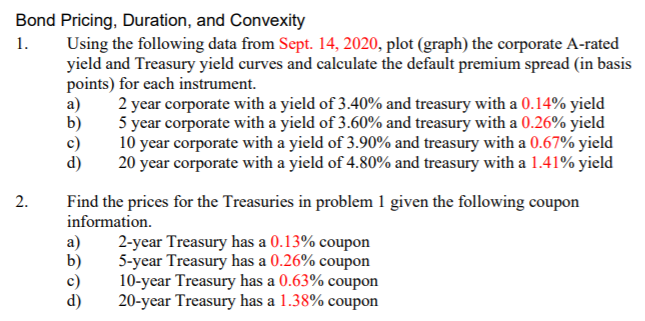

Bond Pricing, Duration, and Convexity 1. Using the following data from Sept. 14, 2020, plot (graph) the corporate A-rated yield and Treasury yield curves and calculate the default premium spread (in basis points) for each instrument. a) 2 year corporate with a yield of 3.40% and treasury with a 0.14% yield b) 5 year corporate with a yield of 3.60% and treasury with a 0.26% yield 10 year corporate with a yield of 3.90% and treasury with a 0.67% yield 20 year corporate with a yield of 4.80% and treasury with a 1.41% yield 2. Find the prices for the Treasuries in problem 1 given the following coupon information. a) 2-year Treasury has a 0.13% coupon 5-year Treasury has a 0.26% coupon 10-year Treasury has a 0.63% coupon 20-year Treasury has a 1.38% coupon 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts