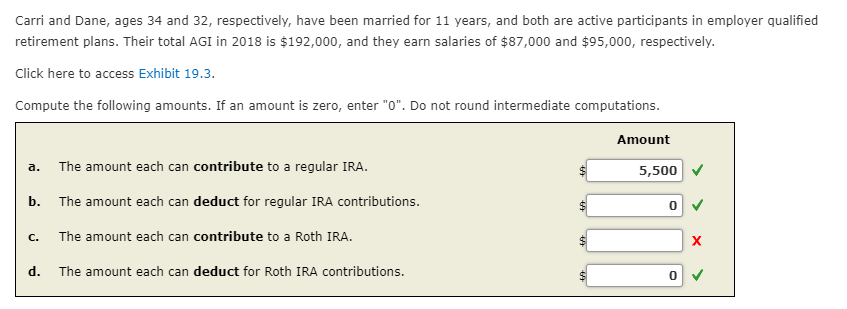

Question: Only need the answer for C, everything else is correct. C is not 0 or 5500, or 11000. This is my third time asking this

Only need the answer for C, everything else is correct. C is not 0 or 5500, or 11000. This is my third time asking this question.

Carri and Dane, ages 34 and 32, respectively, have been married for 11 years, and both are active participants in employer qualified retirement plans. Their total AGI in 2018 is $192,000, and they earn salaries of $87,000 and $95,000, respectively. Click here to access Exhibit 19.3 Compute the following amounts. If an amount is zero, enter "O". Do not round intermediate computations. Amount The amount each can contribute to a regular IRA. The amount each can deduct for regular IRA contributions. The amount each can contribute to a Roth IRA. a. 5,500 b. 0 c. d. The amount each can deduct for Roth IRA contributions. 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts