Question: onnect.. ent 4 Saved Help Sov Required information [The following information applies to the questions displayed below] 14 Sweeten Company had no jobs in progress

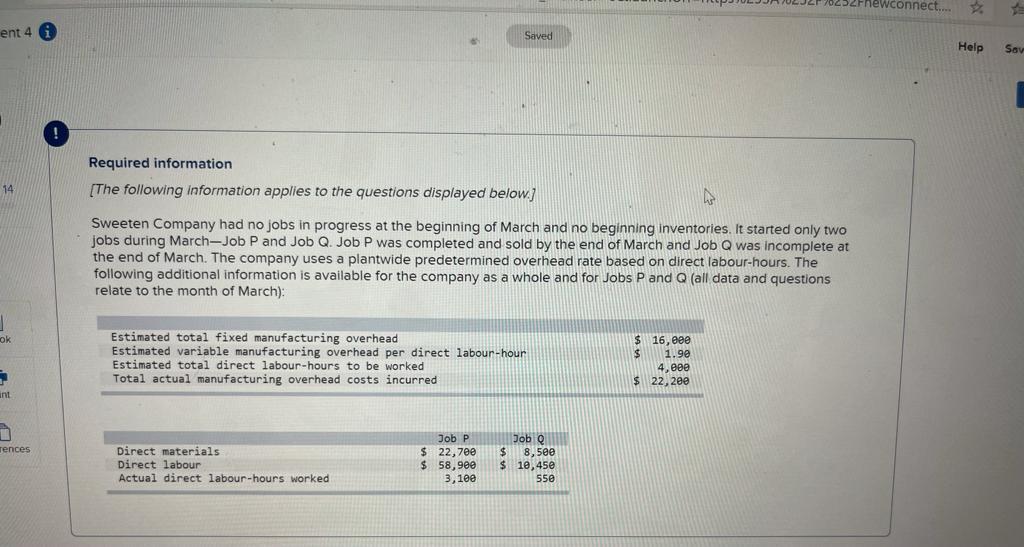

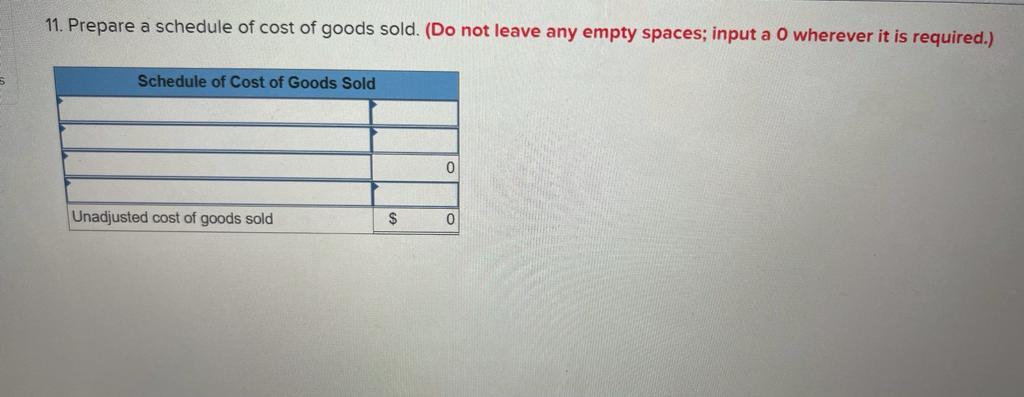

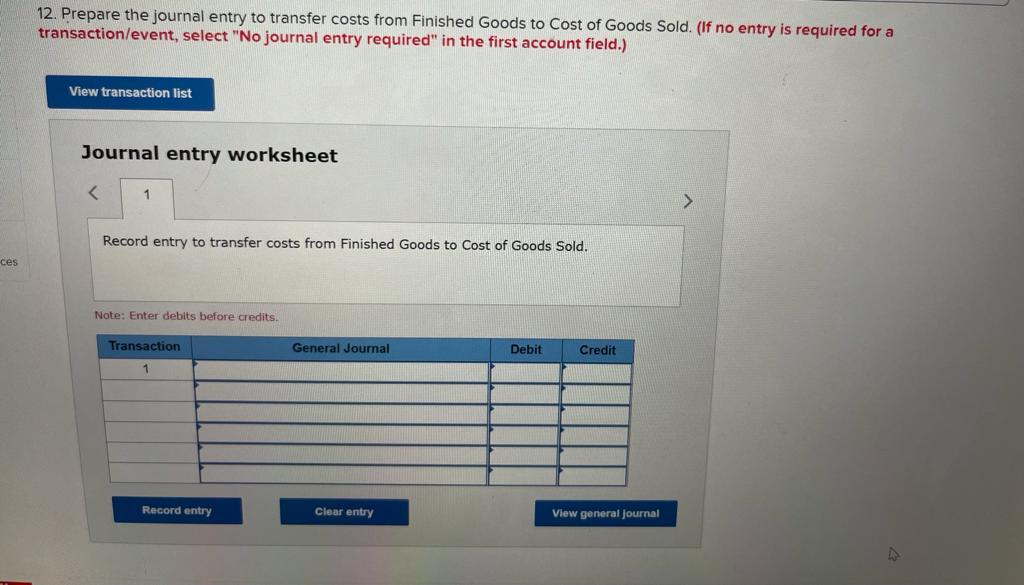

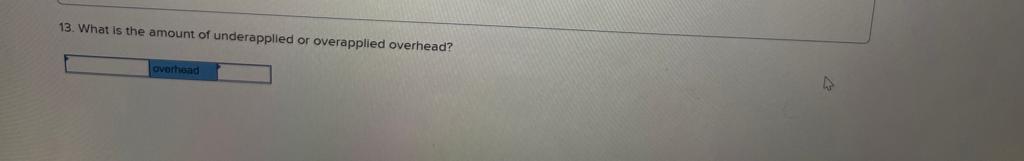

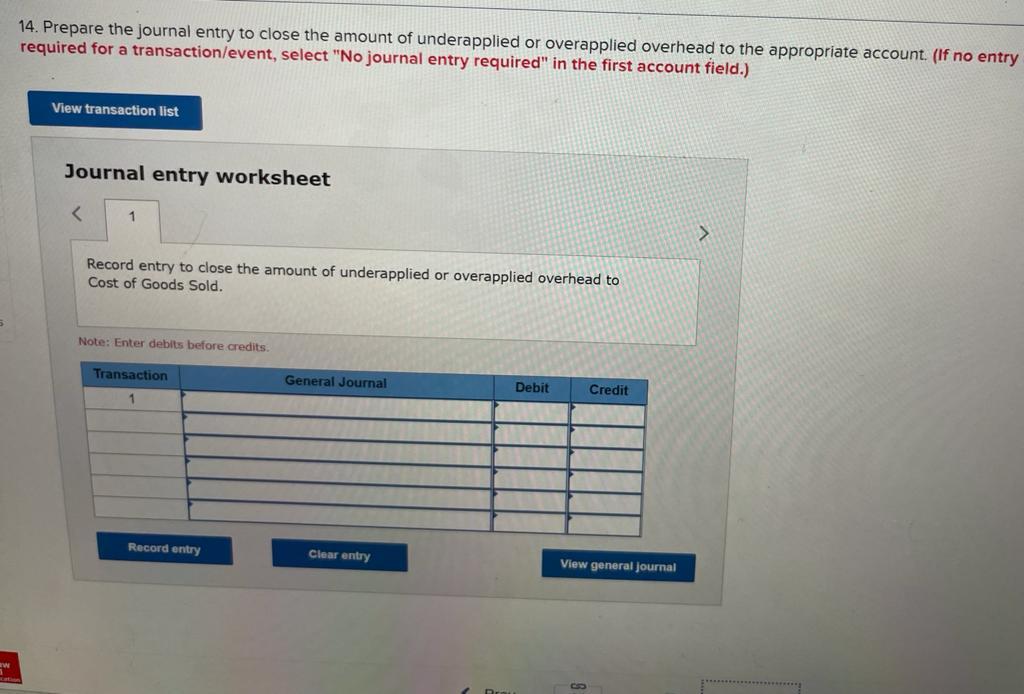

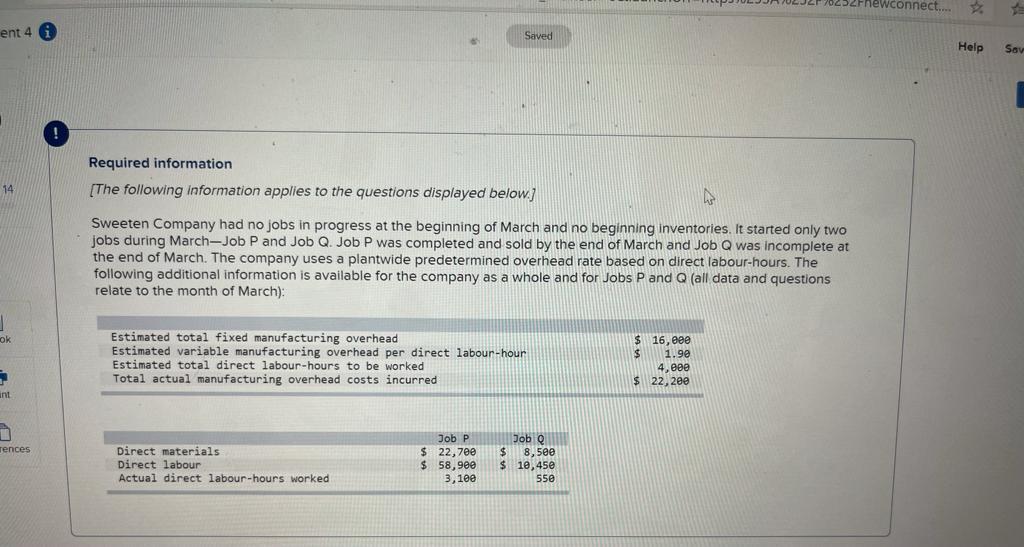

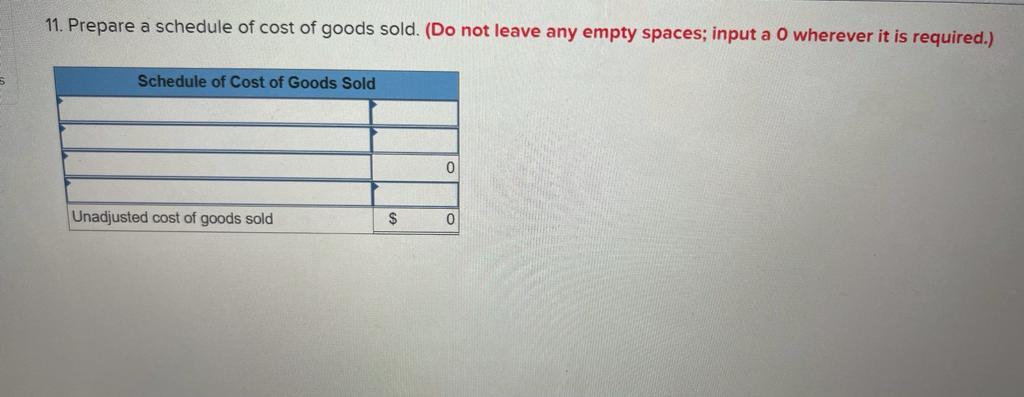

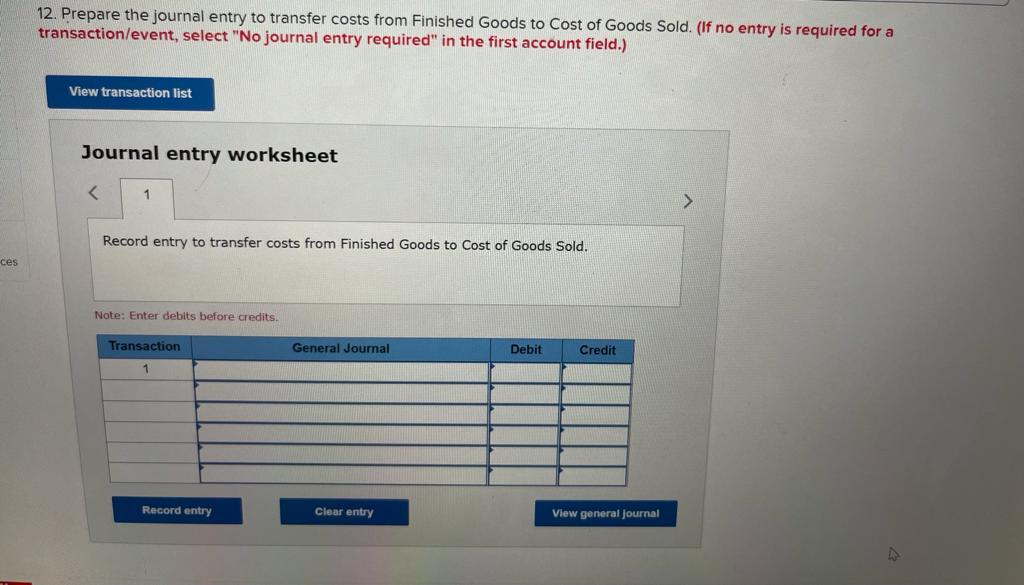

onnect.. ent 4 Saved Help Sov Required information [The following information applies to the questions displayed below] 14 Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. It started only two jobs during March-Job P and Job Q. Job P was completed and sold by the end of March and Job Q was incomplete at the end of March. The company uses a plantwide predetermined overhead rate based on direct labour-hours. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): ok Estimated total fixed manufacturing overhead Estimated variable manufacturing overhead per direct labour-hour Estimated total direct labour-hours to be worked Total actual manufacturing overhead costs incurred $ 16,000 $ 1.90 4,000 $ 22, 2ee int Tences Direct materials Direct labour Actual direct labour-hours worked Job P $ 22,700 $ 58,90 3,100 Job Q $ 8,500 $ 19,450 550 11. Prepare a schedule of cost of goods sold. (Do not leave any empty spaces; input a 0 wherever it is required.) Schedule of Cost of Goods Sold 0 Unadjusted cost of goods sold $ 0 12. Prepare the journal entry to transfer costs from Finished Goods to Cost of Goods Sold. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record entry to transfer costs from Finished Goods to Cost of Goods Sold. ces Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general Journal 13. What is the amount of underapplied or overapplied overhead? overhead 14. Prepare the journal entry to close the amount of underapplied or overapplied overhead to the appropriate account. (If no entry required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record entry to close the amount of underapplied or overapplied overhead to Cost of Goods Sold. Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal w onnect.. ent 4 Saved Help Sov Required information [The following information applies to the questions displayed below] 14 Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. It started only two jobs during March-Job P and Job Q. Job P was completed and sold by the end of March and Job Q was incomplete at the end of March. The company uses a plantwide predetermined overhead rate based on direct labour-hours. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): ok Estimated total fixed manufacturing overhead Estimated variable manufacturing overhead per direct labour-hour Estimated total direct labour-hours to be worked Total actual manufacturing overhead costs incurred $ 16,000 $ 1.90 4,000 $ 22, 2ee int Tences Direct materials Direct labour Actual direct labour-hours worked Job P $ 22,700 $ 58,90 3,100 Job Q $ 8,500 $ 19,450 550 11. Prepare a schedule of cost of goods sold. (Do not leave any empty spaces; input a 0 wherever it is required.) Schedule of Cost of Goods Sold 0 Unadjusted cost of goods sold $ 0 12. Prepare the journal entry to transfer costs from Finished Goods to Cost of Goods Sold. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record entry to transfer costs from Finished Goods to Cost of Goods Sold. ces Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general Journal 13. What is the amount of underapplied or overapplied overhead? overhead 14. Prepare the journal entry to close the amount of underapplied or overapplied overhead to the appropriate account. (If no entry required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record entry to close the amount of underapplied or overapplied overhead to Cost of Goods Sold. Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal w