Question: Only question 2 please , Question 1 (5 points) In 2021, Leo construction traded in a light duty pickup truck that had a book value

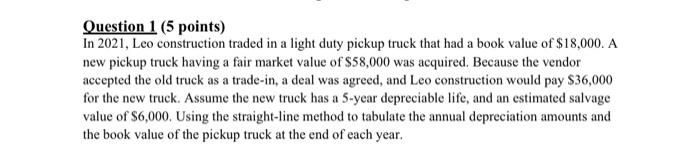

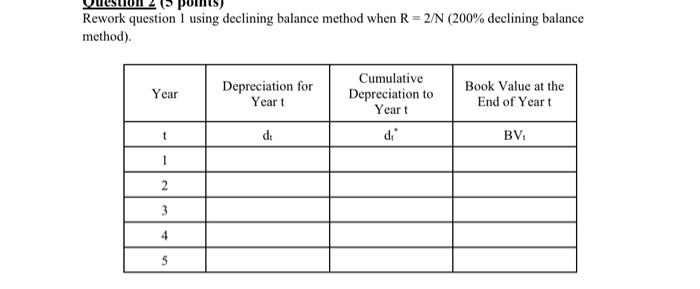

Question 1 (5 points) In 2021, Leo construction traded in a light duty pickup truck that had a book value of $18,000. A new pickup truck having a fair market value of $58,000 was acquired. Because the vendor accepted the old truck as a trade-in, a deal was agreed, and Leo construction would pay $36,000 for the new truck. Assume the new truck has a 5-year depreciable life, and an estimated salvage value of $6,000. Using the straight-line method to tabulate the annual depreciation amounts and the book value of the pickup truck at the end of each year. Rework question 1 using declining balance method when R = 2/N (200% declining balance method). Year Depreciation for Yeart Cumulative Depreciation to Yeart di Book Value at the End of Yeart d BV 2 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts