Question: Only need the answer to Required #1 a-d Problem 2: SW Flour Company buys 1 input of standard flour and refines it using a special

Only need the answer to Required #1 a-d

Only need the answer to Required #1 a-d

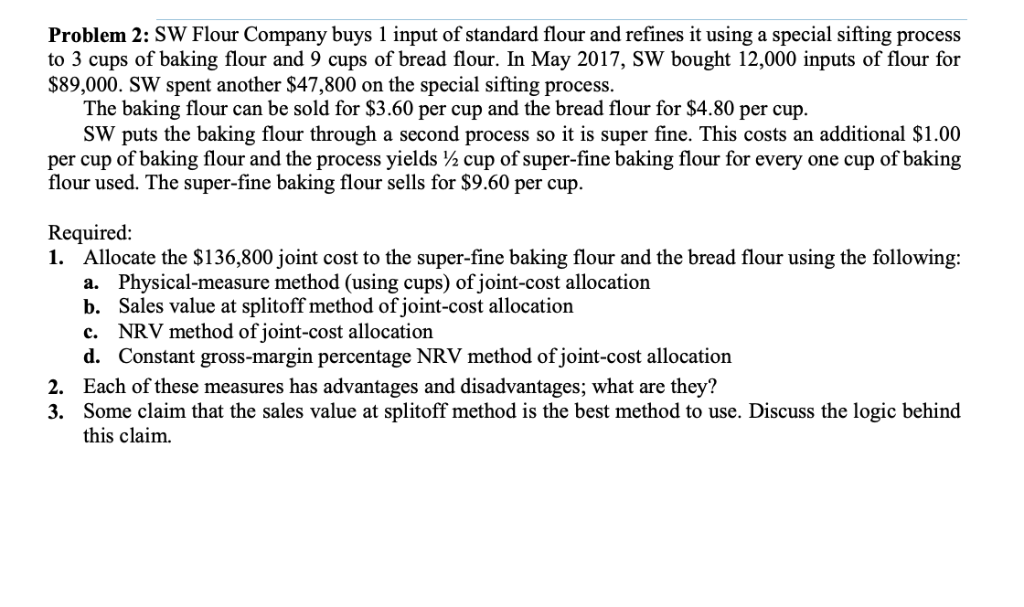

Problem 2: SW Flour Company buys 1 input of standard flour and refines it using a special sifting process to 3 cups of baking flour and 9 cups of bread flour. In May 2017, SW bought 12,000 inputs of flour for $89,000. SW spent another $47,800 on the special sifting process The baking flour can be sold for $3.60 per cup and the bread flour for $4.80 per cup. SW puts the baking flour through a second process so it is super fine. This costs an additional $1.00 per cup of baking flour and the process yields cup of super-fine baking flour for every one cup of baking flour used. The super-fine baking flour sells for $9.60 per cup. Required 1. Allocate the $136,800 joint cost to the super-fine baking flour and the bread flour using the following: a. Physical-measure method (using cups) of joint-cost allocation b. Sales value at splitoff method of joint-cost allocation c. NRV method of joint-cost allocation d. Constant gross-margin percentage NRV method of joint-cost allocation Each of these measures has advantages and disadvantages; what are they? Some claim that the sales value at splitoff method is the best method to use. Discuss the logic behind this claim. 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts