Question: Only Question #4 please!!! TULUI! ategies BASIC a. 12 percent b. 14 percent c. 16 percent d. 6 percent e. 4 percent 3. The common

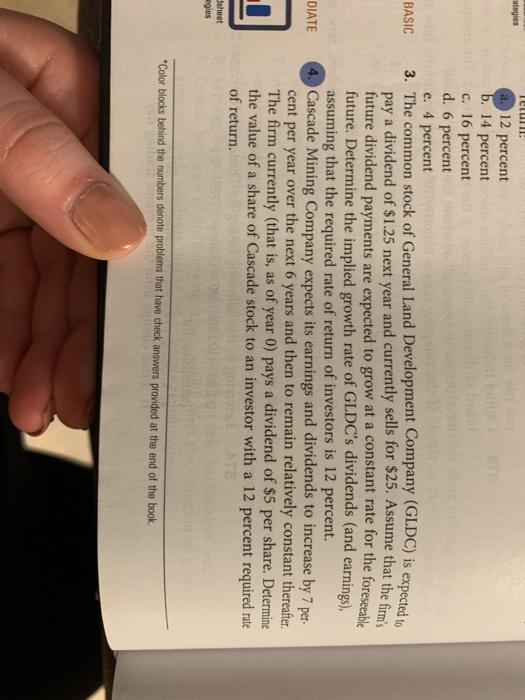

TULUI! ategies BASIC a. 12 percent b. 14 percent c. 16 percent d. 6 percent e. 4 percent 3. The common stock of General Land Development Company (GLDC) is expected to pay a dividend of $1.25 next year and currently sells for $25. Assume that the firm's future dividend payments are expected to grow at a constant rate for the foreseeable future. Determine the implied growth rate of GLDC's dividends (and earnings), assuming that the required rate of return of investors is 12 percent. 4. Cascade Mining Company expects its earnings and dividends to increase by 7 per- cent per year over the next 6 years and then to remain relatively constant thereafter. The firm currently (that is, as of year 0) pays a dividend of $5 per share. Determine the value of a share of Cascade stock to an investor with a 12 percent required rate of return. DIATE sheet ogies "Color blocks behind the numbers denote problems that have check answers provided at the end of the book

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts