Question: Only question #5 3. A foreign exchange trader with a U.S. bank took a short position of 5,000,000 when the $/ exchange rate was 1.55.

Only question #5

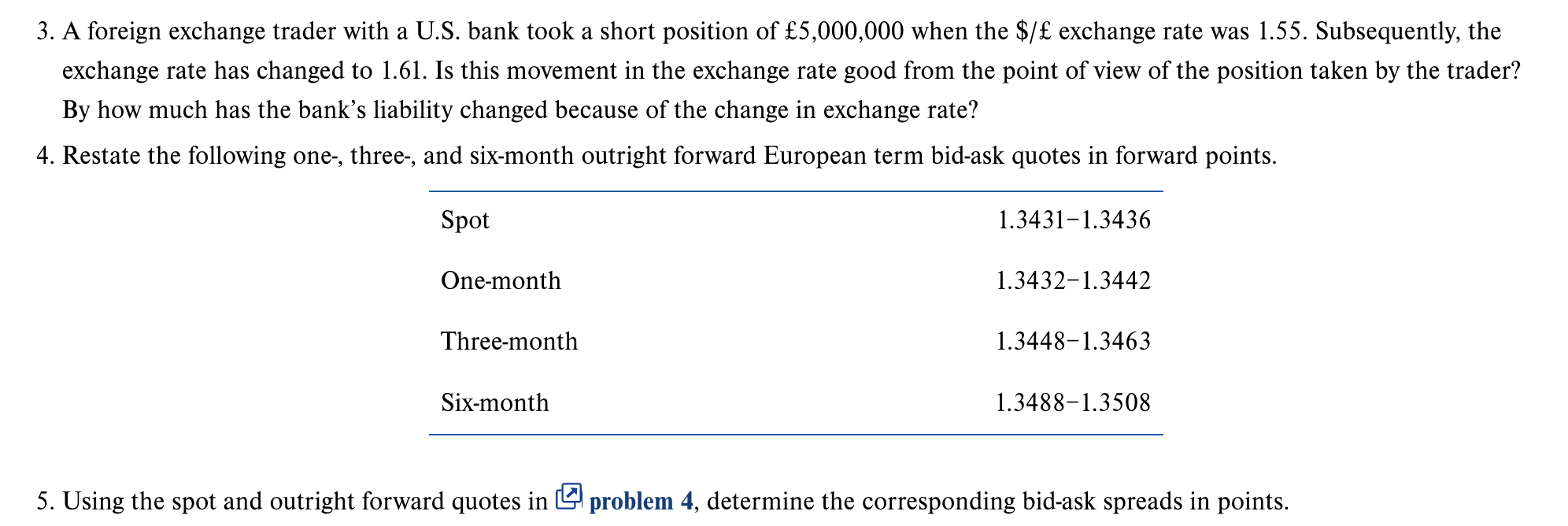

3. A foreign exchange trader with a U.S. bank took a short position of 5,000,000 when the $/ exchange rate was 1.55. Subsequently, the exchange rate has changed to 1.61. Is this movement in the exchange rate good from the point of view of the position taken by the trader? By how much has the bank's liability changed because of the change in exchange rate? 4. Restate the following one-, three-, and six-month outright forward European term bid-ask quotes in forward points. Spot 1.3431-1.3436 One-month 1.3432-1.3442 Three-month 1.3448-1.3463 Six-month 1.3488-1.3508 5. Using the spot and outright forward quotes in problem 4, determine the corresponding bid-ask spreads in points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts