Question: Open the Retirement sheet in the Excel file. The table includes key parameters: Starting Salary The annual income at the beginning of a career. Average

Open the "Retirement" sheet in the Excel file.

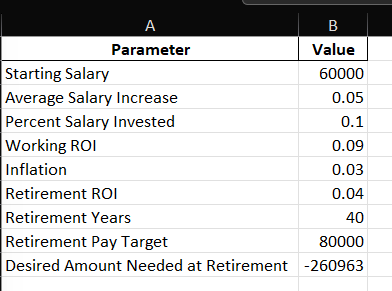

The table includes key parameters:

Starting Salary The annual income at the beginning of a career.

Average Salary Increase Expected annual salary growth.

Percent Salary Invested Portion of salary saved for retirement.

Working ROI Expected return on investments during working years.

Inflation Rate Annual rise in cost of living.

Retirement ROI Investment return after retirement.

Retirement Years Expected duration of retirement.

Retirement Pay Target The annual amount needed during retirement.

Desired Amount Needed at Retirement The total amount required at retirement.

Using these values, calculate the total retirement savings needed and whether the savings plan is sufficient by: Estimating how much savings will grow over time using compound interest. Determining if the total savings at retirement is enough to sustain the target annual withdrawals.

Analysis Questions:

How much money will the person have saved by retirement? Will the savings be sufficient for years of retirement? What happens if salary growth is lower or the ROI changes?

Part : Lottery Annuity Valuation

Instructions

Open the "Lottery" sheet.

The table provides details about a PowerBall lottery payout, including:

Total Prize Today Interest ROI Rate First Annuity Payment Annual Increase in Payments

Calculate the total value of the annuity:

Use the future value of annuity formula to determine how much the entire payout is worth over time. Compare the annuity to a lump sum payout assume a discount rate of

Analysis Questions:

Would it be better to take a lump sum or an annuity?How does the interest rate affect the total value of winnings?What happens if the annual increase is lower or higher?

Bonus Questions for extra credit

Modify the retirement savings rate and ROI assumptions to see how savings are affected.

Change the PowerBall ROI rate and analyze its impact on winnings.

Create "WhatIf Scenarios:

What if inflation rises to What if the student saves instead of What if the student wins $ billion in PowerBall?

A Parameter B Value Starting Salary Average Salary Increase Percent Salary Invested Working ROI Inflation Retirement ROI Retirement Years Retirement Pay Target Desired Amount Needed at Retirement

Parameter B Value PowerBall Total Prize Today Interest ROI Rate First Payment Annual Increase

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock