Question: question 3 please Question 1 (5 points) In 2021, Leo construction traded in a light duty pickup truck that had a book value of $18,000.

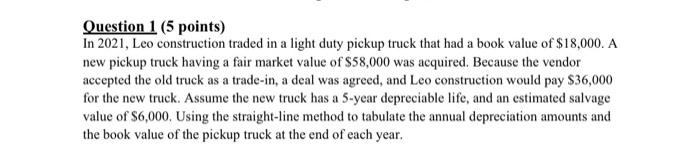

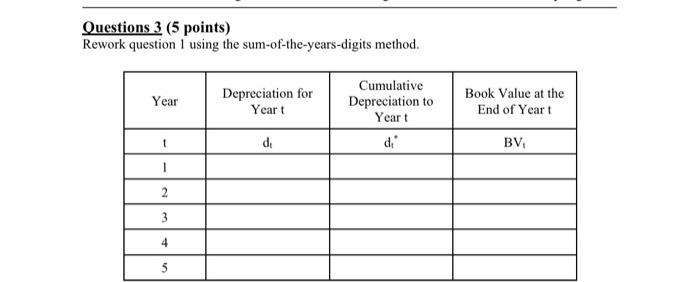

Question 1 (5 points) In 2021, Leo construction traded in a light duty pickup truck that had a book value of $18,000. A new pickup truck having a fair market value of $58,000 was acquired. Because the vendor accepted the old truck as a trade-in, a deal was agreed, and Leo construction would pay $36,000 for the new truck. Assume the new truck has a 5-year depreciable life, and an estimated salvage value of S6,000. Using the straight-line method to tabulate the annual depreciation amounts and the book value of the pickup truck at the end of each year. Questions 3 (5 points) Rework question 1 using the sum-of-the-years-digits method. Year Depreciation for Yeart Cumulative Depreciation to Yeart di Book Value at the End of Yeart d BV, 2 3 4 5 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts