Question: Only need the answer for the 2 that are incorrect. Thank you Assume that on January 1, year 1,ABC Incorporated issued 7,350 stock options with

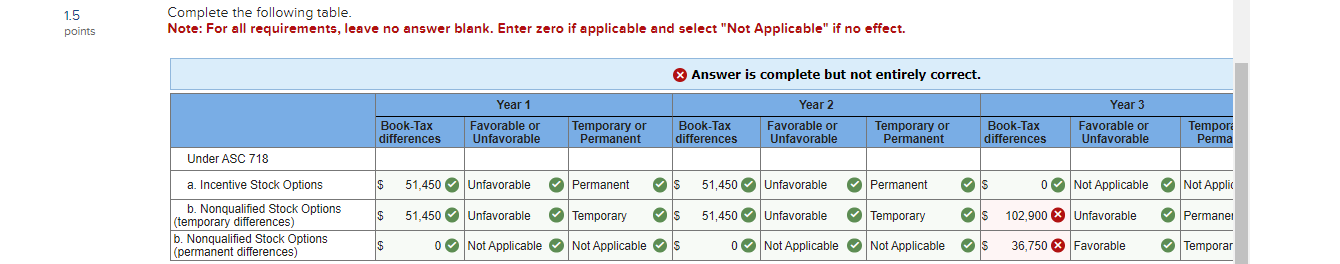

Only need the answer for the 2 that are incorrect. Thank you

Only need the answer for the 2 that are incorrect. Thank you

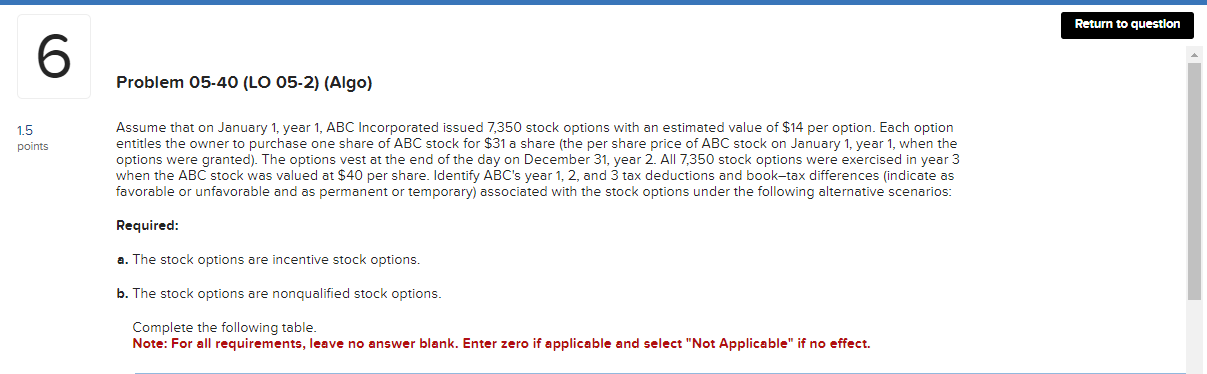

Assume that on January 1, year 1,ABC Incorporated issued 7,350 stock options with an estimated value of $14 per option. Each option entitles the owner to purchase one share of ABC stock for $31 a share (the per share price of ABC stock on January 1 , year 1 , when the options were granted). The options vest at the end of the day on December 31 , year 2 . All 7,350 stock options were exercised in year 3 when the ABC stock was valued at $40 per share. Identify ABC 's year 1,2 , and 3 tax deductions and book-tax differences (indicate as favorable or unfavorable and as permanent or temporary) associated with the stock options under the following alternative scenarios: Required: a. The stock options are incentive stock options. b. The stock options are nonqualified stock options. Complete the following table. Note: For all requirements, leave no answer blank. Enter zero if applicable and select "Not Applicable" if no effect. Complete the following table. Note: For all requirements, leave no answer blank. Enter zero if applicable and select "Not Applicable" if no effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts