Question: only the data shown in the preceding table: a. If the risk-free rate is 4.4 percent and the expected market risk premium (l.e., E(Rig) -

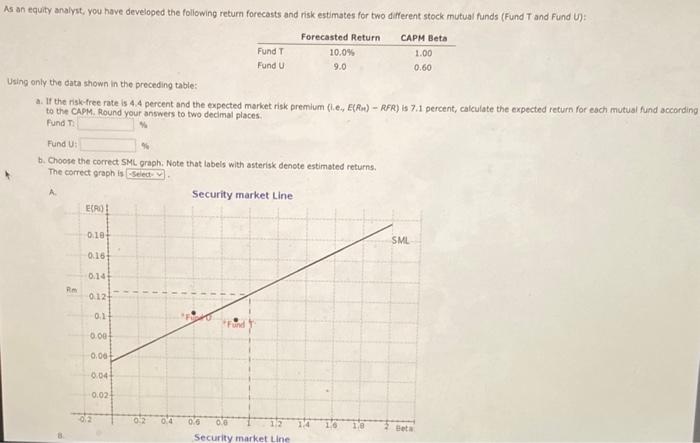

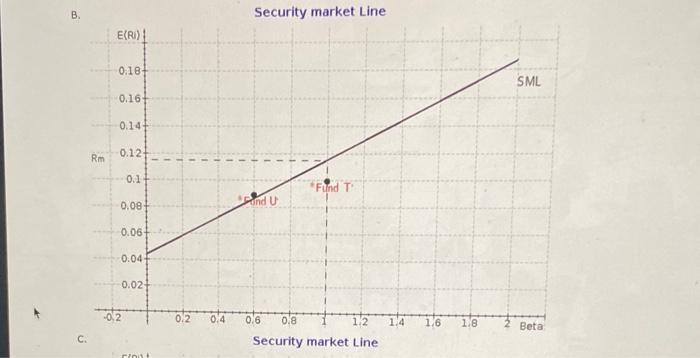

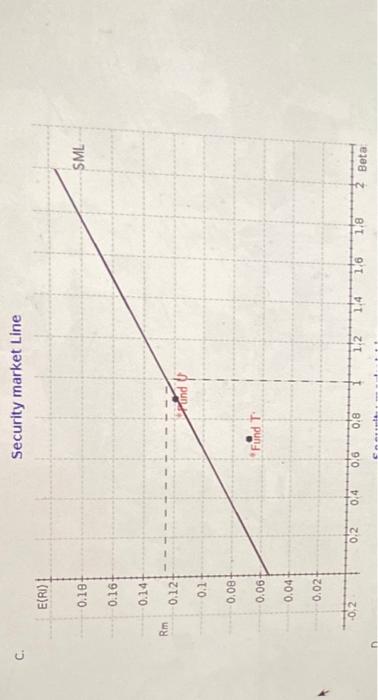

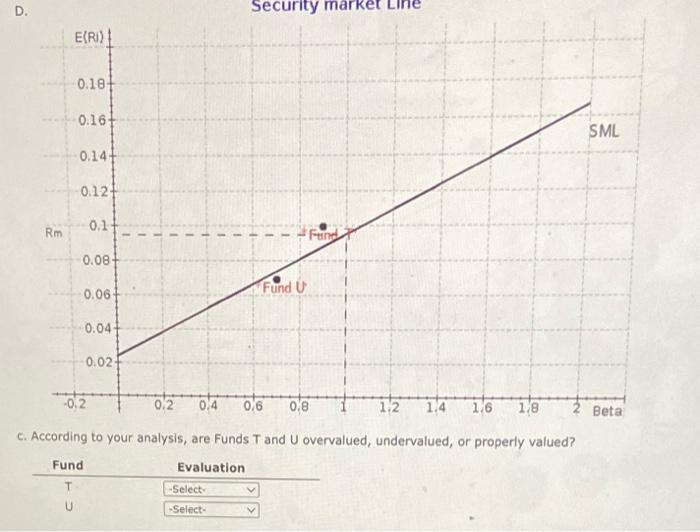

only the data shown in the preceding table: a. If the risk-free rate is 4.4 percent and the expected market risk premium (l.e., E(Rig) - RFR) is 7.1 percent, calculate the expected return for each mutual fund accordin to the CAPM. Round vour answers to two decimal places. Fund T Fund U; b. Choose the correct SML graph. Note that labels with asterisk denote estimated returns. The correct graph is B. Security market Line C. Security market Line c. Security market Line D. c. According to your analysis, are Funds T and U overvalued, undervalued, or properly valued? \begin{tabular}{cc} Fund & \multicolumn{1}{c}{ Evaluation } \\ \hlineT & - Select V \\ U & -Select. V \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts