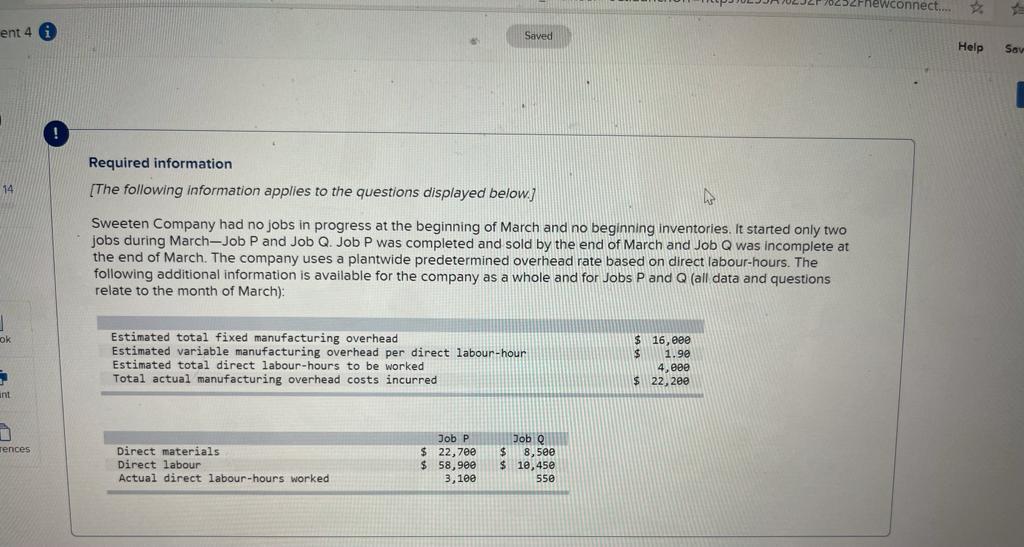

Question: onnect.. ent 4 Saved Help Sov Required information [The following information applies to the questions displayed below] 14 Sweeten Company had no jobs in progress

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock