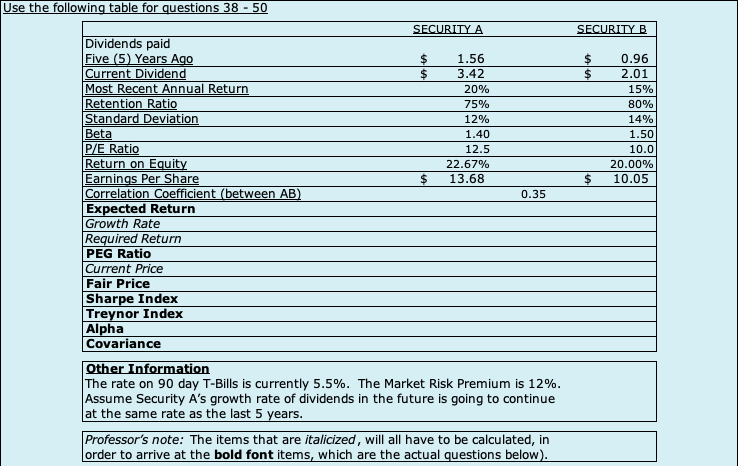

Question: Only need the answer, thank you! SECURITY B $ $ 0.96 2.01 15% 80% 14% 1.50 10.0 20.00% 10.05 $ Use the following table for

Only need the answer, thank you!

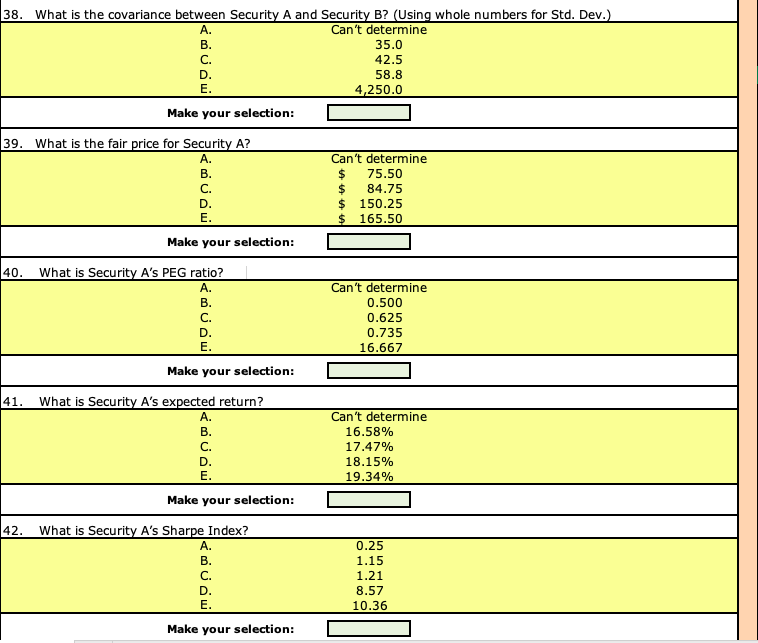

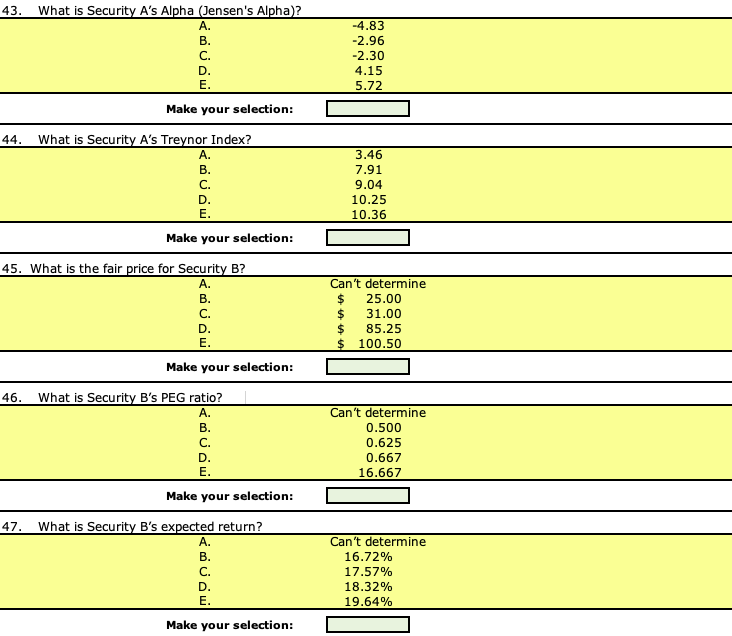

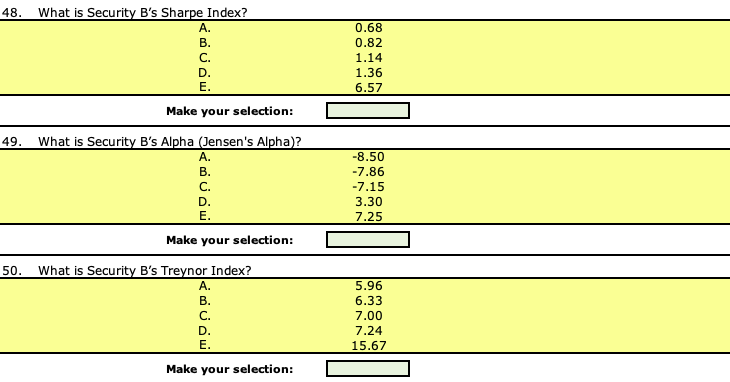

SECURITY B $ $ 0.96 2.01 15% 80% 14% 1.50 10.0 20.00% 10.05 $ Use the following table for questions 38 - 50 SECURITY A Dividends paid Five (5) Years Ago $ 1.56 Current Dividend $ 3.42 Most Recent Annual Return 20% Retention Ratio 75% Standard Deviation 12% Beta 1.40 P/E Ratio 12.5 Return on Equity 22.67% Earnings Per Share $ 13.68 Correlation coefficient (between AB) 0.35 Expected Return Growth Rate Required Return PEG Ratio Current Price Fair Price Sharpe Index Treynor Index Alpha Covariance Other Information The rate on 90 day T-Bills is currently 5.5%. The Market Risk Premium is 12%. Assume Security A's growth rate of dividends in the future is going to continue at the same rate as the last 5 years. Professor's note: The items that are italicized, will all have to be calculated, in order to arrive at the bold font items, which are the actual questions below). 38. What is the covariance between Security A and Security B? (Using whole numbers for Std. Dev.) A. Can't determine B. 35.0 C. 42.5 D. 58.8 E. 4,250.0 Make your selection: 39. What is the fair price for Security A? A. B. C. D. E. Can't determine $ 75.50 84.75 $ 150.25 $ 165.50 Make your selection: 40. Can't determine 0.500 0.625 0.735 16.667 41. What is Security A's PEG ratio? A. B. C. D. E. Make your selection: What is Security A's expected return? A. B. C. D. E. Make your selection: What is Security A's Sharpe Index? A. B. C. D. E. Can't determine 16.58% 17.47% 18.15% 19.34% 42. 0.25 1.15 1.21 8.57 10.36 Make your selection: 43. What is Security A's Alpha (Jensen's Alpha ? A. B. C. D. E. Make your selection: -4.83 -2.96 -2.30 4.15 5.72 44. What is Security A's Treynor Index? A. B. C. D. E. 3.46 7.91 9.04 10.25 10.36 Make your selection: 45. What is the fair price for Security B? A. B. C. D. E. Make your selection: Can't determine $ 25.00 $ 31.00 $ 85.25 $ 100.50 46. What is Security B's PEG ratio? A. B. C. D. E. Make your selection: Can't determine 0.500 0.625 0.667 16.667 47. What is Security B's expected return? A. B. C. D. E. Can't determine 16.72% 17.57% 18.32% 19.64% Make your selection: 48. What is Security B's Sharpe Index? A. B. C. D. E. Make your selection: 0.68 0.82 1.14 1.36 6.57 49. What is Security B's Alpha (Jensen's Alpha2 A. B. C. D. E. -8.50 -7.86 -7.15 3.30 7.25 Make your selection: 50. What is Security B's Treynor Index? A. B. C. D. E. 5.96 6.33 7.00 7.24 15.67 Make your selection: SECURITY B $ $ 0.96 2.01 15% 80% 14% 1.50 10.0 20.00% 10.05 $ Use the following table for questions 38 - 50 SECURITY A Dividends paid Five (5) Years Ago $ 1.56 Current Dividend $ 3.42 Most Recent Annual Return 20% Retention Ratio 75% Standard Deviation 12% Beta 1.40 P/E Ratio 12.5 Return on Equity 22.67% Earnings Per Share $ 13.68 Correlation coefficient (between AB) 0.35 Expected Return Growth Rate Required Return PEG Ratio Current Price Fair Price Sharpe Index Treynor Index Alpha Covariance Other Information The rate on 90 day T-Bills is currently 5.5%. The Market Risk Premium is 12%. Assume Security A's growth rate of dividends in the future is going to continue at the same rate as the last 5 years. Professor's note: The items that are italicized, will all have to be calculated, in order to arrive at the bold font items, which are the actual questions below). 38. What is the covariance between Security A and Security B? (Using whole numbers for Std. Dev.) A. Can't determine B. 35.0 C. 42.5 D. 58.8 E. 4,250.0 Make your selection: 39. What is the fair price for Security A? A. B. C. D. E. Can't determine $ 75.50 84.75 $ 150.25 $ 165.50 Make your selection: 40. Can't determine 0.500 0.625 0.735 16.667 41. What is Security A's PEG ratio? A. B. C. D. E. Make your selection: What is Security A's expected return? A. B. C. D. E. Make your selection: What is Security A's Sharpe Index? A. B. C. D. E. Can't determine 16.58% 17.47% 18.15% 19.34% 42. 0.25 1.15 1.21 8.57 10.36 Make your selection: 43. What is Security A's Alpha (Jensen's Alpha ? A. B. C. D. E. Make your selection: -4.83 -2.96 -2.30 4.15 5.72 44. What is Security A's Treynor Index? A. B. C. D. E. 3.46 7.91 9.04 10.25 10.36 Make your selection: 45. What is the fair price for Security B? A. B. C. D. E. Make your selection: Can't determine $ 25.00 $ 31.00 $ 85.25 $ 100.50 46. What is Security B's PEG ratio? A. B. C. D. E. Make your selection: Can't determine 0.500 0.625 0.667 16.667 47. What is Security B's expected return? A. B. C. D. E. Can't determine 16.72% 17.57% 18.32% 19.64% Make your selection: 48. What is Security B's Sharpe Index? A. B. C. D. E. Make your selection: 0.68 0.82 1.14 1.36 6.57 49. What is Security B's Alpha (Jensen's Alpha2 A. B. C. D. E. -8.50 -7.86 -7.15 3.30 7.25 Make your selection: 50. What is Security B's Treynor Index? A. B. C. D. E. 5.96 6.33 7.00 7.24 15.67 Make your selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts