Question: only need to answer problem 9 8. A stock price is $40 now. In one month it can go 10% up or down. In the

only need to answer problem 9

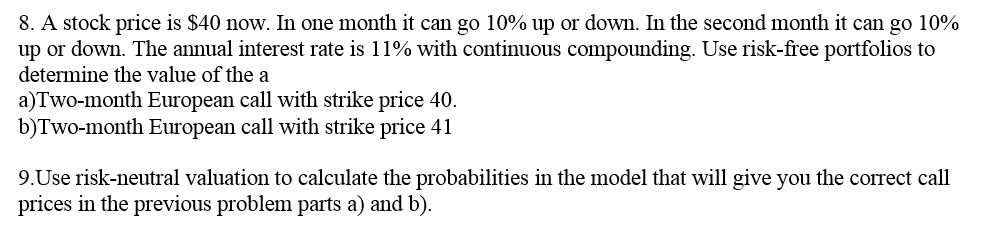

8. A stock price is $40 now. In one month it can go 10% up or down. In the second month it can go 10% up or down. The annual interest rate is 11% with continuous compounding. Use risk-free portfolios to determine the value of the a a)Two-month European call with strike price 40. b) Two-month European call with strike price 41 9.Use risk-neutral valuation to calculate the probabilities in the model that will give you the correct call prices in the previous problem parts a) and b). 8. A stock price is $40 now. In one month it can go 10% up or down. In the second month it can go 10% up or down. The annual interest rate is 11% with continuous compounding. Use risk-free portfolios to determine the value of the a a)Two-month European call with strike price 40. b) Two-month European call with strike price 41 9.Use risk-neutral valuation to calculate the probabilities in the model that will give you the correct call prices in the previous problem parts a) and b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts