Question: Operating and Cash Conversion Cycle 185. (Related to Checkpoint 18.2 on page 580) (Calculating the cash conversion cycle) Network Solutions just introduced a new, fully

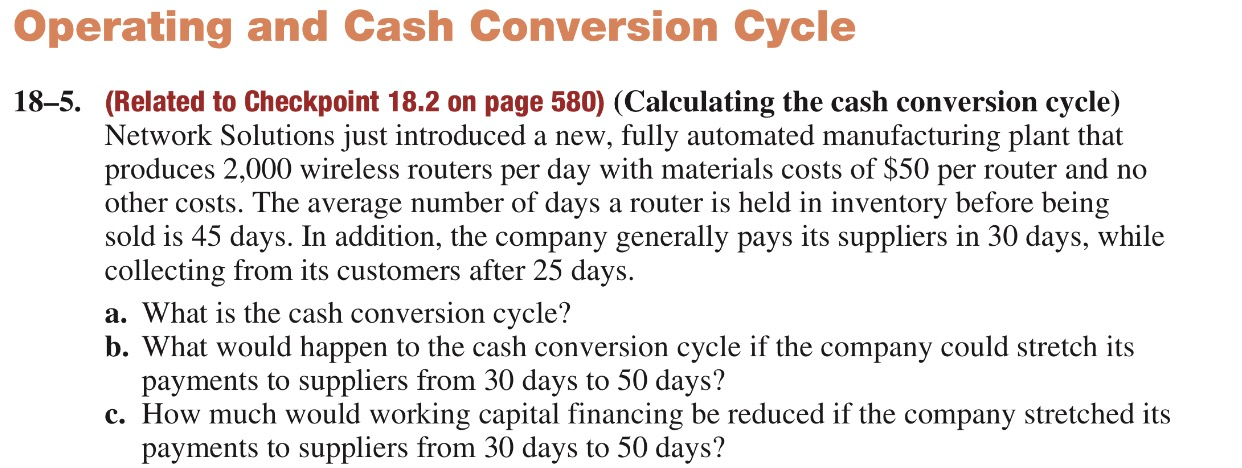

Operating and Cash Conversion Cycle 185. (Related to Checkpoint 18.2 on page 580) (Calculating the cash conversion cycle) Network Solutions just introduced a new, fully automated manufacturing plant that produces 2,000 wireless routers per day with materials costs of $50 per router and no other costs. The average number of days a router is held in inventory before being sold is 45 days. In addition, the company generally pays its suppliers in 30 days, while collecting from its customers after 25 days. a. What is the cash conversion cycle? b. What would happen to the cash conversion cycle if the company could stretch its payments to suppliers from 30 days to 50 days? c. How much would working capital financing be reduced if the company stretched its payments to suppliers from 30 days to 50 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts